The United States Securities and Exchange Commission has just delivered long-awaited clarity on one of the market's most controversial topics: US SEC Liquid Staking under specific conditions—does not fall under securities laws.

Before we move forward in its details, let's first understand; What is Liquid Staking?

Liquid staking lets you lock your crypto assets (like ETH or ADA) while still keeping a version of them liquid.

When an individual stakes through a service provider, he/she receives a receipt token in return. This token proves that you own the asset and entitles you to rewards—but the beauty is, an individual can also trade or use this token in various DeFi staking regulation platforms.

As highlighted on the Wu Blockchain official X account, this latest SEC news today is being celebrated as a turning point for protocols like Lido, Rocket Pool, and ETH, and Coinbase’s yielding services, all of which allow users to earn rewards without locking up their tokens.

According to its latest statement, the issuance and use of receipt tokens, under certain structures, does not constitute the offer or sale of securities. This decision is a major win for decentralized finance (DeFi) and a green light for protocols offering delegating-as-a-service across the industry.

As per the Division of Corporation Finance, when the model is structured properly, it doesn’t involve the offer or sale of securities.

This aligns with the current news and offers a much-needed interpretation of where crypto stands legally. The key point? As long as the provider is simply facilitating the delegating process—without promising profits, controlling funds, or making managerial decisions—it doesn’t count as a securities transaction.

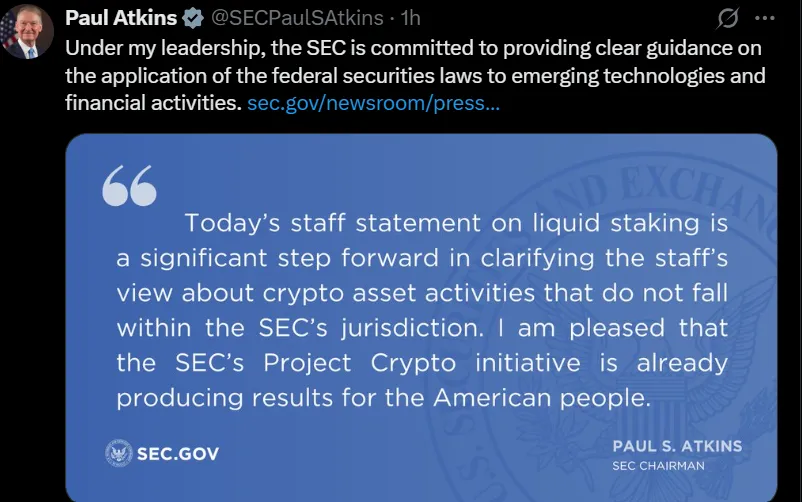

“Paul Atkins says:

Source: Paul Atkins Official X Account

While the US SEC liquid guidance is promising, it comes with clear boundaries. If the underlying crypto asset itself is part of an investment contract, then the this process could still be classified as a security transaction.

Additionally, if service providers begin managing rewards, deciding when or how much to stake, or promoting tokens as investment vehicles, they risk falling under the Howey Test.

As per my analysis, being a crypto observer for a long time now, this highlights a consistent message: structure matters.

This event may also influence the next generation of exchange-traded products. Asset managers behind upcoming Solana ETFs are lobbying to include locked rewards in their products.

If liquid staking not security becomes the accepted view, including receipt tokens in ETFs may be the next big step—especially within U.S. markets.

The US SEC Liquid Staking clarification is more than a legal technicality—it’s a milestone. For the first time, developers, investors, and users can engage with greater confidence in the rules that govern their actions.

In a sector constantly disrupted by regulatory uncertainty, this decision from the SEC latest news today feels like a long-overdue relief. For many, it represents the most bullish signal for DeFi all year.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.