The President on Monday extended the Trade truce with Beijing for another 90 days. Preventing triple-digit tax on Chinese products as American merchants prepare to increase their stock levels in anticipation of the crucial end-of-year Christmas season.

Source: Truth Social

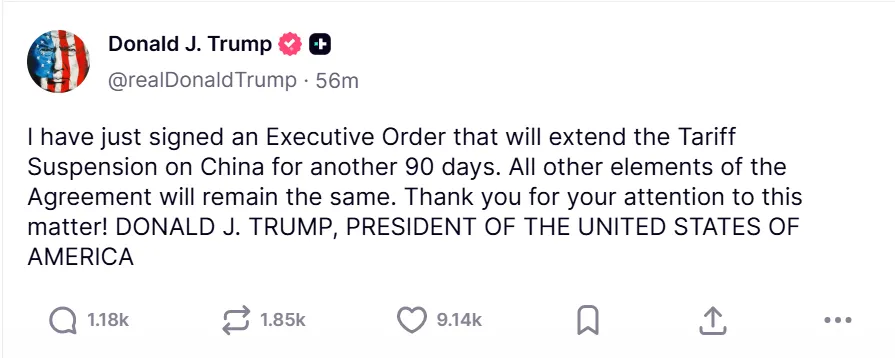

The US President posted on his Truth social platform that he had signed an executive order suspending the imposition of higher trump tariff on china until 12:01 a.m. EST on November 10, with all other elements of the truce to remain in place.

The prior deadline was scheduled to end on Tuesday at 12.01 a.m. If that had occurred, Beijing might have raised reciprocal taxes on US exports. This is not a new event of delay on Trump tariff on China, previously this kind of action has taken place.

It is anticipated that the deal between U.S. and Chinese trade officials, held in Stockholm in July, was expected to result in the delay. At the time, the Chinese reacted with 125% levies on U.S. goods after the US increased taxes on Chinese imports to 145%.

However, following their first meeting in Geneva in May, the two parties decided to halt the majority of those taxes. The Chinese lowered its duties to 10%, while the United States reduced its taxes back to 30%.

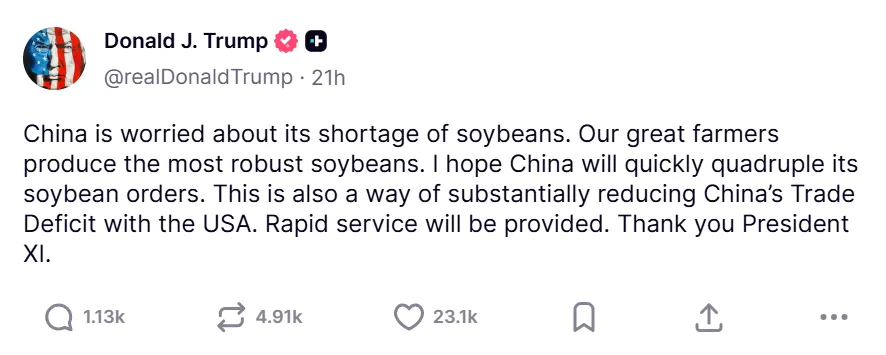

In his Truth Social post, he announced, "This is also a way of significantly decreasing the Trump tariff on China Trade Deficit with the USA." He declared on Sunday that he wants country purchases of American soybeans to "quickly quadruple."

Source: Truth Social

In the past, the President has declared high taxes on nations or industries, only to halt, modify, or scale them back days or weeks later.

For example, the "reciprocal tax" he first introduced in early April was swiftly halted, then postponed many times before going into force last week in a modified version. The latest example of his on-again, off-again shifting with no warning is going crazy. For many firms, this has made U.S. trade policy uncertain.

The overall global crypto market is slightly down today with market capital of 3.96T with a slight decline of 0.56%. All the top 5 crypto currencies are trading with a bit high and low.

Source: CoinMarketCap

Trump tariff on China is getting a new direction. Bitcoin is trading at $119,026 after hitting its almost all time high yesterday with a dip of 0.19%. Ethereum and XRP saw a dip of 0.44% and 1.74% respectively. Ethereum crossed its $4k target reaching new heights. BNB surged by 0.22%due to its corporate treasury accumulation and trading at $811.23.

The US trade war news is directly impacting the Crypto market. Trump's tactics and his surprising decision created a shock wave to the world. After giving tax relief to Chinese lets see how he deals with with India

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.