In a move that could redefine the financial landscape, JPMorgan Chase Coinbase partnership just got announced. The $4 trillion banking titan is now enabling Chase credit card crypto integration to fund platform's accounts, while also allowing the company's reward points to be redeemed as $USDC.

This is the first time a major U.S. credit card loyalty program is offering direct crypto conversion—signaling a bold shift in how traditional finance views digital assets.

According to the official Coinbase latest X post, this deal consist of three major features, which are:

Source: X

1. Chase Cards + $COIN = Swipe and Buy Cryptocurrency

Starting Fall 2025, users will be able to use their Chase credit cards directly on the exchange. This removes third-party hurdles—enabling direct token buys using your card.

Not only does this simplify the crypto new partnership experience for millions of U.S. users, but it also aligns with JPMorgan’s mission to expand payment innovation while $COIN unlocks mainstream accessibility.

2. Reward Points Turned Tokens: Ultimate Rewards to $USDC

Imagine turning unused reward points into tokens. Now, 100 Chase Ultimate Rewards points = $1.00 in USDC. This gives new value to one of the most widely used loyalty programs in the U.S.

Customers can move points into a $COIN account, then invest in ETH, BTC, or yield products. It’s not just rewards anymore—it’s a liquid financial tool for the future.

3. Secure Bank-to-Wallet Transfers Through JPM API

The agreement also includes a bank-to-wallet API, which allows users to connect accounts to wallets on the platform directly. This helps to strengthen KYC, cut down on fraud, and guarantees a safe fiat-to-cryptocurrency transfer.

Melissa Feldsher of JPMorgan Chase stated this partnership is a “significant step in empowering financial futures,” especially as Coinbase crypto rewards go live. The move also aligns with increasing jpmorgan news today trends of privacy and utility.

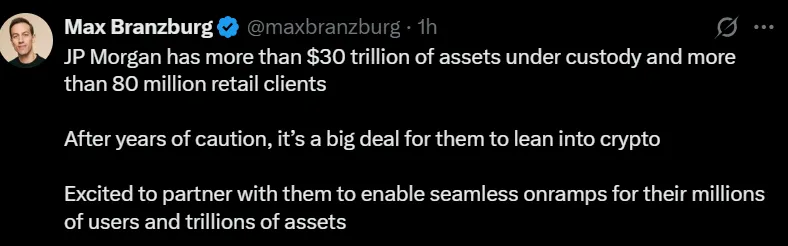

Coinbase’s Max Branzburg echoed this, saying it lowers access barriers and opens the door for mass TradFi-onchain. He also said:

“JP Morgan has more than $30 trillion of assets under custody and more than 80 million retail clients. After years of caution, it’s a big deal for them to lean into crypto”

Mass Onboarding: With 80M+ cardholders and 100M+ rewards accounts, the exchange may see exponential wallet growth.

Bullish for $USDC: Redemptions are set to spike, driving demand.

Fresh Liquidity: Every swipe becomes a potential coin buy, enhancing the exchange's new partnership traction.

As a cryptocurrnecy analyst, this feels like a pivotal moment. The JPMorgan Chase Coinbase partnership gives platform access to retail capital, while it avoids the risks of holding coins directly—yet still offers this exchange credit card buy functionality.

This is about aligning crypto infrastructure with financial legacy powerhouses.

With features rolling out from late 2025 into 2026, the JPMorgan Chase Coinbase partnership stands as perhaps the most groundbreaking move yet in bridging crypto and banking. It’s not just collaboration—it’s a signal that it may be the start of something irreversible, so keep an eye on Coinbase latest news to stay ahead of the market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.