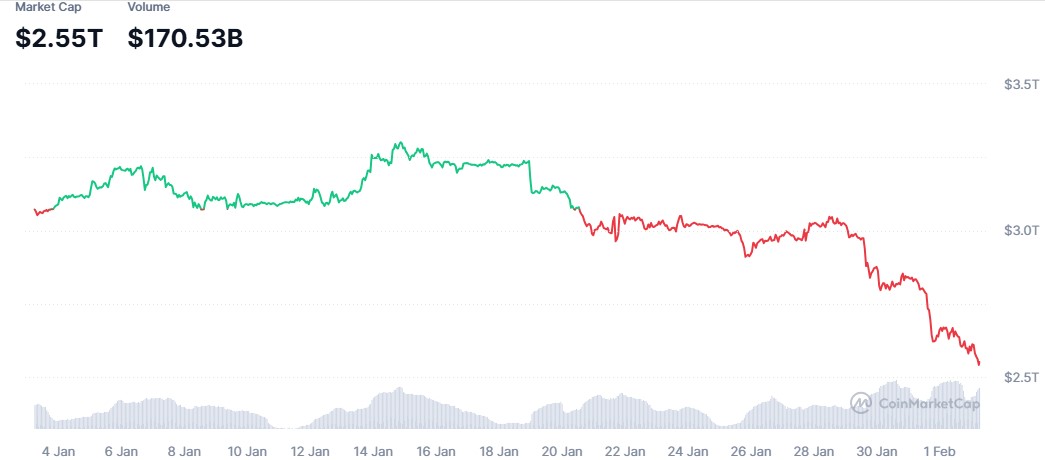

The crypto market has plunged again, raising major questions and concerns: Is this the first real crash of 2026, or just another wave of volatility following the continuous downturns of the October 2025 crash?

Source: CoinMarketCap

After a long bull run that peaked last year where many digital currencies achieved their all time highs, many traders hoped 2026 would be smooth. But this crypto weekend’s sharp drop stunned the industry and left many under shock about what’s really happening in crypto.

Over the weekend, the crypto market declined sharply. Potential sell-off, strong bearish pressures and extreme fear, greed and fear index at 15, dominating the sentiments. Major coins fell hard stating how significant this downturn is.

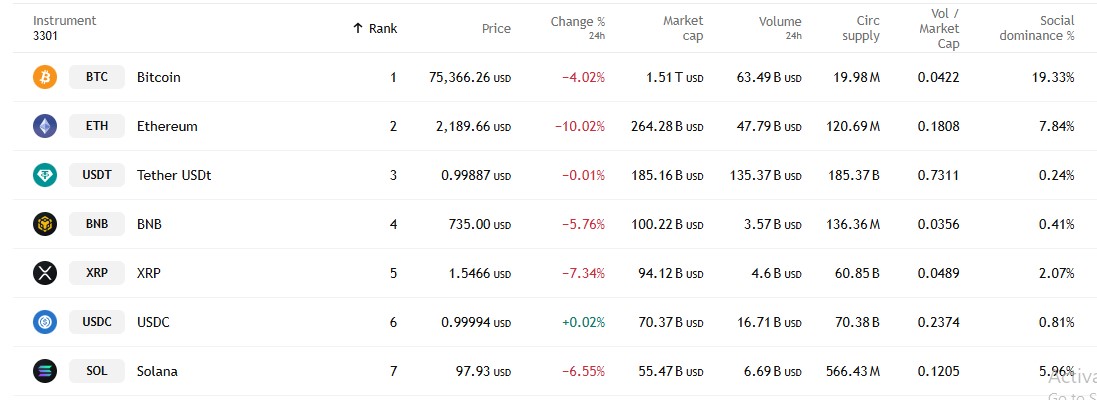

Bitcoin price dropped to around $75,000, hitting lowest since 2024

Ethereum went below $2,200 facing around 10% value loss in the last 24 hours

Solana also fell below $100, while BNB and XRP face 5–7% declines

Source: Trading View

The total crypto market cap has slipped by 4.37% to $2.55 trillion. The ETF marketplace is also suffering with heavy outflows, where Bitcoin, Ethereum, and Solana noted -$509.70M, -$252.87M, and -$11.24M in daily flows respectively as of 31st January.

All these represent one of the steepest downturns after the 2025 crash, raising speculations on the start of the 2026 crash which caused the sale of many coins.

The weekend crash was not caused by one single event. It was the result of many latent activities building pressure quietly over time and flared up when they received support.

Source: Wise Advice

Macro Liquidity Tightness Pressured the Situation

The major reason behind the sell-off was a shortage of U.S. dollar liquidity in global markets. When dollars become harder to access, investors usually pull money out of risk assets like cryptos, stocks, and tech shares.

During the weekend:

U.S. bond yields stayed elevated, reducing demand for speculative assets

Crypto showed a 67% correlation with the S&P 500, meaning both markets fell together

As a result, the crypto market reacted like a macro asset class, not an isolated sector.

Fear and Leveraged Liquidations Deepened the Sell-Off

Once the prices started falling, fear spread rapidly across the sector. As the drop accelerated, more than $760 million in leveraged long positions were liquidated, where bitcoin alone saw $255 million forced wipeouts, as per Coinglass Data.

This scenario created a chain reaction, where selling pushed prices lower, triggered even more liquidations.

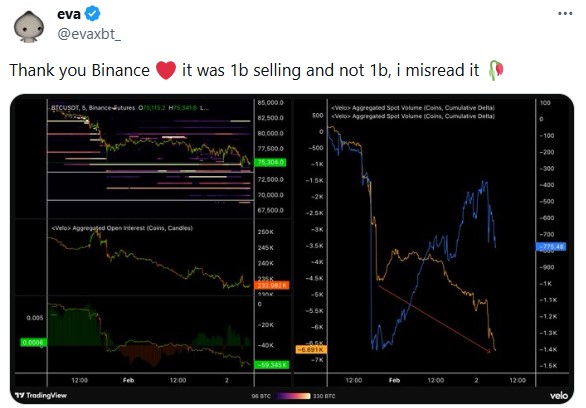

Rumors and Social Media Controversies Increased Panic

Rumors spread that Binance was buying $1 billion worth of Bitcoin, briefly lifting sentiment. However, on-chain data later showed nearly $1 billion in BTC selling, not buying.

At the same time, several high profile claims spread on social media, fueled the situation further:

Financial influencers such as Anthony Pompliano, were linked to geopolitical rumors (no verified evidence)

Old Jeffrey Epstein files resurfaced, mentioning major crypto figures like Michael Saylor, in a non-criminal context

TRX Justin Sun faced fresh accusations from an ex-associate, which remain unverified

Although most of these claims were unverified, they added greatly to the fear and confusion.

Even in this situation of confusion and uncertainties, there are some major players who are still bullish, spreading some positivity.

On-chain data showed, whales accumulated 50,000+ BTC during the dip, where some institutions are also expanding their portfolio taking the dip as an opportunity.

The latest slide in the cryptocurrency market feels fierce, but it is not necessarily a full crash like October 2025. It appears driven by macro liquidity stress, leverage unwind, and social fear rather than clear systemic failure.

With large investors buying the dip and support levels holding, the crypto market still has a chance to calm down and recover.

Disclaimer: The information above is based on differential sources and does not constitute any claim or advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.