One of China’s e-commerce giants is officially entering the stablecoin arena. Via its fintech subsidiary JD Coinlink, the JD.com company stablecoin initiative is now being tested in Hong Kong within the city’s legal sandbox program.

According to Liu Peng, CEO of JD Coinlink, the company is piloting pegged assets backed by the Hong Kong dollar and other global tokens. These trials are part of the Hong Kong Monetary Authority’s sandbox, allowing the company to test blockchain-based payment game plan for its Hong Kong and Macau e-commerce platforms in a safe, compliant environment.

Source: Journal Du Coin X

Whereas many blockchain experiments that remain limited to proof-of-concept stages, this project is directly tied to its commercial operations. The company pegged tokens is expected to go live for client payments as early as Q4 2025.

As confirmed by Wu Blockchain, this isn’t only hype. It’s a severe attempt to integrate blockchain payments into the retail ecosystem. According to Journal Du Coin, the project reflects China’s wider ambition to lead innovation in digital finance.

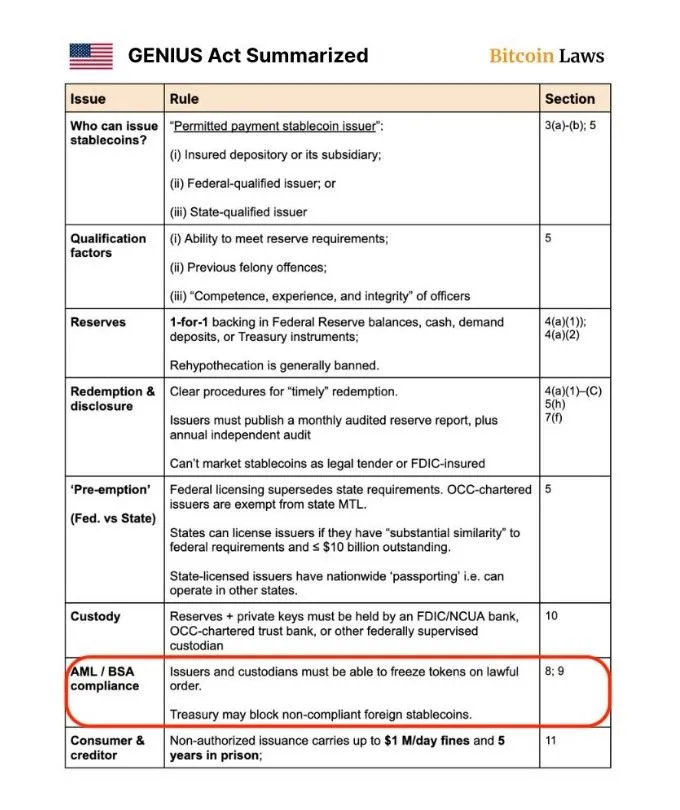

In the latest Stablecoin news , the U.S. Senate has passed the GENIUS Act, which also confirms stricter oversight of these coins, according to Coin Bureau. The law states that only licensed institutions, like federally chartered banks licensed by the United States, qualified entities can offer pegged crypto in the U.S.

Source: Coin Bureau X

Here’s what the GENIUS Act stablecoin regulation demands:

All digital stable coins must be backed 1:1 by cash or US. Treasuries

Issuers will publish verified reserve reports daily

Money and keys must be held with controlled depositories

US. Treasury can block foreign coins like Tether if deemed non-compliant

Unlicensed project teams face heavy fines and jail time

The timing of the JD.com company stablecoin pilot and the U.S. GENIUS Act is no coincidence, as per CoinGabbar analysts observation. It reflects a growing divide in how global powers approach crypto.

China, leveraging this firm and Hong Kong, proceeds to be rational and innovative with legal advice.

The US., via the GENIUS Act, is emphasizing control and restriction

This divergence may lead to a fragmented global pegged crypto asset landscape, with Asia concentrating on commerce and the U.S. on compliance.

If the Hong Kong trial prevails, This JD Coinlink news can scale the game plan to other regions where the firm operates. This will position the JD.com company as a real-world example of how blockchain can power next-gen e-commerce payments.

Additionally, it shows that China's retail firm is prepared to lead the next phase of blockchain adoption, not with market bets, but via real USE CASE in digital commerce.

As the country embraces digital payments via its JD.com company stablecoin, the US. is cracking down with the GENIUS Act. Whether one approach proves more effective than the other remains to be seen—now it’s clear that the race to shape the coming days of digital stable currency has officially begun.

Sudeep Saxena is one of the co-founders of Coin Gabbar. Apart from developing the business, he is also a CMA by profession. Sudeep contributes to #TeamGabbar by writing geopolitical blogs.

Sudeep has an extensive experience in the crypto space and intents to build a rich knowledge bank in the form of blogs and articles, that shall develop a basic understanding of the crypto world for any new entrant in the market. When not writing, he can be found reading books.

You can connect with Sudeep on Twitter and LinkedIn.