Today, the financial world woke up to a big shock. The July US PPI Data Surge showed that inflation is much higher than expected.

This made traders across the globe nervous. Traditional markets were affected, but cryptocurrency investors faced their own storm. In just a few minutes, a huge crypto market liquidation wiped out millions in leveraged positions.

With Bitcoin and altcoins moving sharply, traders are asking—what happens next, and is this the right moment to reposition before the next rally?

The U.S. economy surprised everyone with the release of the July US Data Surge. According to Wu Blockchain, the annual Producer Price Index jumped to 3.3%, way higher than the 2.5% expected.

This is the highest level since February. On a monthly basis, the PPI data news highlighted 0.9% increase, the largest since June 2022.

These numbers mean PPI inflation is still strong, and the Federal Reserve might keep interest rates high for a while. For traders, this often causes cryptocurrency volatility.

When the producer price index jumps suddenly, crypto market liquidation happens, which means BTC and major altcoins can drop fast as leveraged positions are closed.

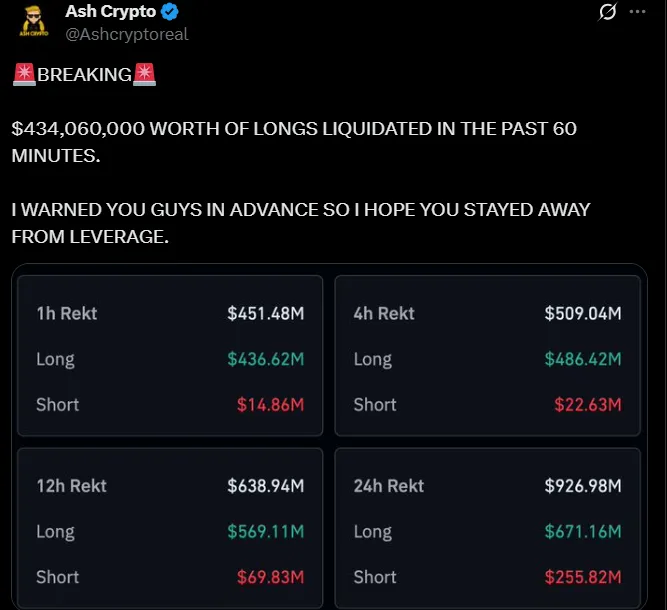

This PPI news caused big moves in the industry. Analyst Ash Crypto reported that $434,060,000 worth of long positions were liquidated in just 60 minutes. This shows how sensitive the industries are to news like this.

Traders saw quick price drops in Bitcoin and altcoins, highlighting the importance of watching crypto news today carefully.

Bitcoin price at the time of writing, quickly dropped to $119,172.61, reflecting a sharp drop of around 1.1% (1d), just after hitting an all time high today.

On the other hand, altcoins like ethereum price is also seeing a drop of around 4%, currently standing at $4,545.60

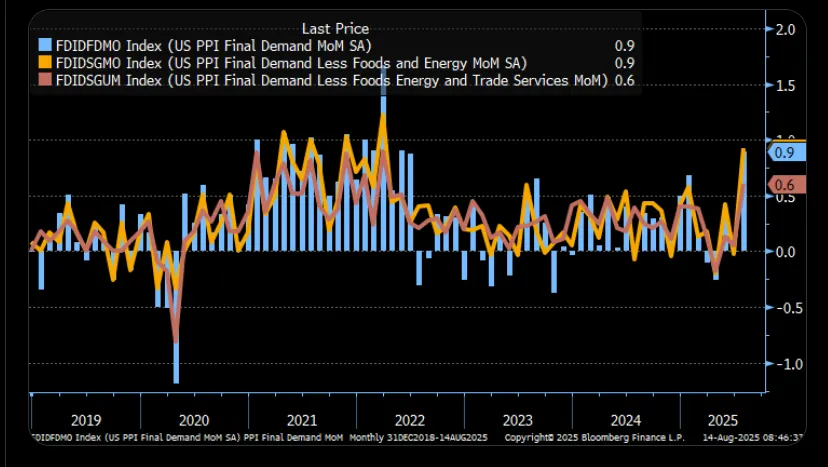

Kathy Jones, Chief Fixed Income Strategist, explained while sharing a chart, that both headline and core PPI rose 0.9%, the highest in more than three years. With Treasury yields rising, the Fed now has to manage inflation while also thinking about a softening labor marketplace.

Even though the marketplace is volatile now, experts remain positive about altcoins. When crypto market liquidation happens, it clears weaker hands and creates a chance for smart investors to buy at better prices.

Many analysts like CryptoElites say Q3 and Q4 could be strong for alt season, and some may even outperform $BTC. Traders should watch macro signs closely.

If inflation stays high or the Fed rate cuts delayed, the price swings may continue. But once the industry sees a Fed pivot, altcoins usually bounce first with added liquidity, and money flow is confirmed with much-needed investor confidence.

Watch Inflation Data: Rising US PPI data report may keep rates high and affect market volatility.

Monitor Liquidations: Events like $434M wiped out in minutes show risks and chances for traders.

Focus on Altcoins: Experts expect altcoin season index gains in Q3-Q4, especially for strong projects.

In summary, the July US PPI Data Surge has rattled the industry and will continue for the near-term. There will be short-term drops expected, due to crypto market liquidation, but altcoins have a positive long-term outlook.

All traders should constantly monitor the ongoing US Market news today, before the flow of gains begins again. But always do your own research before putting your money in any cryptocurrency, as the industry is currently experiencing massive highs and lows.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.