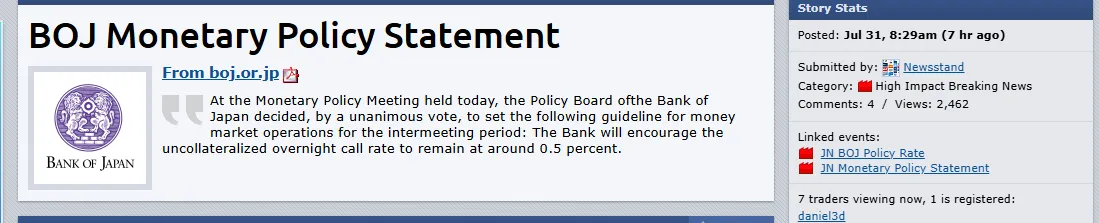

According to a recent report of Reuters, the Bank of Japan (BOJ) has decided to keep its benchmark interest rate steady at around 0.5% which aligns with the US Federal Reserve’s recent move to maintain the rates for the fifth consecutive time.

Source: Forexfactory

This Interest rate news decision shows the cautious approach of Japan towards its economic recovery is particularly in light of ongoing trade talks with the United States.

Analysts believe the central bank is being careful, given the fragile state of the economy and uncertainty surrounding global tariff policies.

On the Interest rate news, the Japan bank’s decision was with one voice approved with the experts indicating that inflation remains an ongoing concern.

Tohru Sasaki, Chief Strategist at Fukuoka Financial Group, stated that– “While the BOJ could adopt a hawkish stance, it continues to tread carefully due to risks tied to US trade policies”.

The central bank revised its CPI forecast for 2026 slightly upward that highlights the moderate expectations. Real interest rates remain at extremely low levels, leaving room for potential hikes in the future if economic conditions improve.

On July 23, 2025 the U.S President announced a trade deal with Japan. The country will cut car import taxes to 15% and invest $550B in U.S. factories to boost jobs and local pride, these taxes affect the market price indirectly.

In response to uncertainties growing from possible US tariffs the country has rolled out a $6.3 billion relief package. Experts suggest this stimulus could indirectly benefit the crypto market, as additional liquidity often boosts investor confidence.

Source: Reuters

The Bank of Japan (BOJ) also repeated its commitment for achieving a 2% inflation target in a sustainable and stable manner which aims that the monetary policy adjustments will depend on future economic data.

The more the Fed keeps Interest rate news steady, the more Donald Tariff steps up his trade actions and this push and pull is rattling the crypto market

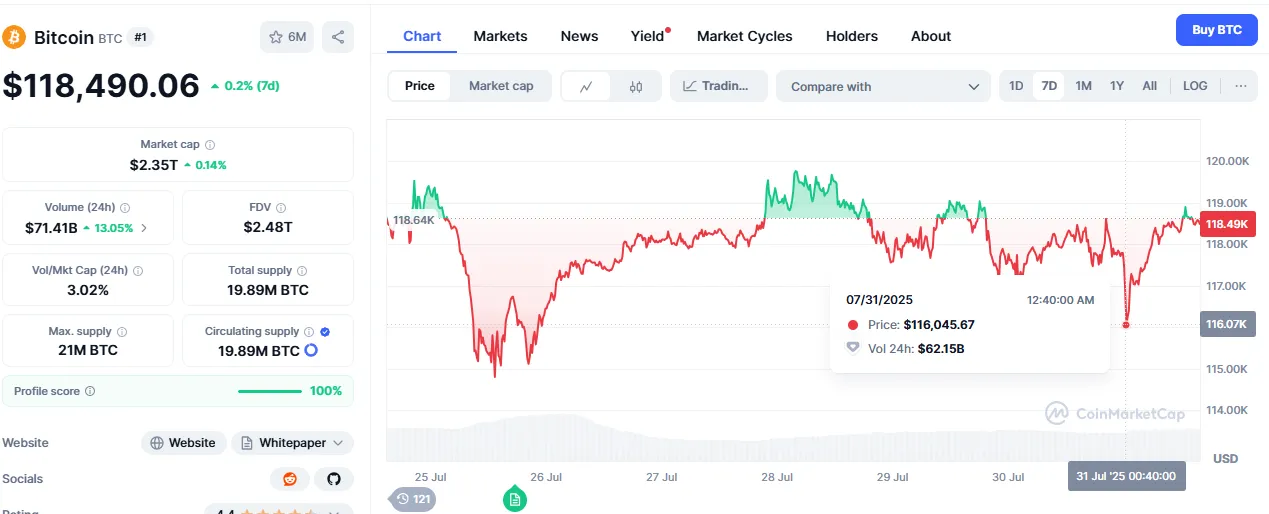

While the global crypto market cap currently stands at $3.89 trillion, up 0.76%, top assets are showing mixed signals. The price of Bitcoin dropped to $116,000 before rising to $118,490 (at the time of writing).

Source: CoinMarketCap

Ethereum touched a low of $3,680 but gained its value sharply , while XRP hit a six-day low of $3.062. Analysts hint that economic instability and cautious financial policies could trigger a cautious phase for digital assets.

The interest rate news, BOJ’s decision has introduced fresh uncertainty to the global crypto market. While the sudden impact remains limited, potential rate hikes, trade tensions, and inflation risks could lead to heightened volatility in the coming weeks.

Investors may need to remain cautious as market sentiment continues to fluctuate.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.