In a sharp move that has rocked Washington, Senator Lummis criticizes DOJ Bitcoin Sale tactics, calling out federal agencies for apparently going rogue against current White House orders.

The friction started when news broke that the U.S. Marshals Service (USMS) offloaded roughly 57.55 BTC about $6.3 million worth that had been seized from the Samourai Wallet developers.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

This liquidation has set off a political firestorm because it seems to fly right in the face of Executive Order 14233. That mandate was supposed to lock down all "Government BTC" to build the nation’s Strategic Bitcoin Reserve. For anyone following the market, this internal power struggle is a major headline, making people wonder if the long-standing "War on Crypto" is actually over or just shifting to a new front.

The heat of the argument centers on a November 3, 2025, transaction. Allegedly, the USMS used Coinbase Prime to liquidate assets that were supposed to be kept in a "digital Fort Knox." Under Trump’s new mandate, these coins are considered strategic national resources similar to how we treat gold or the Strategic Petroleum Reserve. They aren't supposed to be sold on the open market

Senator Lummis took to social media to voice her alarm, stating, "We can’t afford to squander these strategic assets while other nations are accumulating Bitcoin." Critics argue that the Southern District of New York (SDNY) and the DOJ are operating as a "Sovereign District," ignoring the executive branch’s shift toward treating This digital asset as a long-term national asset rather than criminal loot to be discarded.

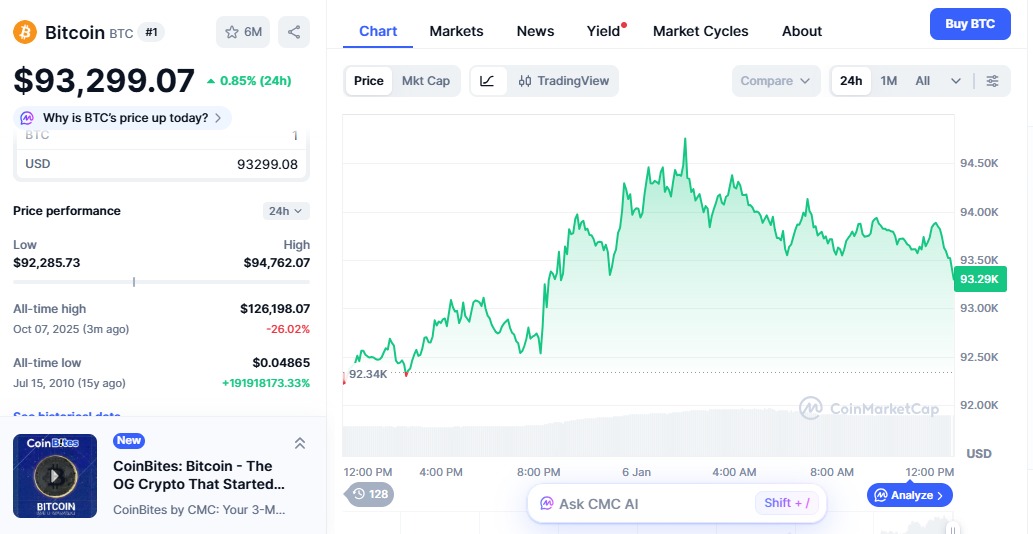

Despite the political noise, the market is showing a surprising amount of backbone. As of today, January 6, 2026, the total crypto market cap has hit $3.26 trillion, climbing 1.76% as big investors stay focused on the long term. Bitcoin itself is holding its ground, currently trading at $93,299 a rise of 0.85% over the last 24 hours. While the DOJ’s $6.3 million sale is a drop in the bucket for BTC’s total volume, the real risk is the mixed message it sends to the world about U.S. financial policy.

Source: CoinMarketCap Bitcoin Chart

Source: CoinMarketCap Bitcoin Chart

Despite the $6.3 million sell-off, the broader market remains bullish on the prospect of a formal federal reserve. However, as Senator Lummis criticizes DOJ Bitcoin sale activities, the fear remains that inconsistent enforcement of Executive Order 14233 could lead to more "surprise" liquidations that dampen price discovery.

Legal experts point out that the Samourai developers forfeited their holdings under 18 U.S. Code § 982, which fits the Executive Order's definition of "Government BTC" to build the nation’s Strategic Bitcoin Reserve. There is no statutory requirement that mandates these funds be converted to fiat currency immediately. The decision to sell appears to be a discretionary move by the DOJ, one that flies in the face of Deputy Attorney General Todd Blanche’s recent memo, "Ending Regulation By Prosecution."

The defiance shown by the DOJ has led many to wonder if President Trump will issue a formal pardon for the Samourai developers or take disciplinary action against the agencies involved. As Senator Lummis criticizes DOJ Bitcoin sale tactics, the pressure is mounting on the administration to consolidate control over federal digital assets. As the total crypto market cap holds at $3.26 trillion, the industry is looking for a "unified front" from Washington. If the U.S. truly intends to build a "Digital Fort Knox," it must first stop the leaks within its own departments.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.