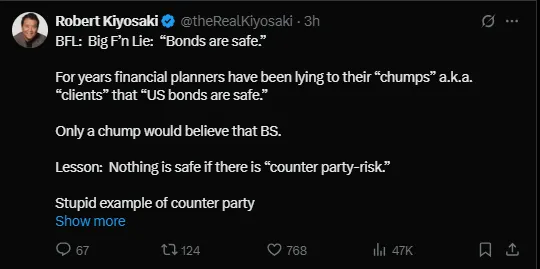

In a fiery new tweet on X (formerly Twitter), Rich Dad Poor Dad author Robert Kiyosaki revived his long-standing critique of the financial system, stating the notion that "US bonds are safe" is a "Big F'n Lie." Famous for his outspoken views and passionate warnings, Robert latest message is the harsh reality check for all traditional investors and financial advisors.

His message has been very simple: Nothing is safe when counterparty risk exists, and in his mind, the US bonds are among the riskiest assets an investor can hold nowadays.

Robert Kiyosaki has been very generous in raising his voice over financial planners. He called them liars who peddle false narratives to unsuspecting clients-whom he calls "chumps." At the core of his argument is lack of proper education and blind trust in systems that are prone to systemic risk.

Since the U.S. left the gold system in 1971, he argues, the Federal Reserve and U.S. Treasury have been printing what he calls "fake fiat money"-a scheme that he says The Swamp uses to keep criminal enterprises afloat.

He compared it to trusting government-backed financial products, such as bonds, to letting a convicted pedophile babysit your child just because his parole officer said so. Although harsh, it serves to illustrate his point about how dangerous blind trust in the system can be.

Among other things, the main point of the tweet is counterparty risk: the possibility of the entity on the other side of the investment failing to fulfill the commitment. According to Robert Kiyosaki, US bonds and ETFs represent this hidden risk.

He calls ETFs, especially any claiming to represent real assets such as gold or Bitcoin, "expensive toilet paper." His core belief remains: unless you hold the physical asset, you expose yourself to an unnecessary risk-and even worse-a risk that can be potentially catastrophic.

Robert considers himself vindicated by Moody's downgrade of the United States' credit rating, as it signals the world's awakening to the fragilities of the nation's economy. He points out how central banks are selling US bonds and aggressively buying physical gold-the acted-right-and-necessary way.

Therefore, such a sweeping change by financial institutions worldwide could only add to his suggestion's strength that a dollar is no longer the accepted store of value and that the shift toward hard money assets gets stronger by the day.

Robert Kiyosaki has been consistent for many years, encouraging people to ditch fiat and shift to real money-gold, silver, and Bitcoin. These assets have no counterparty risk, retain inherent value, and serve as hedges against inflation and financial downfall in his view.

Robert Kiyosaki reminds investors of an old saying by JP Morgan: "Gold is money, everything else is just toilet paper." With rising debt levels, quantitative easing, and weakening public faith in centralized institutions, this argument has become more pressing.

Robert Kiyosaki has been warning for decades of the fact that those holding hands with paper fiat money—from his expressions, toilet paper—myriad at purchasing power shrinkage every day. The solution, for him, is clear-cut: acquire physical gold, physical silver, and real-bitcoin (not ETFs). Ignore all the mainstream advice and start thinking like the central banks-how to stack real assets before it is too late.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.