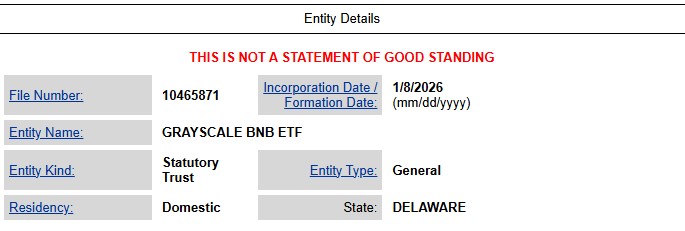

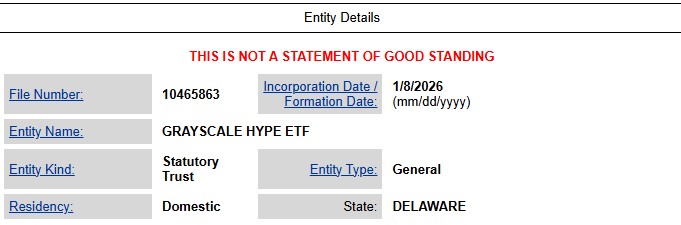

Is institutional crypto investing entering a new phase? Grayscale Investments has registered new trusts in Delaware for a BNB and HYPE ETF, signaling growing interest in altcoins beyond Bitcoin and Ethereum.

Source: Delaware Official

The registrations were filed on January 8, 2026, creating legal entities for potential spot ETFs. While this step does not mean SEC approval yet, Grayscale has historically used Delaware registrations as an early step before formal SEC ETF filings, i.e., like in Bitcoin and Ethereum ETFs.

BNB-HYPE represent two different but fast-growing parts of the crypto marketplace.

BNB is the core token of the Binance Smart Chain ecosystem. It is widely used for DeFi apps, trading, payments, and exchange-related services. An exchange traded fund could allow traditional investors to gain exposure to this ecosystem without directly holding crypto.

HYPE powers Hyperliquid, a high-speed perpetual futures DEX running on its own Layer-1 blockchain. Hyperliquid has captured a large share of on-chain derivatives trading, making the token one of the most active DeFi-related tokens in the market.

Together, BNB and HYPE ETF give the asset manager exposure to both exchange infrastructure and decentralized trading.

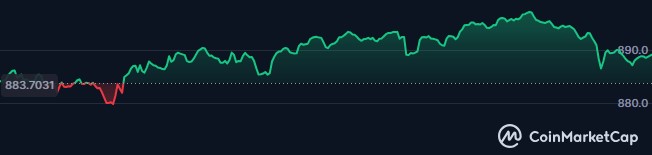

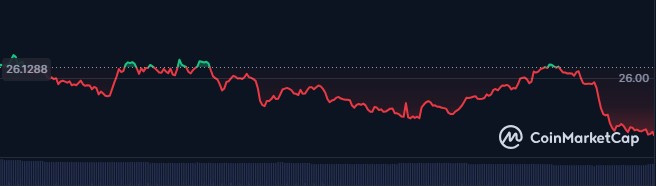

The short-term market reaction has been calm.

Binance coin reacted positively. The token saw gains of 0.54% in the last 24 hrs, currently trading at $889.10, after the news, following its monthly and yearly surges of 0.05% and 27.72% respectively.

On the other hand, HYPE-prices fell 3.38% to $25.26 mostly amid broader market weakness. Analysts say this is expected, as trust registrations are only an early step.

Still, the Grayscale BNB and HYPE ETF move strengthens long-term sentiment. If approved, such ETFs could attract billions in institutional capital, similar to what happened with Bitcoin and Ethereum ETFs.

The Delaware registrations only create the legal framework. The next major milestone will be formal SEC filings, such as S-1 or 19b-4 forms.

Approval could take months or longer, and regulatory scrutiny, especially around Binance coin’s exchange ties, remains a risk. However, the move clearly shows Grayscale’s confidence in altcoins and the expanding crypto ETF market.

As crypto products continue to evolve in 2026, could BNB and HYPE become the next assets to enter mainstream investment portfolios?

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.