When a trader makes millions in hours and loses it all within days, the crypto market takes notice. But when that trader is allegedly manipulating tokens, hunted by whales, and investigated by ZachXBT, the entire market starts asking a deeper question:

Is Hyperliquid the most dangerous playground in crypto right now?

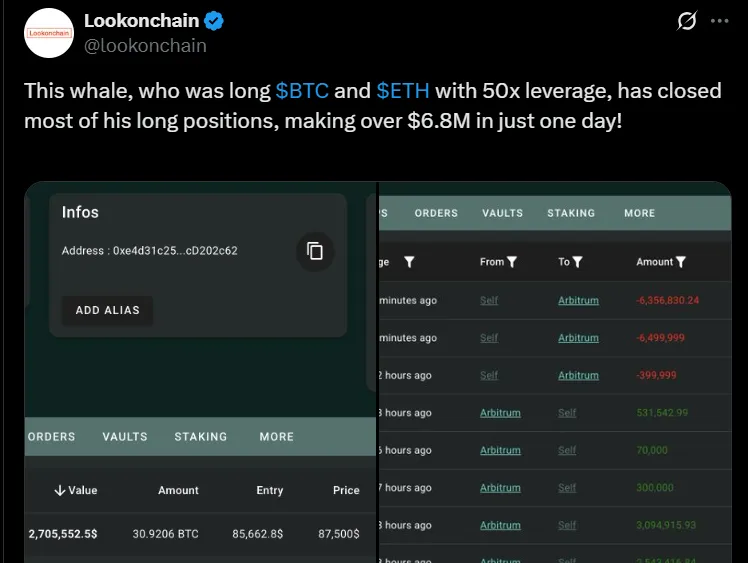

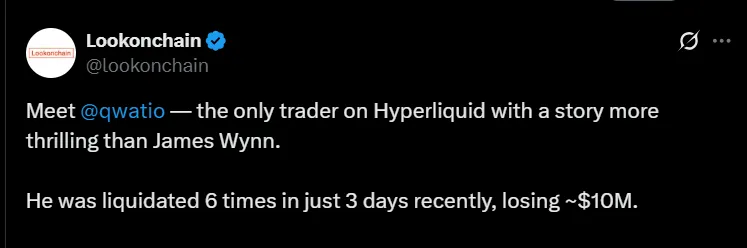

This is the story of a trader named “qwatio” — the most talked-about person right now. On June 26, Lookonchain analysis exposed how he was liquidated six times in just three days, losing around $10 million—it also reveals how volatile and risky this new trading ecosystem has become.

It all began on March 2, when qwatio made headlines by earning $6.8 million in one day. He used 50x leverage on BTC and ETH longs, just before a market-moving executive order by Donald Trump.

Source: Lookonchain X Account

The timing was so perfect that some speculated he had inside information. His wallet, linked to the name "MELANIA", gained massive attention. Traders began following his plays, copying strategies, and tracking his every move—making him a top subject in hyperliquid news across the community.

But what started as admiration quickly turned into a story of downfall.

After that win, qwatio didn’t stop. He bet even bigger. No stop losses. No fear. Then the market flipped. According to Lookonchain’s fresh analysis, he was hit with six liquidations in just three days, losing nearly $10 million.

After the loss, he changed his account name to "falling", deleted old posts, and faded from public view—at least for now. This became one of the most dramatic whale stories in hyperliquid whale tracker reports.

But this wasn’t just a story of a bad trade. It was about what happened next.

As his fall unfolded, Lookonchain flagged suspicious activity around $JELLY (jellyjelly). A wallet—allegedly tied to qwatio—dumped 124.6M $JELLY ($4.85M), crashing the token price.

This tricked chain's HLP system into taking a massive passive short. The whale then bought back $JELLY, driving up the price and forcing HLP into a $12M loss. This has now become a textbook example of hyperliquid manipulation.

Whale hunter Cbb0fe even formed a public group to liquidate qwatio, turning this from trading into warfare.

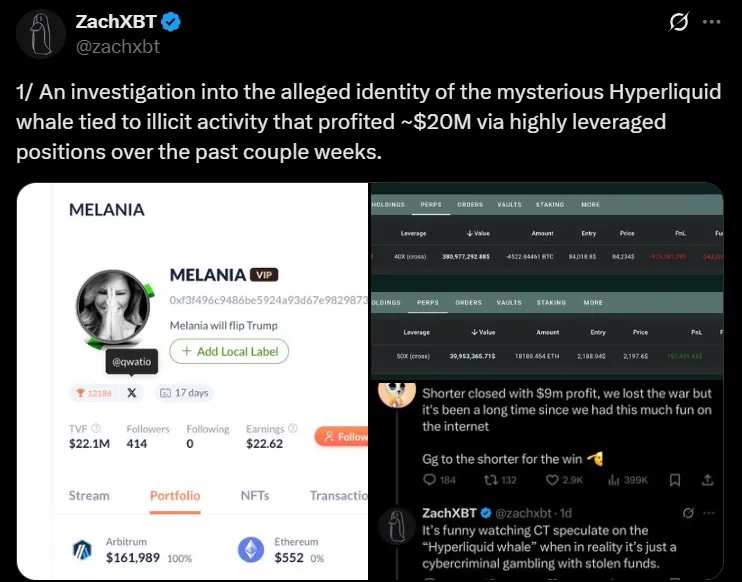

Just when things couldn’t get any crazier, ZachXBT, crypto’s top investigator, entered the chat while all this was happening.

Source: ZachXBT

He launched an official investigation into the wallet behind "MELANIA." His post suggested the $20M+ in profits seen earlier might be tied to suspicious wallet behavior, possibly even stolen or laundered funds. The earlier ZachXBT MELANIA investigation has drawn widespread attention in Hyperliquid news today headlines.

All eyes turned to the platform itself. Because if one person could make millions and lose millions in such a short period—what does that say about this blockchain?

Source: TradingView

According to TradingView chart analysis, the current setup shows:

Current Price: $37.37

Bollinger Bands: Narrowing — low volatility phase

RSI (52.5): Neutral—no strong momentum

MACD: Bullish crossover forming

As per my observation as a crypto analyst, this token is in a low-volatility phase, but based on Bollinger Bands, a sharp price move could happen soon. This makes $HYPE price volatility a key concern moving forward.

For those new to the platform or considering trading $HYPE, here’s what you must understand:

High leverage (20x+) without stop-losses leads to cascade liquidations, as seen in this hyperliquid $10M loss.

HLP mechanics can be exploited, as demonstrated in the $JELLY trade.

Whale dominance is real. Retail traders often exit liquidity.

These dynamics are driving today’s hyperliquid whale liquidated narratives across social platforms.

The qwatio case shows how quickly fortunes can shift on Hyperliquid. With high leverage and volatile mechanics, the risks are real.

Yet, the technical setup hints at possible upside momentum. As $HYPE token news heats up, traders should proceed with caution—and fully understand what they’re stepping into before making aggressive moves.

Sudeep Saxena is one of the co-founders of Coin Gabbar. Apart from developing the business, he is also a CMA by profession. Sudeep contributes to #TeamGabbar by writing geopolitical blogs.

Sudeep has an extensive experience in the crypto space and intents to build a rich knowledge bank in the form of blogs and articles, that shall develop a basic understanding of the crypto world for any new entrant in the market. When not writing, he can be found reading books.

You can connect with Sudeep on Twitter and LinkedIn.