Can a community-led digital asset build trust while launching through an IDO? The Huostarter listing Glunity Coin has sparked discussion across crypto circles after the project confirmed its upcoming $GLUN IDO and presale structure.

Source: Huostrater X Account

Glunity Coin ($GLUN) runs on BNB Chain and uses a simple, immutable ERC-20 smart contract designed to improve transparency, fairness, and blockchain-based participation.

According to the official Glun X announcement, the Huostarter listing Glunity Coin also comes with a structured presale date starting 16 February 2026, with a limited bonus model:

First 5 buyers ($1,000+) → 100% bonus

Next 5 buyers ($1,000+) → 75% bonus

Next 10 buyers ($1,000+) → 50% bonus

Others → 5% bonus

Traders should note that the minimum buy is $5, while the cap is $5,000. Only the first 20 buyers qualify for higher rewards.

The $GLUN presale in Feb 2026 will begin with a total allocation of 300,000,000 tokens (30% of supply). The minimum raise target is about $405,000.

The total supply of 1,000,000,000 coins was minted at deployment, and no additional mining is possible.

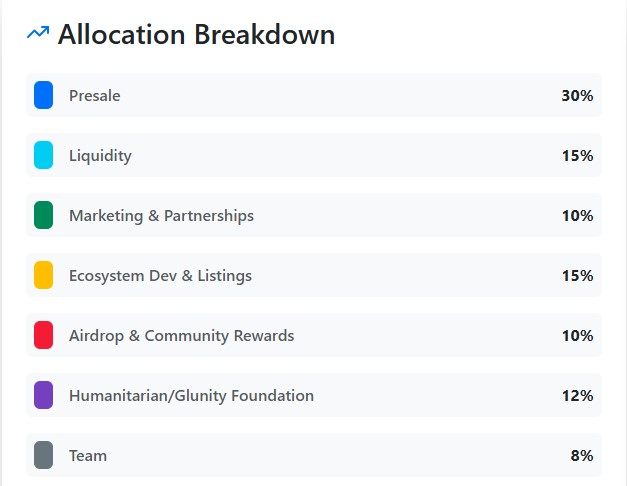

Here is the structured allocation:

Presale: 30% (300,000,000 coins are reserved for community ownership.)

Liquidity: 15% (150,000,000 tokens support trading stability on the Glunity listing date 2026.)

Ecosystem: 15% is reserved for platform growth and utility expansion.

Humanitarian: 12% is fixed for charitable efforts or initiatives.

Marketing: 10% is for global outreach.

Team: 8% (24-month linear vesting)

Team allocation follows a 24-month linear release schedule to prevent sudden supply pressure.

Based strictly on the announced structure around the Huostarter listing and $GLUN IDO, Coingabbar’s analysts create a realistic timeline:

Confirmed presale date: 16 February 2026

Potential TGE window: 20 March–5 April 2026

Initial DEX launch: Late March or early April

Possible mid-tier CEX: Q2 2026

All other dates above, except early sale, are analytical projections based on the current metrics; they do not guarantee a confirmed schedule.

Since 50% of tokens unlock at TGE and the remaining 50% vest linearly over two months, a Token Generation Event is realistically expected 30–45 days after the presale timeline.

Market discussions mention possible listings on MXC, Binance, Bitget, OKX, Gate.io, and ByBit. However, these remain speculative. However, without official exchange statements, any listing beyond Huostarter should be treated as unconfirmed.

Roadmap Phase 1 covers brand launch, community growth, liquidity provisioning, and foundation announcement.

Phase 2 focuses on major exchange expansion, marketing, and partnerships.

Phase 3 introduces DAO launch, Swap, Launchpad, and community initiatives.

With 300 million coins in presale and a minimum raise target of ~$405,000, the estimated listing value may range near $0.0013–$0.0020.

Due to 50% unlock at TGE and bonus tiers reaching up to 100% for early buyers, short-term volatility is highly likely. The initial DEX range between $0.0015 and $0.0035 appears technically realistic. If major exchanges or current crypto airdrop demand increases, $0.006–$0.012 becomes possible.

These figures are strictly based on token supply, raise target, and unlock design, so readers should view this estimate with caution.

Conclusion

Huostarter listing $GLUN shows a clear plan with DAO control, audit security, and phased growth. Future price and stability will depend on liquidity strength, roadmap delivery, and confirmed new exchange listings in 2026.

YMYL Disclaimer: This article is for informational purposes only and does not give any financial advice. Cryptocurrency investments carry high risk. Readers should do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.