Morgan Stanley is expanding its presence in the crypto market by filing with the SEC for a spot Ethereum Trust. This move comes just days after the bank submitted filings for spot Bitcoin and Solana ETFs, showing its growing commitment to bringing regulated digital asset products to institutional and retail clients.

Source: SEC Official

The filings highlight how major Wall Street firms are increasingly entering the crypto space, reflecting wider adoption of cryptocurrencies through familiar and regulated investment vehicles.

MorganStanley, which manages around $1.7–1.8 trillion in assets, submitted S-1 filings to the SEC on January 6, 2026, for two products:

A spot Bitcoin ETF, tracking BTC prices directly

A spot Solana ETF, including staking rewards

This marked the first time a major U.S. bank, not just asset managers like BlackRock or Fidelity, applied to launch its own spot-crypto ETFs.

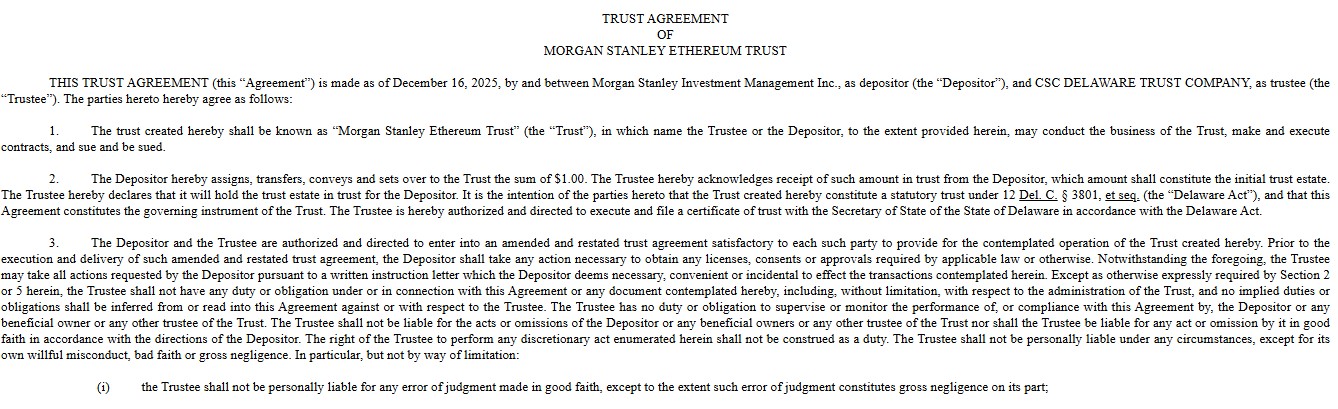

Following the two previous filing, Morgan Stanley followed up with a confirmed filing for a Ethereum-ETF. The proposed fund would hold ETH directly and stake part of its holdings through third-party providers, aiming to generate extra yield.

If approved, this would make Morgan Stanley the first major U.S. bank to issue a spot Ethereum ETF, signaling deeper institutional confidence in ETH.

Ethereum funds already exist from key players:

BlackRock iShares ETH Trust (ETHA): low fees and high inflows

Fidelity ETH Fund (FETH): institutional-friendly option

Grayscale Ethereum Trust (ETHE & Mini Trust): first to enable staking, with payouts starting Jan 6, 2026

Bitwise's ETHW, VanEck's ETHV, ARK/21Shares Ethereum ETF, Invesco Galaxy ETH ETF, and Franklin Ethereum's EZET

Together, these products manage $19–20 billion in assets, showing strong investor interest and adoption. Morgan Stanley’s entry adds credibility and competition in this growing space.

Wall Street adoption is accelerating. Bitcoin-ETFs already hold over $120 billion in assets, and Ethereum-ETFs have seen renewed inflows in early 2026 after a slow end to 2025.

The Solana-ETF’s staking feature has also drawn attention, with analysts estimating $10–20 billion in potential inflows if approved.

Together, these filings strengthen crypto’s position as a mainstream investment option.

This move signals a major step toward institutional adoption of cryptocurrencies. MorganStanley’s filings strengthen the legitimacy of Ethereum, Bitcoin, and Solana as investment options.

With Wall Street involvement increasing, 2026 could mark a turning point for crypto’s integration into traditional finance. Investors are watching closely to see if approvals follow and how inflows could impact prices.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.