In a major move for the crypto industry, the U.S. SEC has approved a major appeal by the Grayscale. Enabling Digital Large Cap Fund by the organisation to trade as an ETF. The Exchange Traded Fund includes top crypto assets like Bitcoin, Ethereum, XRP, and Cardano. This Grayscale ETF will be listed on New York Stock Exchange Arca, opening the door for more conventional traders to access several digital currencies in one regulated product.

Source: SEC

This approval was granted under Section 19(b)(2) of the Exchange Act. It is giving the green signal to a proposal first submitted by NYSE Arca. The Grayscale ETF became one of the first times a multi-asset crypto fund has been allowed to trade like a stock in the United States market.

This SEC approval gives the digital assets space a much-needed boost. Unlike single-asset funds, the Grayscale ETF covers a basket of the largest digital coins, offering broader exposure in one place. For everyday investors, this makes it easier to buy into digital currency without needing to manage wallets or trade on unfamiliar platforms.

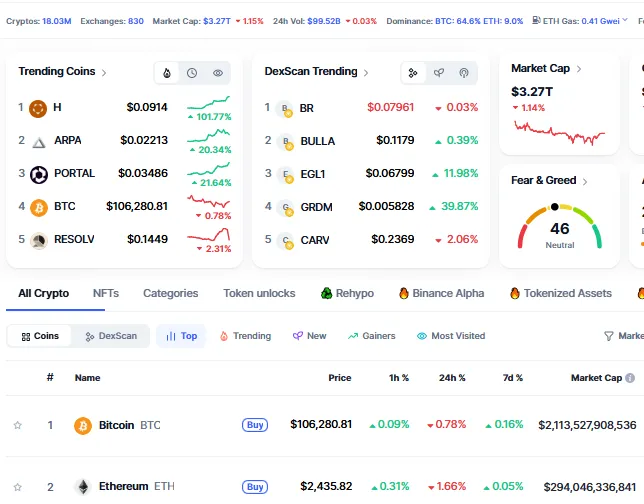

With rising interest from both retail and institutional investors, the new fund could help bring more capital into digital assets, while giving investors a way to spread risk across multiple assets. The cryptocurrencies are now trading at Bitcoin $106,280, 0.74% decrease, Ethereum $2435, 1.66% decrease, XRP $2.18, 1.92% decrease, and Cardano $0.5509, 2.60% decrease as per the CoinMarketCap.

Even after this positive announcement about the Grayscale ETF approval, the cryptocurrency market is down. The major catalyst of the downward market momentum is the fear among the traders before the 9th July update about the tariffs. As President Trump has already said, tariffs are not going to be postponed, which might accelerate trade war tensions again. What president Trump is going to announce will impact the crypto market in the upcoming days.

Source: CoinMarketCap

After this approval has achieved this milestone, another major crypto organisation Bitwise is still waiting on a decision for its own Bitwise 10 Crypto Index Fund. Bitwise hopes to offer investors exposure to a wider range of cryptocurrencies in one product. The SEC has not given a timeline for the decision, but interest in diversified ETFs is clearly growing.

This approval came after the months of back-and-forth between cryptocurrency organisations and United States regulators. In 2024, the commission approved many spot Bitcoin Exchange Traded Fund and Ethereum ETF. It was a huge milestone that triggered billions of dollars in inflows. In the months that followed, firms like Grayscale also filed for other ETFs, which includes Ethereum staking options.

Single-asset funds for Solana and Litecoin were also applied. Some of these are still under the process of review.

Even without the feature of staking, Ethereum ETFs have already pulled in over $2.28 billion for investment, proving strong demand. Grayscale’s Ethereum staking plan is still awaiting a decision, expected later in 2025.

The SEC approval of Grayscale ETF is not just any other listing. It indicates that regulators are increasingly becoming comfortable with crypto, particularly when provided in a controlled and regulated manner. Although the road is slow and the legalization is still to get a force, every approval helps others to go ahead.

There is a growing list of ETF applications and increasing interest by investors, so this ruling about Grayscale ETF approval could be used to propel further multi-asset cryptocurrency ETFs. Until the time, this is taking place as a good sign in the market- and even closer to being mainstream.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

2 months ago

Informative