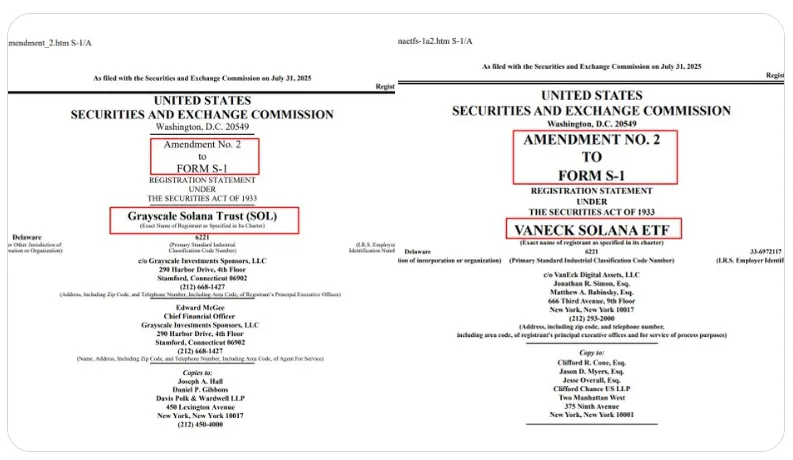

Bitwise, Fidelity, Canary Capital, CoinShares, VanEck, and Franklin Templeton submitted amended S-1 registration statements to the SEC. The race for Sol ETFs is heating up the market. As they may come closer to receiving the U.S. Securities and Exchange Commission's approval, companies aiming to introduce spot Sol exchange-traded funds filed adjustments to their registration.

Source: Website

Grayscale Solana ETF Filing, intends to collect a 2.5% fee for its fund, which will be paid in SOL. Updated S-1 files for Grayscale and VanEck's Sol ETFs have been submitted to the SEC, indicating that both companies are moving closer to approval. The most important phase in the procedure is the submission of these updated S-1 forms. It seems that both are probably on the correct track toward compliance and have received preliminary replies from the SEC.

VanEck is launching the VanEck Sol Trust fund, listed on Cboe BZX under the ticker VSOL, pending regulatory approval. The fund charges a 1.5% annual sponsor fee, lower than Grayscale's, and is unique among US-based crypto ETFs. It includes staking of coin from the start and has stringent criteria for staking validators, including performance metrics, slashing history, and security certifications.

Under the Trump administration SEC is considering a number of plans to introduce a SOL Electronic Trading Fund in addition to dozens of other cryptocurrency products, ranging from those that follow DOGE to XRP. It has adopted a more accommodative posture toward digital assets, indicating that the funds may eventually be approved. Many approval are pending from its side and it is under the review process.

Source: X Profile

Nate Geraci, president of NovaDius Wealth, also reported about the news in his social media post. He stated that VanEck, 21Shares, Grayscale Solana ETF filing are among the spots that are now undergoing the implementation of S-1 changes.

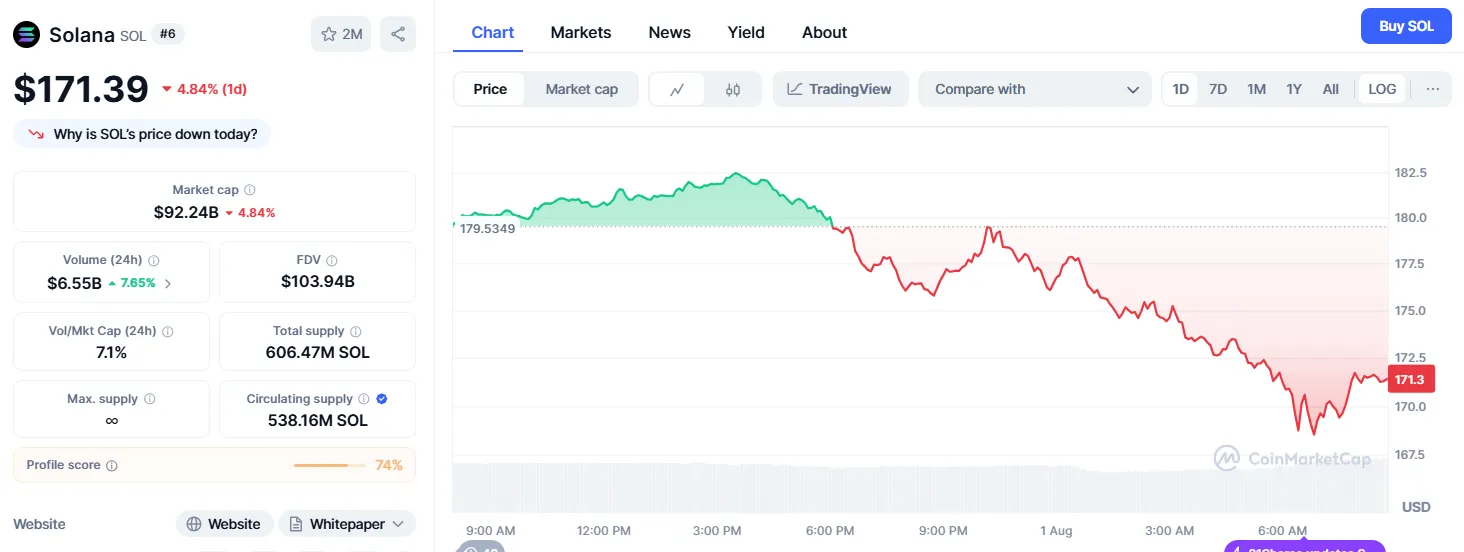

Source: Coinmarketcap

Despite Grayscale Solana ETF Filing SOL is facing a dip of 4.84% in the past day. The coin is currently trading at $171.39 with $92B market capital. If approved, SOL might be included into diverse crypto Exchange Trade Funds which could impact the price and increase volatility in the market.

The Grayscale Solana ETF Filing can gain momentum by the SEC raising option limitations for bitcoin funds earlier this week and authorized in-kind redemptions for Ethereum ETFs and spot bitcoin. Then on Thursday, the agency's Chair Paul Atkins presented "Project Crypto" in the name of revising the SEC's regulations and declared that, in contradiction to what the SEC said earlier, that "most crypto assets are not securities."

According to crypto industry analysts, it reflects a bigger trend. Regarding cryptocurrency investment products, the SEC has taken a more lenient position. It favors those that prioritize investor safety, custody security, and transparency after the historic spot Bitcoin Exchange Trade Fund approval in January 2025.

The approval could drive the Altcoin market to another level. As many big institutions are driving towards the Altcoin market and can lead to surge by the end of this year. If approved investors can facilitate access to it from many brokerage platforms and encourage institutional usage.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.