The latest Metaplanet Bitcoin Buy suggests that institutions are once again stepping in after the cryptocurrency tested the $90,000 level. Just a day after MicroStrategy added more of this digital currency, Japan-based Metaplanet confirmed a massive purchase, strengthening the idea that large companies see current prices as long-term buying opportunities.

During the fourth quarter of 2025, the firm acquired 4,279 BTC for about $451 million, paying an average price of $105,412 per coin. As of December 30, 2025, the company now holds 35,102 BTC, bought for a total cost of nearly $3.78 billion.

At current market prices, those holdings are valued lower due to coin’s recent dip. Even so, the organisation reported a strong BTC Yield of 568.2% in 2025, showing how aggressively it expanded its position this year.

Source: Simon Gerovich X (formerly Twitter)

They began buying in April 2024 as a way to protect itself from a weakening Japanese yen. Since then, it has used a mix of debt, equity, and income from derivatives to fund its Bitcoin strategy.

Because of its bold digital asset strategy, Metaplanet is often called “Asia’s MicroStrategy.” The company’s CEO, Simon Gerovich, has openly stated the goal of reaching 100,000 of this digital coins by 2026.

However, the aggressive buying plan has not come without concerns. After the latest Metaplanet Bitcoin Buy announcement, the company’s stock fell around 8%, as investors worried about dilution and rising debt. Still, the accumulation itself shows strong long-term confidence.

Metaplanet is not acting alone. MicroStrategy, led by Michael Saylor recently added 1,229 BTC for about $108.8 million, at an average price of $88,568 per coin.

MicroStrategy's holding 672,497 BTC as of December 28, 2025, which cost over $50.44 billion at the average price of $74,997 per BTC is really impressive and gives a strong line to the company's long-term crypto investment policy. The company reported 23.2% BTC Yield in 2025.

These large purchases combined indicate one thing: right now, large institutions are buying the digital asset once more after recent price recovery.

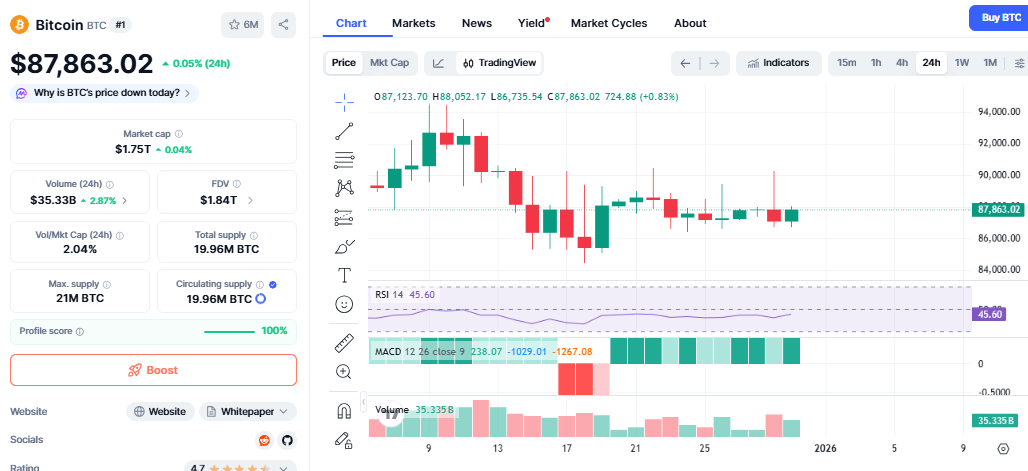

As per the Coinmarketcap, It is currently around $87,800 and is in a sideways trend following the recent pullback. The RSI in the area of 45 indicates a neutral momentum, which is neither overbought nor oversold. The MACD is still positive, which is a sign that the overall trend is still good.

Source: CoinMarketCap

Bullish Scenario:

If the price holds above $86,000–$87,000 and then retakes the $90,000 mark, the following targets might be $95,000 and perhaps even $100,000.

Bearish Scenario:

In case it drops below $85,000, it may fall to $82,000–$80,000.

The recent Metaplanet Bitcoin Buy along with the MicroStrategy acquisition, sends a clear message. After the $90,000 mark, the institutions are not exiting the market. Rather, they are stacking up quietly. The price volatility in the short term will still be there, but these moves are signs of increasing long-term confidence in crypto's future.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.