Why is the Marina Protocol Price Crash becoming such a big topic today? Many traders woke up to see the token fall almost 29% in just 24 hours. While the wider crypto market stayed mostly flat, the $BAY token took a much harder hit.

The price crash came as a surprise to holders and has pushed many to look for answers. With the selling pressure rising and confidence dropping, the big question now will be: what caused today's crash, and what comes next?

One of the primary concerns today came from large on-chain movements related to the project's wallets. Not long after the Marina Protocol Price Crash had started, the Foundation issued an official note. They said that the transfers were just part of an internal restructuring plan.

Source: X (formerly Twitter)

They also said the tokens were not sold or liquidated and that all assets remain safe. Still, the timing created confusion, and many traders assumed a sell-off was happening. The clarification helped calm the community, but the price damage was already visible.

Another major reason contributing to today's drop is the Binance Alpha trading competition. During events like these, traders often sell their reward tokens once the campaign has ended. This is a normal pattern in the market.

After the event closed, the 24-hour trading volume of BAY fell by more than 90%. Due to less liquidity being left, even medium-sized sell orders were able to push the price down quickly. This added more fuel to the Marina Protocol Price Crash today and made it hard for buyers to hold support levels.

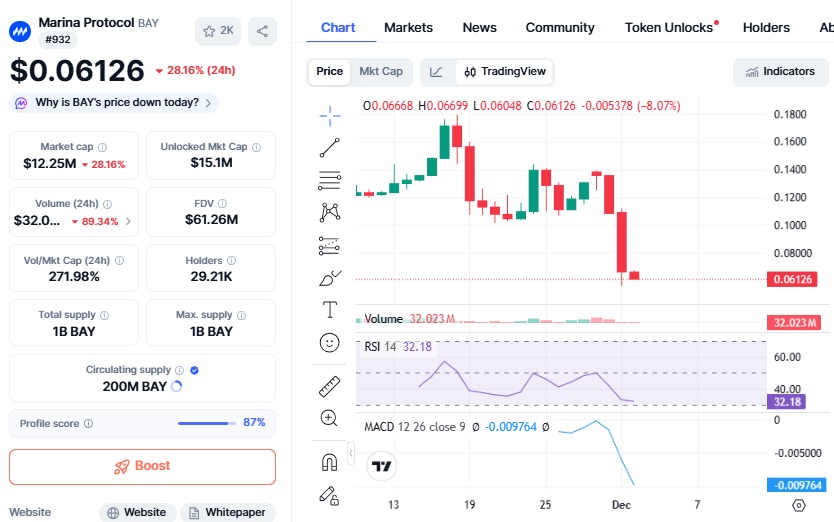

Source: CMC

Since there isn't any strong support until the lower psychological levels, the chart still looks fragile. This kept the Marina Protocol Price Crash going through the day, as many short-term traders moved out to avoid further losses.

In the short run, BAY may attempt to bounce towards $0.075 or $0.085 if buying returns. The only possible stronger recovery would come if market sentiment sees a change. If the price falls further, the next area to watch is the $0.05 support level.

A large upside trigger could be a listing on Binance. If this happens, it will likely see far stronger demand and improved liquidity. This would go some way to reversing some of the decrease in price and take the price back above key levels.

The Marina Protocol Price Crash is a result of event-driven selling, technical weakness, and a fearful market. The explanation by the Foundation eased concerns, but traders now await whether the token can hold the next support zone. The next few days will be important, especially if new incentives or listings appear.

Disclaimer: This article is for information and news purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.