Can the Interlink Labs listing date finally take shape after the private mainnet goes live in Q1 2026? That is the question investors and early users are asking as the project moves closer to launching its mini app and human-verified blockchain infrastructure. The coming months are not just technical milestones. They decide when real on-chain activity, token utility, and exchange exposure can begin.

The roadmap shows a clear story. First comes the mini app and private mainnet in Q1 2026. Then comes the expected token listing phase in Q2 2026. Each step builds pressure toward a broader market launch.

Q1 2026 is centered on the private mainnet. This is not a test chain. It is a payment-ready Layer-1 designed for speed and high transaction throughput, with a first goal of 10,000 payment points. That means the chain is being prepared for real usage, not just experiments, the team shared the details over X (formerly Twitter).

Source: Official X

At the same time, the mini app expands the free-mining model into a full super app. Users earn value by being verified humans, not by buying hardware or staking capital. Facial scanning and liveness checks protect the system from bots and fake accounts. This makes the Interlink Network launch date more important than a normal blockchain release. It introduces proof of personhood as the core of the economy.

Private launch plus human verification equals real token demand. Without these, the Interlink Labs listing date would remain speculative.

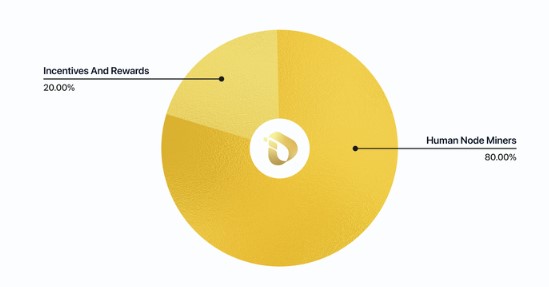

Interlink Network tokenomics are built around activity, not speculation. The total supply of ITLG is capped at 100 billion tokens. Eighty percent is reserved for human node miners, meaning verified users who stay active. Only twenty percent goes to ecosystem growth, development, and partnerships.

Source: White Paper

There is no venture capital dominance and no early insider unlock pressure. Emissions expand and contract based on real human participation. Inactive and unverified balances can be burned or redistributed, which adds a natural deflation effect.

The dual-token system adds depth. ITLG is the participation token. ITL is the reserve token with a total supply of 10 billion. Half of ITL is earned through staking verified ITLG. Treasury companies buy ITL through OTC markets, not from the core team. That creates external demand without inflating supply.

The Interlink Network mainnet launch date in Q1 sets the stage for exchange exposure in Q2 2026. The token listing on major exchanges is expected around May-June 2026. However, the team hasn’t made any confirmation on this yet.

Mini apps bring real user activity. The private mainnet proves payment throughput. Human verification proves uniqueness. Once these systems are stable, major exchanges have a stronger reason to list the token.

The roadmap also points toward U.S. market ambitions, including future NYSE-related expansion. That is why analysts expect the Interlink Labs launch date for trading markets to follow, not precede, the mainnet.

The Interlink Labs listing date depends on execution, not hype. With the mini app and private mainnet launching in Quarter 1 2026, the project builds real demand before opening public markets. A Q2 2026 exchange listing appears logical, structured, and aligned with sustainable token growth and verified human participation.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.