The Lighter token launch is gathering more attention following its long run pre-market trading and updates. Traders, analysts, and airdrop hunters are all paying attention as multiple signs point toward an imminent launch.

Source: Wise Advice

But is the excitement only about the airdrop, or does the real story begin after launch?

Lighter is a decentralized trading platform exchange that lets users trade perpetual futures. Built on Ethereum, it uses zero-knowledge infrastructure and is designed to be fast, scalable, and low cost. The platform can process tens of thousands of orders per second with very low latency, making it a direct competitor to Hyperliquid.

The platform already ranks near the top of the perpetual DEX market, despite being relatively new.

The project is backed by major investors, including Founders Fund and Ribbit Capital, which contributed to its $68 million funding. Its public mainnet also launched in October, and later Coinbase added Lighter to its listing roadmap. In a recent update, MEXC announced the LIT listing (date is still to be announced), with deposites are already opened.

Speculation around the $LIT listing surged after Polymarket traders placed large bets on an airdrop event before December 31. Around 86% of traders predicted a “yes” outcome, with betting volume reaching $9.5 million.

Adding to this speculation, a core contributor confirmed on Discord that the team is completing important steps ahead of the token generation event (TGE). These steps include removing Sybil activity, wash trading, and self-trading, with deducted points being redistributed back to genuine users.

The distribution of tokens can strongly affect price behavior after the launch. For the $LIT listing, the project has allocated 25% of the total supply to airdrops.

In comparison to other competitors, this is much lower. For example Hyperliquid allocated around 27.5%, while Aster allocated more than 53%. A lower amount than some competitors.

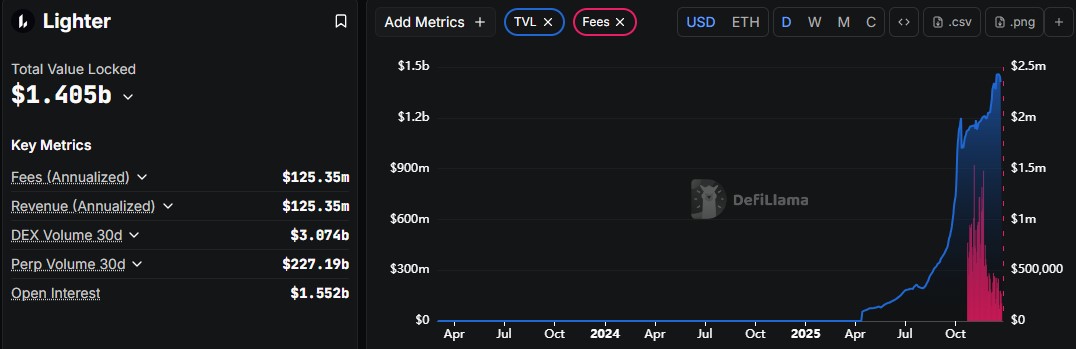

While the platform now ranks among the top decentralized perpetual markets, it has grown steadily since mainnet debut. According to DeFiLlama and on-chain data, the platform holds the second-largest market share in its category.

The Lighter token launch is currently in the pre-market, with LIT trading near $3.48, placing its fully diluted valuation around $3.48 billion. With zero circulating supply on Coinmarketcap, this price reflects early levels rather than actual spot demand.

Source: DeFiLlama Metrics

After market debut, short-term volatility is likely as airdropped tokens enter the market. However, if real trading liquidity and user activity scale as expected, LIT could claim the $5–$6 range in a healthy market environment.

With sustained growth and rising volumes, a move toward $6+ over the longer term is possible as valuation re-rates closer to top competitors.

The Lighter token launch reflects growing adoption, a rising user base, strong infrastructure, and real trading activity.

But as the airdrop hopes are more hyped, the key question remains is to see whether users are here only for a free token, or are they positioning for long-term engagement?

As Lighter’s community, liquidity, and usage expand, the answer may become clearer in early 2026.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.