Income Tax Bill 2025: India Uncovers ₹29,208 Cr in Hidden Foreign Assets and Crypto

India's High authority, as well as the new Income Tax Bill, is clamping down on untaxed assets. Overseas investments and cryptocurrency profits are now under tighter scrutiny, revealing vast amounts of previously untaxed assets.

But the big question is- are these crackdowns cleaning up the system or pushing people away from it? A record ₹29,208 Cr. in hidden foreign wealth - is this proof of stronger laws or a growing challengem for digital investors?

Income Tax Bill 2025: In a recent TweetJournalist Sapna Singh (@earnwithsapna) shared one more major update related to Digital Assets and Income Tax Bill on X:

Source: X

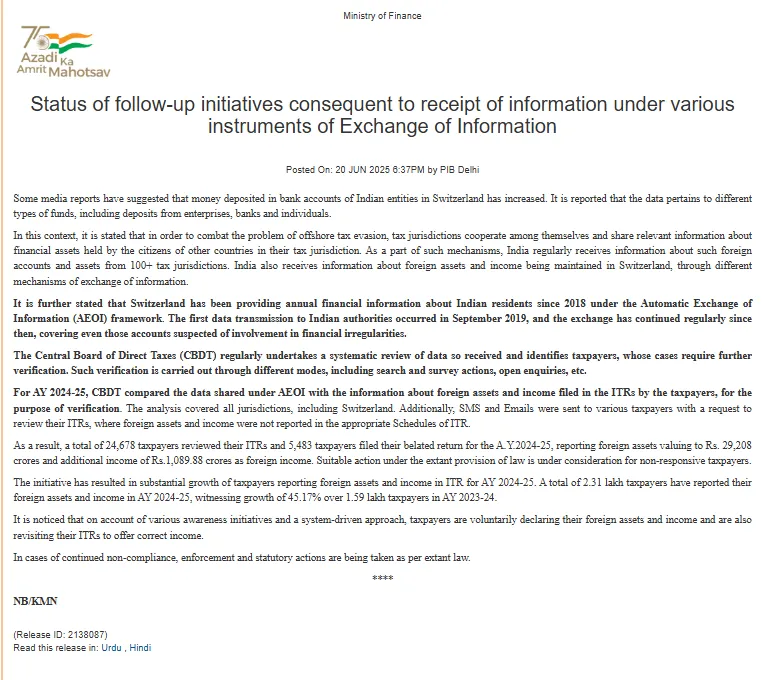

For the assessment year 2024–25, the Finance Ministery says 5,483 payers filed late returns declaring ₹29,208 crore in previously hidden foreign assets. Along with this, ₹1,089 crore in extra foreign earn was disclosed.

This wave of declarations came after a targeted campaign launched on November 17, 2024, urging people to correct past filings. In total, over 30,000 payers came forward. The number of people reporting foreign assets jumped by 45% compared to last year.

It seems the government’s “disclose now or face the consequences” strategy is working- at least on paper. But is fear the only reason people are coming clean?

Source: PIB

The crackdown hasn’t stopped at bank accounts and offshore companies. Authorities have also uncovered around ₹630 crore in unreported wages from digital trades. Minister of State for Finance Pankaj Chaudhary revealed that over 44,000 notices have been sent to individuals and businesses suspected of hiding crypto profits.

These findings are not guesses. The Income Tax Bill and the department is using advanced systems like the Non-Filer Monitoring System (NMS) and Project Insight, which match blockchain transactions and exchange records against filings. If your crypto activity doesn’t match your fee return, it’s now much harder to hide.

Source: X

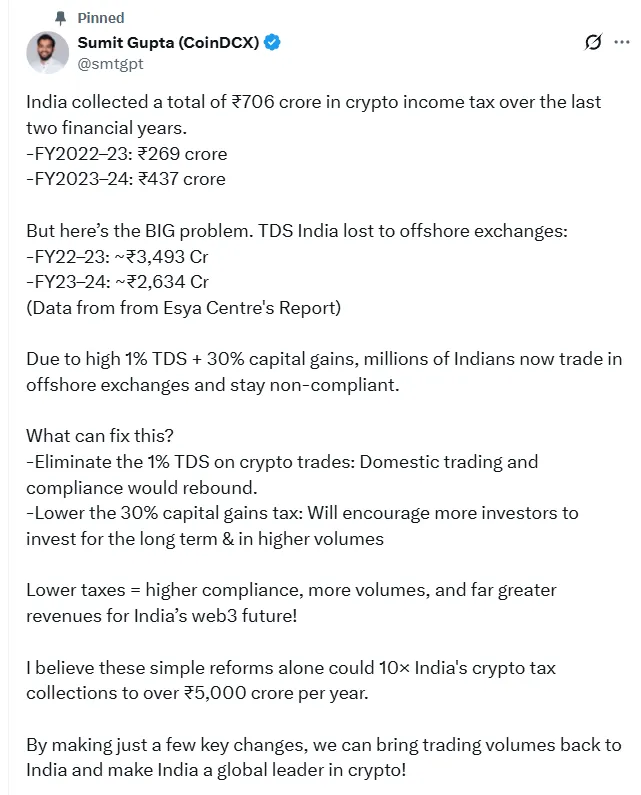

While the government says it’s about fairness and transparency, the crypto community feels a different kind of pressure. Since April 2022, India has imposed a 30% on crypto profits plus a 1% deducted at source (TDS) on every trade.

Amid the crackdown, CoinDCX CEO Sumit Gupta warned that India earned ₹706 Cr in taxes but lost over ₹6,100 Cr to offshore trades due to 1% TDS and 30% charges. He questioned if cutting these rates could 10× collections and make India a global crypto leader?

Source: X

As per the Income Tax Bill, the rate is reduced from 30% to 20%, collections based on the same declared gains would fall from ₹706 crore to about ₹471 crore, and at 10% they’d drop to roughly ₹235 crore.

However, as Sumit Gupta suggests, lower rates could bring trading volumes back to India, making actual collections much higher. For investors, it implies holding on to more of their gains, incurring fewer penalty on every trade, and being more likely to trade within India instead of shifting towards offshore exchanges.

A fresh bill will be introduced in Parliament on Aug 11 to replace the 60-year-old Income Tax Act, 1961. It remains to be seen whether the bill will correct high digital charges such as the 30% gains fee and 1% TDS, which have pushed traders to offshore platforms. Any relief could enhance compliance, domestic trading, and government revenues.

The discoveries of ₹29,208 crore of international assets and ₹630 crore of hidden profits make clear that India's enforcement tools are becoming sharper. But the question ultimately is this: will these measures bring long-term compliance, or will they deter investors and traders?

As crypto adoption around the world picks up speed, will India's intense surveillance and tight charges measures support its reputation-or will it cause the country to miss its chance to become a true hub of digital finance?

Deepak Choudhary is a solid two years of writing experience and crypto enthusiast. He writes about blockchain games, Telegram games, and tap-to-earn platform. Like his audience, he writes with clarity, simplicity, and lots of useful tips in his articles. He helps those unfamiliar with various aspects of crypto world in a very simple way. He also provides regular updates on the fast growing world of blockchain, with great articles covering current and expected trends and guides. His writings on crypto games as well as crypto earning apps on Telegram are quite useful and informative for people novice and experienced. His aim is to help more people explore and profit from Web3 ecosystem.