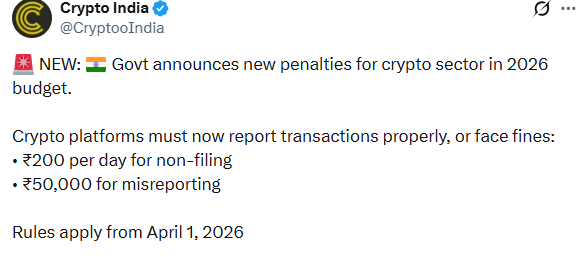

The Indian government has taken the strongest action yet to punish entities that fail to comply with crypto regulations. Under the Union Budget 2026–27, India Crypto Penalties 2026 establish a clear daily penalty system for crypto-related reporting failures, marking a decisive shift from loosely enforced disclosure norms to strict statutory accountability.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The new regulations will come into effect from April 1, 2026, under Section 509 of the Income Tax Act, 2025, and apply to Digital Assets exchanges, digital asset platforms, and all reporting entities required to disclose crypto transactions. The framework introduces a ₹200 per day penalty for delayed filings and a ₹50,000 fine for inaccurate or misleading disclosures, even if the transaction value involved is relatively small.

Early in the Finance Bill’s crypto provisions, the government made its intent unmistakable: non-disclosure and improper reporting of Digital Assets will no longer be accepted under India’s tax system.

The major purpose of the India Crypto Penalties 2026 is to force systemic transparency across the board. The new rules do not simply target domestic exchanges; they apply to wallet providers, intermediaries, and even individual investors who fall within the statutory reporting net. Under Section 509, "prescribed reporting entities" must now maintain granular data on all user activities, including trades, swaps, and transfers.

The calibrated penalty framework is divided into two distinct categories to ensure data integrity:

Non-Filing Penalties: A ₹200 per day fine for every day a required statement remains unsubmitted after the deadline.

Misreporting Penalties: A flat ₹50,000 fine for furnishing inaccurate particulars or failing to rectify defects in a timely manner.

Prosecution Risks: For high-value defaults exceeding ₹50 lakh, the government has introduced the possibility of up to two years of imprisonment, signaling that these India Digital Assets Penalties 2026 carry significant legal weight.

Despite the heavy emphasis on compliance, the industry's plea for tax rationalization was largely ignored. The India Budget 2026 maintains the status quo on several controversial fronts:

30% Flat Tax: Gains from VDA transfers continue to be taxed at the highest bracket regardless of the holder's income level.

1% TDS Mismatch: The 1% Tax Deducted at Source remains active, which industry leaders argue continues to drain liquidity from domestic order books.

No Loss Set-Offs: Investors are still prohibited from offsetting losses in one token against gains in another, a rule that remains a major point of contention for active traders.

Preparation is now critical. Crypto users should:

Maintain reliable records of all Digital Assets transactions

Review platform-specific reporting procedures

Correct historical inaccuracies proactively

Avoid delayed or partial disclosures

Failure to act early could expose investors to cumulative fines under the new regime.

The introduction of the India Crypto Penalties 2026 suggests that the government is preparing for a more regulated future, possibly aligning with global standards like the OECD's Crypto-Asset Reporting Framework (CARF). By prioritizing enforcement over incentives, the Centre is filtering out casual or non-compliant participants.

Industry experts have described these measures as a "positive milestone" that formalizes the industry but warned that high taxes could still push talent and capital toward offshore platforms. For the average investor, the road ahead involves meticulous record-keeping. The financial cost of even a minor oversight in reporting could now outweigh the profits from a successful trade.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.