After years of explosive growth, a failed $20B Adobe acquisition, and a wave of AI innovation, Figma IPO is finally opening its books. The collaborative design powerhouse, has just filed its S-1 to go public on the NYSE under the ticker “FIG.” The company first revealed it planned to go public and had confidentially filed its paperwork with the SEC on April 15.

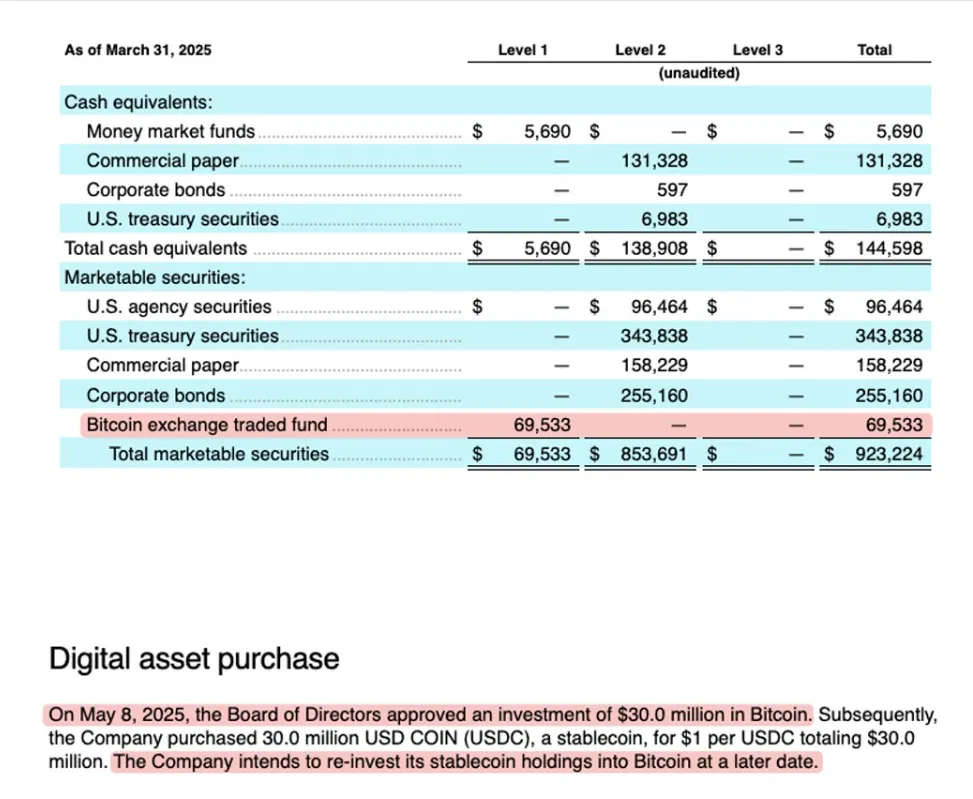

The firm has $70 million worth of Bitcoin ETFs in its wallet, based on its S-1 filing, and it has board authorization to buy $30 million more worth of Bitcoin with USDC.

Source : Figma Official SEC Document

It was reported $228.2M in revenue for the first quarter of 2025, with net income of $44.9M for the same period. That puts the company on pace for $821M ARR, a staggering leap from $400M in 2024 and $190M in 2022. Gross margins remain sky-high, reportedly around 91%, and NRR has hovered near 132%.

It’s growth isn’t just about numbers. The company’s user base is global, with over 85% of customers outside the U.S. and marquee clients like Google, Microsoft, Netflix, and Airbnb. Over 78% of the Fortune 2000 rely on company for their design.

It established in 2012, offers cloud-based design and development tools. Its Design enables designers to design user interfaces and experiences, while FigJam is a collaborative brainstorming online whiteboard. Other features are Dev Mode for design specs and FigmaSlides for making and sharing slide decks in the projects platform.

Company went public as Adobe Inc. was unable to buy the company for $20 billion owing to regulatory concerns. The acquisition was considered reducing competition in the U.K. and Europe, and hence Adobe dropped the acquisition plan in December 2023. It raised an undisclosed amount of funding in July 2024, raising a reported valuation of $12.5 billion, significantly lower than Adobe's initial offer. The revelation of the S1 paperwork has revealed Figma IPO financial position, with its valuation rising from $10B in 2021 to $17.8B in private markets this year, reflecting investor confidence even after the Adobe deal collapsed.

Figma IPO S-1 offers opportunities for AI-powered product expansion, including Make and Sites, which automate tasks and make design accessible to more teams. With FedRAMP certification, It is eligible for U.S. government contracts and expanding into EMEA and APAC. The company also plans to create a multi-product platform with FigJam and Dev Mode, increasing upsell potential. However, the S-1 faces challenges such as pricing and monetization, regulatory and competitive pressures, and pushback from smaller companies.

Since company originally revealed its intentions to go public and file for IPO in April, things have quickly evolved, and timing is frequently crucial when it comes to initial public offerings (IPOs). Markets were erratic at the time, making it hard to forecast how Figma IPO would be accepted. However, the IPOs that took place during that time have gone successfully, and the stock markets are at all-time highs just under three months later.

On its first day of trading, the stock of eToro Group Ltd., which went public on the Nasdaq in May, closed up 29%. On the first day of trading on June 4, Circle Internet Group Inc.'s shares closed up 168%. Additionally, Chime Financial Inc.'s shares opened up 37% on June 12.

The findings show that the market is interested in IT companies in general, even though none of those businesses are in the same industry vertical as this. Figma IPO enters the market with a tested product and respectable financials. The business will undoubtedly be looking for comparable outcomes.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.