Infinex TGE is finally here. On January 30, 2026, at exactly 7 PM UTC, the INX token will be generated, marking one of the most important DeFi launches of early 2026. Backed by Synthetix founder Kain Warwick, the project is built as a decentralized perpetual exchange that aims to deliver the speed and ease of centralized platforms.

In this article, we will uncover the sale numbers, lock rules, vesting schedules, listing exchanges, and pre-market pricing mechanics.

What makes this event serious is not hype, but structure. As per the official X announcement, Infinex TGE listing date is set on January 30, 2026 on some of the top CEXs, and DEX platforms.

The market is already reacting, especially after Bybit launched the $INXUSDT pre-market perpetual contract with up to 5x leverage. The project has also confirmed that the official coin will exist only on Ethereum and Solana, removing confusion around multi-chain inflation risks.

One major reason behind why tomorrow’s launch is interesting is because the project’s structure heavily depends on lockups, which can reduce early sell pressure upon new token Q1 market listing.

The token sale closed on January 10, 2026, and the numbers speak clearly:

Total committed: $7,214,204.80 USDC

Participants: 868

Allocated: $5M (5% of total total supply)

Refunded: $2.21M

Oversubscribed: 44%

Only 5% of the supply was sold at a $99.99M FDV with a strict one-year lock. That means most buyers cannot sell until January 30, 2027. This instantly reduces early circulating supply and keeps short-term dumping pressure low after $INX listing date Jan 30.

The Patron NFT snapshot happens before the Token Generation Event. Two timelines to watch before Infinex TGE goes live:

Patron Snapshot: January 30, 2026 at 07:00 UTC

INX TGE: at 19:00 UTC

For every Patron NFT held at the snapshot, users can claim 100,000 coins in the official app from launch time. Traders should note that any patrons bought after snapshot will get nothing. The project also warns users to cancel active marketplace bids to avoid losing Infinex airdrop.

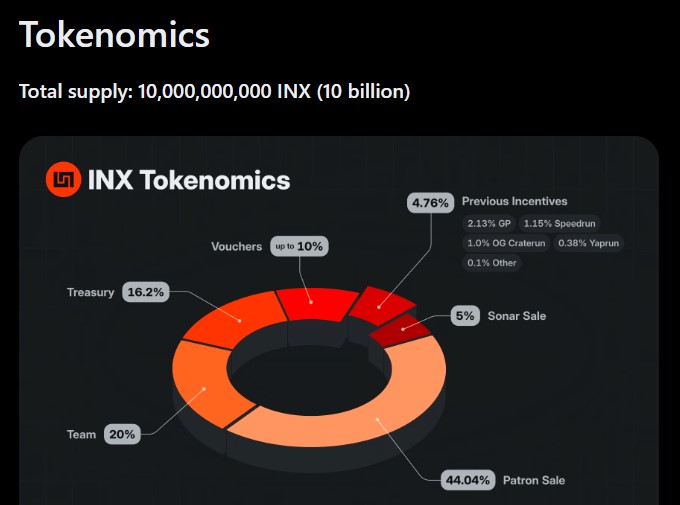

Total supply: 10,000,000,000 coins

This tokenomics structure shows that most of the supply is either locked or gradually released. That is healthy for Infinex listing price discovery.

At the Token Generation Event, the early unlock price starts at:

$300M FDV = $0.03 per coin

This price slides down linearly over one year until:

$99.99M FDV = $0.0099 per asset

To unlock early, holders must pay the difference between their purchase price and the current unlock price. This explains why the Bybit $INX pre-market price is holding between $0.031–$0.032. The market is literally pricing the asset at its official early-unlock valuation.

Traders will be able to trade $INX on MEXC, Bitget, ByBit, and WEEX. Coinbase has added Infinex crypto to its roadmap. Analysts also suggest Binance may support the launch later.

Pre-market behavior shows a strong support zone around $0.027–$0.029, so the listing range expectations are $0.03–$0.035. The Short-term bullish behaviour can pull the price around $0.045–$0.06 zone. The market is already treating $0.03 as fair value confirms trust in the design rather than emotional speculation.

Infinex TGE listing on January 30, 2026 is a well-structured launch backed by real demand and disciplined token economics. With oversubscription, locked supply, Patron rewards, and strong pre-market pricing near $0.03, INX token price enters the market as a serious DeFi asset.

YMYL Disclaimer: This article is for informational purposes only and does not provide financial advice. Cryptocurrency involves high risk. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.