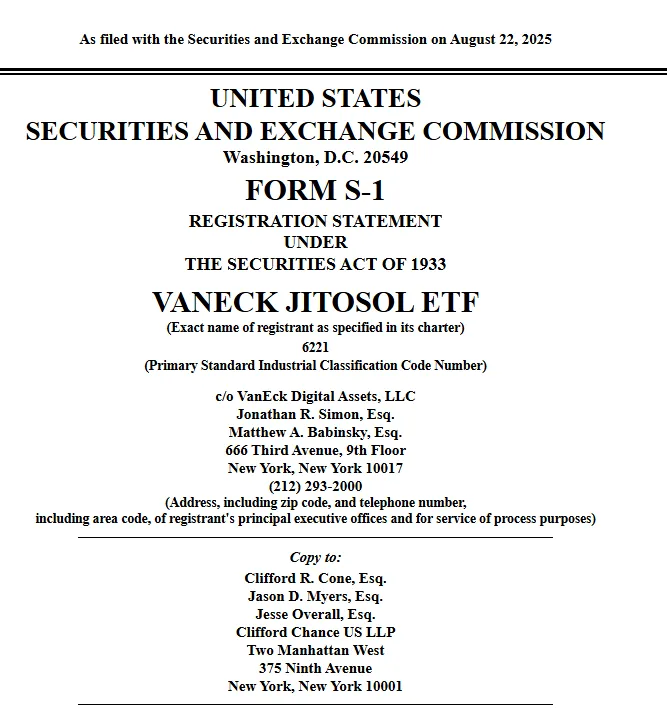

On August 22, global asset manager VanEck Files JitoSOL ETF, making news by submitting an S-1 registration with the U.S. Securities and Exchange Commission for a fund backed exclusively by JitoSOL, a Solana-based liquid staking token. This isn’t just another crypto filing—it could be the first of its kind in the U.S.

Source : Website

This filing didn’t happen overnight. The timing is key, as the SEC recently clarified that certain liquid staking activities do not count as securities transactions. This gave companies the green light to design products like ‘LST’.

Source : X

The Firm has been in communication with the SEC since February, as VanEck files JitoSOL ETF in order to guarantee compliance. The official beginning of a review procedure started but may take months to approve. This exchange traded fund, if granted approval, would be the first product listed in the United States that combines staking rewards with exposure to Solana.

In simple terms, the token represents Solana tokens (SOL) that have been staked, but unlike traditional staking, it stays liquid. That means investors can trade it just like any other token while still earning rewards from Solana’s proof-of-stake network. This is a big deal because staking usually involves “locking up” assets for weeks, limiting flexibility.

As the assets managing company VanEck files JitoSOL ETF, now this provides a solution to the persisting problem by utilizing this token. Solana will be purchased by the ETF, which will then stake it via the Jito system and create shares backed by these tokens. As with stocks, investors may purchase and sell these shares using their brokerage accounts. This successfully simplifies a difficult encryption procedure into something recognizable and approachable. It is a unique link between traditional finance (TradFi) and decentralized finance (DeFi).

A number of other organisations are also looking into funds based in Solana, including Bitwise, Fidelity, and Grayscale. However, This firm is the first to completely utilize liquid staking tokens, making its action unique. The way digital assets are packaged for Wall Street may change as a result of this filing, since investor interest is increasing and crypto laws are becoming more lenient.

If it's a success, the VanEck Files JitoSOL ETF might bring in more supporters of Solana. It may pave the way for staking-based exchange-traded funds on other blockchains.Analysts think that by making crypto yield schemes as easy as purchasing an ETFs share, these products might speed up institutional adoption.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.