The United States administration under President Donald Trump has confirmed a sharp 50% tariffs on Indian products starting August 27, 2025, according to a draft notice by the Department of Homeland Security. The decision doubles the existing duty from 25% and is seen as Washington’s move to penalize India for continuing crude oil imports from Russia.

Source: X

The declaration announced a fresh chapter in the ongoing political and economic tensions that the U.S., India, and Russia are embroiled in.

Prime Minister Narendra Modi gave a strong-fisted response, saying would never permit the interests of its farmers, small industries, or strategic independence of the country to be compromised. Drawing inspiration from Lord Krishna and Mahatma Gandhi, he spoke of India standing tall to external pressures. External Affairs Minister S. Jaishankar defended India over energy imports by reiterating that India's direct imports of Russian oil are far lesser than those of China or certain European countries, which have also never been penalized.

A strong declaration signaling the country's resolve to protect its internal priorities in the face of international pressure. These tariffs will, in fact, be perceived increasingly as an additional source of worry between both trade relations in sectors such as agriculture, textiles, and pharmaceuticals, according to analysts.

According to President Trump, the tariffs were designed to act as measures to “stop wars,” because he thought an economic penalty might pressure Russia into peace negotiations with Ukraine. But negotiations between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky remain at a stalemate.

Economist Peter Schiff criticized the decision, saying that, irrespective of whether Trump is a good businessman, one must never treat the taxpayer's money as if it were money of a private company.

Source: X

He said that presidents are not elected to act as businessmen and warned that if future leaders pursue this path in government policy, they are opening dangerous roads.

The Trump tariffs on India immediately rattled world markets. Investors fear the decision could escalate into a broader trade war if the country retaliates. American consumers are also expected to face higher prices on everyday goods imported from India, which could increase inflationary pressures in the U.S. economy.

Stocks linked to both the countries trade dropped following the announcement. Industries such as textiles, IT services, and pharmaceutical companies with strong exposure to India saw noticeable declines. Global uncertainty rose sharply, with analysts predicting that prolonged trade disputes could hurt both economies.

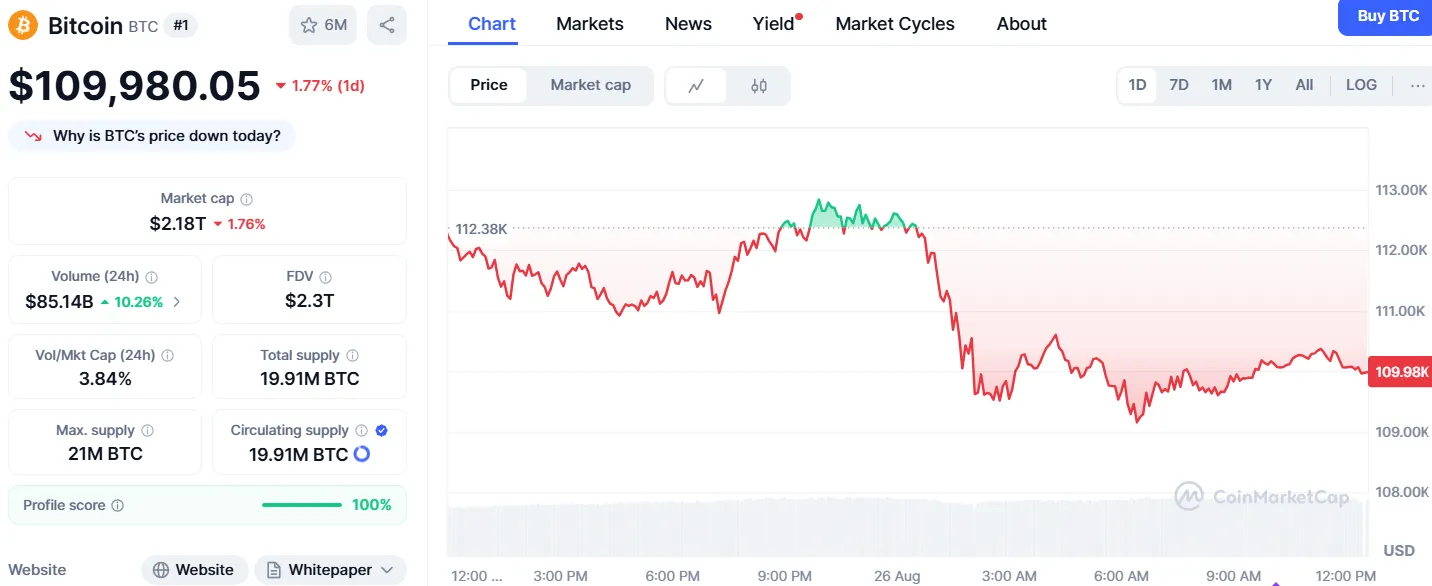

The ripple effect of these tariffs also reached the cryptocurrency market. Rising economic and political uncertainty drove investors toward risk-off strategies. The overall global crypto market capitalization fell by 2.63% in a single day, standing at $3.79 trillion. Bitcoin, the largest cryptocurrency, dropped 1.7%, trading around $109,980.

Source: CoinMarketCap

Other major digital assets, including Ethereum and Solana, also faced volatility. Experts believe that heightened geopolitical tensions reduce investor confidence, leading to short-term selloffs in both stocks and crypto.

While some argue crypto could act as a safe haven, the immediate reaction shows its sensitivity to global political events and market volatility. Traders are expected to remain cautious in the coming weeks, especially if it announces countermeasures.

Being one very important crossroads in U.S. and India relations, these Trump tariffs have already struck the global economic markets. Downward pressure on share prices, rising import costs, and soaring cryptocurrency volatility point to a demanding pathway for both governments. If the tension grows ever more intense, investors should anticipate a wave of turbulence to engulf the global markets.

Disclaimer: This article is for information purposes only and hence should not be considered as fractional or investment advice.Do Your own research before making financial decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.