The Jackson Hole Symposium entered its second day today, August 22, with all eyes on the much-awaited Jerome Powell Speech. Investors, especially from the crypto space, are keenly waiting for Jerome Powell speech today live, hoping for clarity on the Federal Reserve’s next steps. Last year, Fed Chair signaled that rate cuts were coming soon, and with markets already expecting a fed rate cut in September, today’s speech could be the most influential of 2025.

Source: ForexFactory

The Jackson hole meeting 2025 comes at a time of heightened political pressure, with President Trump pushing aggressively for deeper cuts in interest rates and even demanding Powell resignation. For crypto traders, the speech today could be a defining moment, deciding whether markets tilt bullish or bearish.

Two major questions dominate today—will he announce a surprise fed rate cut news, or will he bow to political pressure and resign? Currently, U.S. interest rates stand between 4.25% and 4.50%. Market consensus suggests a September cut, but uncertainty is building.

Some analysts argue that he may drop hints in the Jerome speaks today summary about easing monetary policy, which could spark optimism across markets, particularly in crypto. On the other hand, speculation about possible resignation—amid ongoing clashes with Trump over tariffs—has added another layer of unpredictability.

Beyond the U.S., the European Central Bank’s wage growth indicator and Sweden’s rising unemployment rate are shaping broader economic sentiment. But for investors, the Fed announcement today is still the largest news.

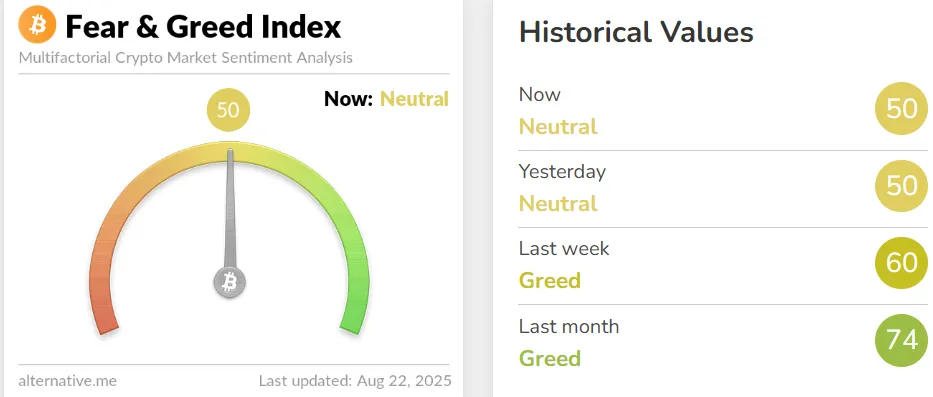

Before news of Jackson Hole symposium, already markets are troubled. Global crypto market cap has dropped to $3.85 trillion, 0.51% lower on a daily basis. Bitcoin declined by 0.51%, at $113,065.26. The Fear and Greed Index has moved from greed (60) last week to neutral (50) today, indicating investor fear.

Source: Fear and Greed Index

People are asking, why crypto market down today? Reason is uncertainty about interest rates and whether a cut or resignation is going to happen.

Meanwhile, traders are waiting, hoping Fed Chair will bring stability or shake investor confidence some more.

The outcome of the speech today could set the tone for crypto’s next move. Both scenarios are seen as potentially bullish for digital assets. A rate cut would inject liquidity, boosting investor appetite. Powell’s resignation could pave the way for a Fed more aligned with Trump’s push for aggressive cuts.

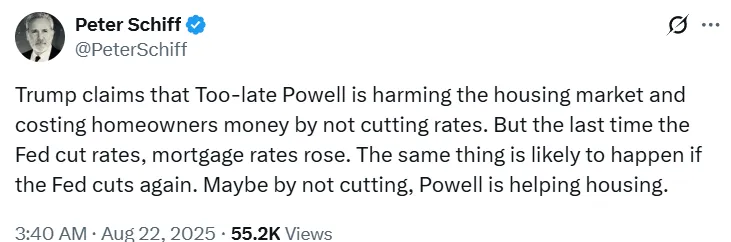

However, not all agree. Noted economist Peter Schiff has warned that rate cuts may not benefit the economy or housing sector. He argued that the last rate cut drove mortgage rates higher, suggesting that Powell might actually help housing stability by resisting Trump’s demands.

Source: X

For now, traders must tread carefully. The news today is dominated by Fed Chair, and the Powell speech could either spark a bullish rally or drag the market into fear.

The Jackson Hole Symposium is shaping up to be one of the most pivotal events of 2025. With the Powell speaks today live, investors brace for clarity on whether a fed cut news or resignation will emerge. Either outcome could have a lasting impact on crypto’s direction, making today a turning point for traders.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Do Your own research before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.