Kraken news is reportedly gearing up to raise $500 million in a fresh funding round and setting its sights on a $15 billion valuation. The move comes as the U.S based exchange prepares for a long awaited Initial Public Offering (IPO) which is scheduled for the first quarter of 2026.

Crypto media platform Wu blockchain recently shared this on X handle about it.

Source: X

According to a report of the Information, the funding round is designed to make potential investors more comfortable with valuation. Kraken news, last valued at $11 billion in 2022 and aims to secure new capital and investor confidence before going public.

Co-CEO Arjun Sethi who took over headship in late 2024 is expected to lead the process of building momentum ahead of the IPO.

Kraken news IPO ambition is reportedly being fueled by a more crypto friendly regulatory climate in the U.S with President Donald Trump’s administration easing the pressure on virtual asset firms.

In March, the Securities and Exchange Commission (SEC) dropped a long-standing lawsuit against it, boosting confidence in path toward a public listing.

Other major crypto players including Ripple, Gemini and Galaxy Digital have also indicated plans to go public amid improved regulatory clarity.

Previously, it has secured EMI License from the Financial regulator to operate as an Electronic Money Institution that means Kraken can now issue digital money for its US clients. These steps are helping it to secure its wide space in the crypto world.

Kraken news has witnessed strong growth in recent months by reporting $472 million in first quarter of 2025 revenue and a 19% increase year over year.

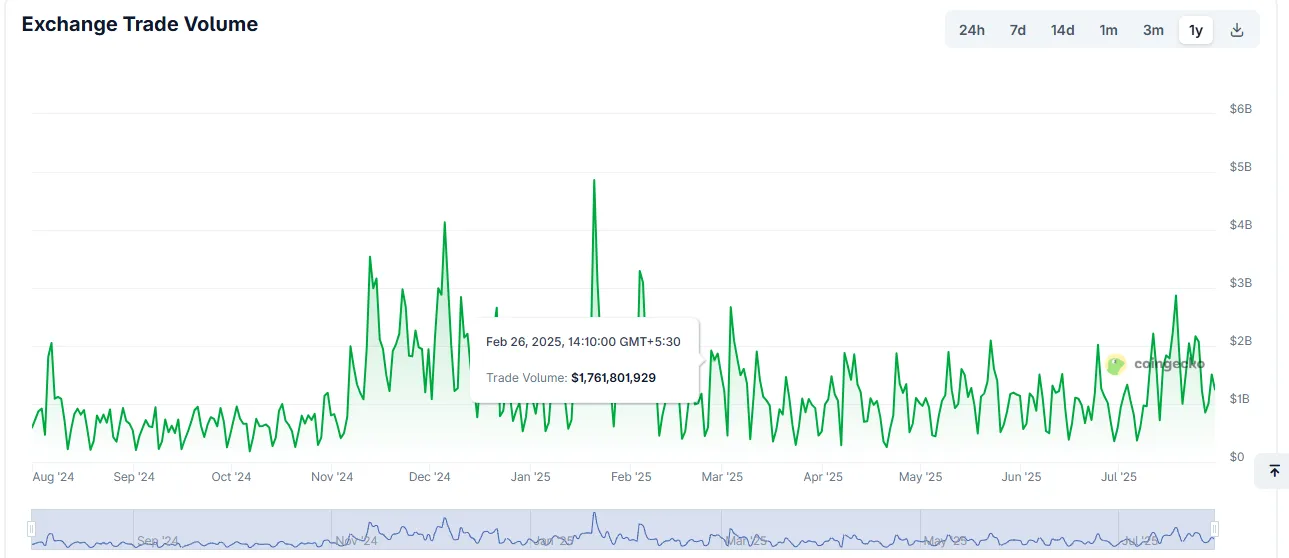

The exchange currently handled around $1.37 billion in daily trading volume with over 1,100 trading pairs and placing it second to Coinbase in the U.S market.

Source: Coingecko

Additionally the Kraken news has expanded services globally and gained Europe approval under the markets in Crypto-assets framework and launched its peer-to-peer launching app- Krak in June.

Although there have been repeated rumors about a IPO since 2021 but no official date has been confirmed. Private shares of the firm are actively traded on secondary marketplaces like Forge, focusing ongoing investor interest.

Kraken news of a $500 million funding plan shows its willpower to boost market confidence before going public. With a friendlier regulatory ecosystem and strong revenue growth the exchange appears to be moving closer to its long-discussed IPO, possibly making 2026 a landmark year for the company.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.