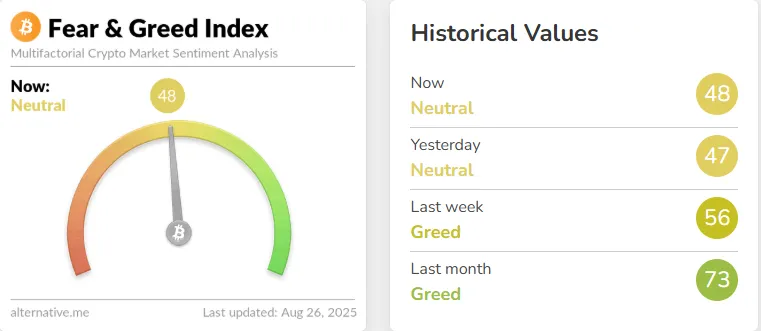

The crypto market mood is pretty balanced right now! The Fear & Greed Index is at 48 which means neither too greedy nor too fearful, just neutral.

Yesterday it was almost the same. But last week it stood at 56 and last month at 73 that shows strong greed earlier. Now the sentiment is cooling down and suggesting traders are becoming more cautious.

Source: Alternativeme

Bitcoin and Ethereum crashed in the last 24 hours, causing about $941 million in liquidations. BTC slipped below $110,000 and is now trading at $110,066 with a 2.27% daily drop and $87.72B volume increased by 15%.

ETH fell under $4,350 support and is now trading at $4,437 with a 5.8% decline and increased 17% in volume. A whale dumped 24,000 BTC ($2.7B) and closed a $250M ETH long by sparking massive liquidations.

Source: Coinglass

BTC also broke below its 7-day and 30-day averages, while ETH lost its 100-hour average. Analysts warn if BTC falls under $109K or ETH under $4K then deeper losses may follow despite institutions still accumulating.

Donald Trump has shaken markets with bold moves, firing Fed Governor Lisa Cook, again targeting Fed Chair Jerome Powell and threatening China with tariffs up to 200% on critical materials.

Source: Kobeissi Letter

Trump accused Cook of misrepresenting mortgage documents but she refused to step down by saying he lacks authority to fire her. This follows Fed Governor Kugler’s sudden resignation and fueled concerns over central bank freedom.

Meanwhile, Donald Trump’s tariff warnings raised fears of trade tensions, supply chain risks and global market instability ahead of the upcoming 2026 elections.

Donald Trump has announced a steep 50% tariff on Indian products effective August 27, 2025 and doubling the earlier 25% duty.

This move is linked to India’s continued Russian oil imports that sparked strong resistance from PM Modi and External Affairs Minister Jaishankar who defended India’s strategic independence.

Source: X

Global markets reacted sharply, stocks tied to India-U.S. trade fell while the U.S. consumers braced for higher import costs.

The decentralised market also dipped with global cap down 2.63% to $3.79T and Bitcoin sliding 1.7% to $109,980 which is reflecting investor caution amid rising geopolitical tensions.

The United Arab Emirates (UAE) has become a major Bitcoin player with a stash of around 6,300 BTC, valued at $700–740 million, according to Arkham Intelligence.

Source: X

This makes the UAE the fourth-largest government holder though BitBo places it sixth behind the US, China, UK, Ukraine, and Bhutan. Unlike the US and UK which gained most coins through seizures.

The UAE accumulated Bitcoin via Citadel Mining owned by the Royal Group’s IHC. Abu Dhabi’s sovereign wealth fund also invested $534 million in a crypto ETF which is signaling the country’s dual strategy of mining and mainstream financial exposure.

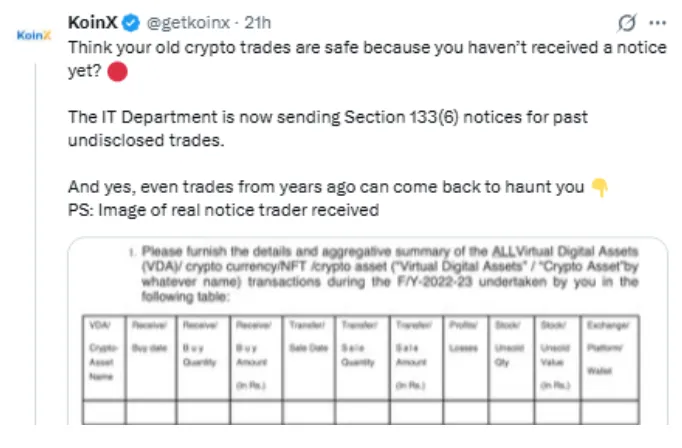

The Indian Income Tax Department has begun issuing Section 133(6) notices to virtual asset traders who failed to disclose past transactions, even from years ago.

This section permits the administrators to demand bank statements, exchange data and wallet histories. Notices are triggered by mismatches like TDS deducted but no return unreported taxable income or incorrect claims.

Source: X

Keeping them aside can lead to penalties up to 200% of tax avoided and even prosecution. Traders are requested to maintain records, file proper VDA reports, and disclose all wallets as compliance is now strictly enforced in India’s growing crypto market.

Today the crypto market stayed neutral but heavy BTC-ETH crashes, U.S President Donald Trump's bold policies, India’s crackdown and UAE’s rising Bitcoin stash shaped the scene. Traders are cautious as global politics and regulations keep adding pressure on markets.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.