The cryptocurrency market witnessed a sudden shake-up on June 24, 2025, after Iran attacked Israel, breaking the recently declared ceasefire. According to a translated post by the Israeli Air Force on X, missiles were launched from Iranian territory, activating alerts in northern Israel.

“In light of the severe violation of the ceasefire carried out by the Iranian regime, we will respond with force,”

— LTG Eyal Zamir, Chief of Staff, Israeli Defense Forces

Source: Israel Defense Forces Official X account

Just hours before this, Donald Trump had shared a hopeful note on his Truth Social account, claiming both the countries were on a path to peace. But that optimism quickly vanished—and the crypto liquidation news followed soon after.

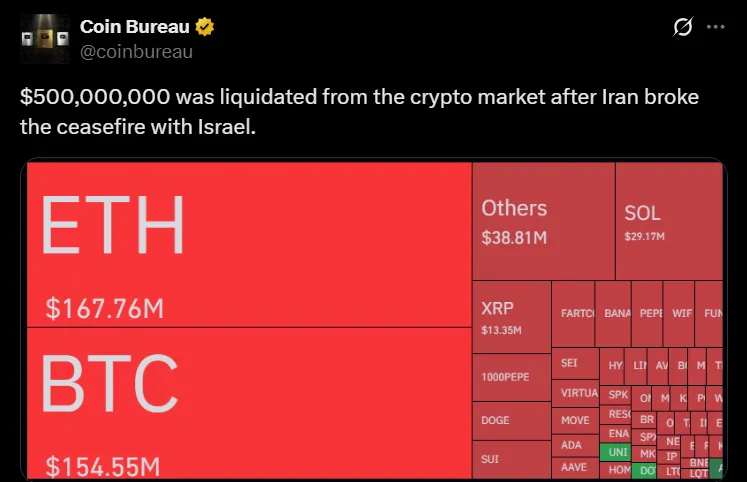

With war tensions escalating, the cryptocurrency market saw $500M crypto liquidated across exchanges in a single day—one of the biggest shocks of the year, confirmed by the renowned X account Coin Bureau.

Key Liquidation Data:

Total value wiped out: $502.92 million

Shorts liquidated: $371.28M

Longs liquidated: $131.63M

Biggest single liquidation: $12.14M ETH/USDT order on Binance

Total traders affected: 132,874

This current crypto news today, showing a strong impact on overleveraged traders. A big amount of short positions were liquidated because $BTC prices spiked initially, before a classic short squeeze.

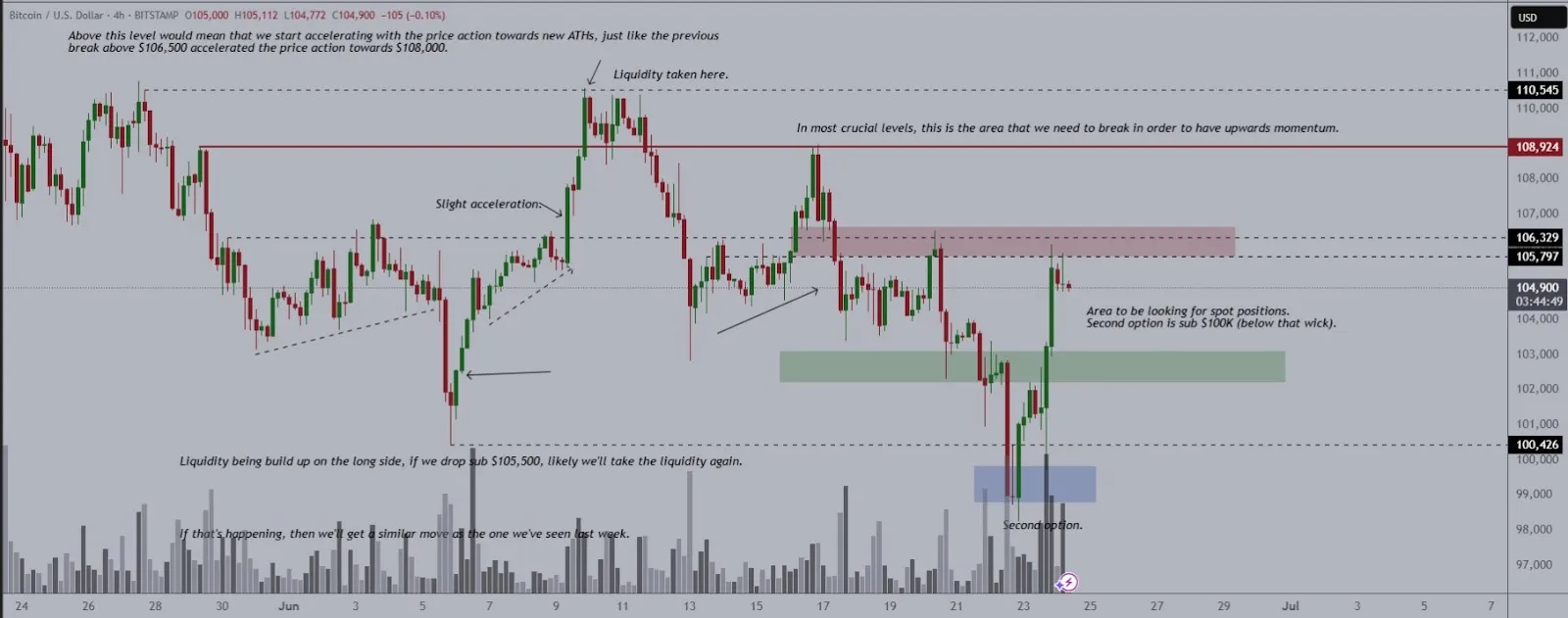

The price of $BTC briefly rallied to $106K after initial peace talks but quickly corrected after the Iran Israel ceasefire violation. The price is now floating around $105,312.

Source: TradingView

Technical Indicators:

Support zone: $100,600

Resistance level: $110,147

Bollinger Bands: BTC bounced off the lower band (buy zone).

RVI Indicator: Purple line still below yellow → bearish pressure

Volume: Weak—suggests bounce may lack strong conviction

This range suggests this currency is in a neutral zone, not fully bullish unless it breaks $110K. The fear now is—will Bitcoin crash again if global tensions rise?

Crypto analyst Ash Crypto posted:

“BITCOIN BOUNCED AS WE HOPED,” alongside a bounce chart showing support strength.

Renowned trader Michaël van de Poppe tweeted:

“#Bitcoin has a trend switch. It went past $103K. If it dips again, $103K is a perfect buy zone." He also shared this price chart while making a statement.

Source: The CIO and Founder of MNFund

Meanwhile, altcoins like Ethereum and XRP have surged sharply, with gains of 6%–8% in the last 24 hours. That suggests in the short term the industry is favoring altcoins.

The market is in a danger zone. With crypto liquidation numbers rising and geopolitical risk peaking, many traders—including myself as a crypto analyst—are closely watching this $105,000 key level for further Bitcoin price prediction July 2025.

Based on current market conditions, my observation is that if BTC sustains above $105,000 and volume increases, a run toward $110K is possible. But if support breaks below $100.6K, further pain may follow.

In this evolving Iran Israel ceasefire broken situation , traders must prepare for high volatility. For now, $BTC is bouncing—but carefully. Watch the headlines. Stay cautious. And remember: one tweet or missile can change the market direction.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.