Lido DAO surges over 20% in a day, grabbing the attention of both large investors and retail traders. This dramatic spike was initiated by Arthur Hayes, BitMEX co-founder, who took the risk of purchasing $1 million's worth of LDO tokens on July 17, 2025.

His investment, complemented by a recent Ethereum upgrade, has brought it back into the limelight as staking service demand intensifies.

Arthur Hayes' new $1 million investment in this token has made a clear statement to the market that he is confident in Lido's future.

As this crypto currently controls 32% of Ethereum's staked value, the platform is the largest liquid staking protocol in the network.

Trading volume for LIDO Dao surges shortly after Arthur Hayes's action. Its 24-hour trading volume climbed 239%, to $496 million.

This wave was not exclusive to deep pockets. Everyday crypto investors soon followed, as well. Statistics indicate that 85% of LDO wallets contain less than $1,000, and the fear of missing out (FOMO) fueled new interest.

This is also the reason behind LIDO Dao surges and fueled momentum for the token.

Ethereum's recent upgrade, launched on July 1 and referred to as the "Gigagas Era," is capable of supporting up to 10 million transactions per second with the help of zk-rollups.

This is a welcome victory for Ethereum, but it also adds extra value to staking platforms such as Lido.

With that, more supply of LDO is held by big investors which constitutes about 58 percent of the supply meaning that the big players are prepared to harvest its new wave of Ethereum performance. With its position in the Ethereum ecosystem and well-defined use case, LIDO DAO surges.

Lido DAO surges also indicate solid readings from market indicators.

On July 17, LDO crossed above its 200-day exponential moving average at $1.00 a barrier that long-term investors keenly followed.

The RSI of the token was at 73.57, indicating bullish momentum but still with room for further growth.

Also, the MACD histogram switched to positive ground (+0.029), indicating upward price strength.

If the trend holds, the next significant level for LDO is $1.34, the 161.8% Fibonacci extension, a level traders are eagerly monitoring.

Lido DAO surges also reflect strong signals from market indicators. Altcoin interest is sweeping in, as investors begin to rotate capital out of the industry giants like Bitcoin and Ethereum.

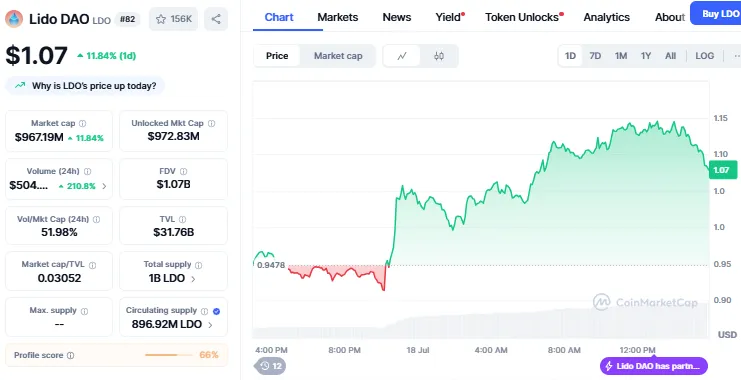

This wider shift towards mid-cap tokens is picking up many names such as Cardano ADA, XRP and Solana including LDO. It is now trading at $1.07 with an increase of 11.04%, while the trading volume has surged by 210% within the last 24 hours as per the CoinMarketCap.

Source: CoinMarketCap

With improved liquidity in the entire crypto space, and increasing demand for projects providing genuine utility, Lido DAO surges with this trend of altcoins.

Lido DAO surges due to the interaction of good news, market demand, and a sense of security on the part of larger investors because of people like Arthur Hayes. However the crypto world is dynamic. Despite this positive setup by this token, its deployment will be subjected to the growth of Ethereum and the fact that it will have to maintain their traders.

Investors should watch how the market reacts near resistance zones and whether this momentum can continue in the coming weeks.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.