Japan’s Metaplanet Bitcoin buying of 103 BTC worth $11.8 million which is drawing attention in the crypto world after announcing this big purchase on its X post. The Tokyo-listed company’s big move has now strengthened the firm’s asset treasury.

Source: X (formerly Twitter)

This bold step takes the firm’s total coin stash to 18,991 coins, reflecting a clear commitment toward long-term digital asset adoption amid the market dip.

The latest Metaplanet Bitcoin buying is not an isolated step but it has been consistently increasing its holdings that is providing the company views the asset as more than just a speculative bet.

Instead, it is building a treasury strategy around the asset and treating it as a long term store of value. Such a steady approach puts Metaplanet Bitcoin buying among the front-runners in Japan when it comes to corporate digital asset adoption.

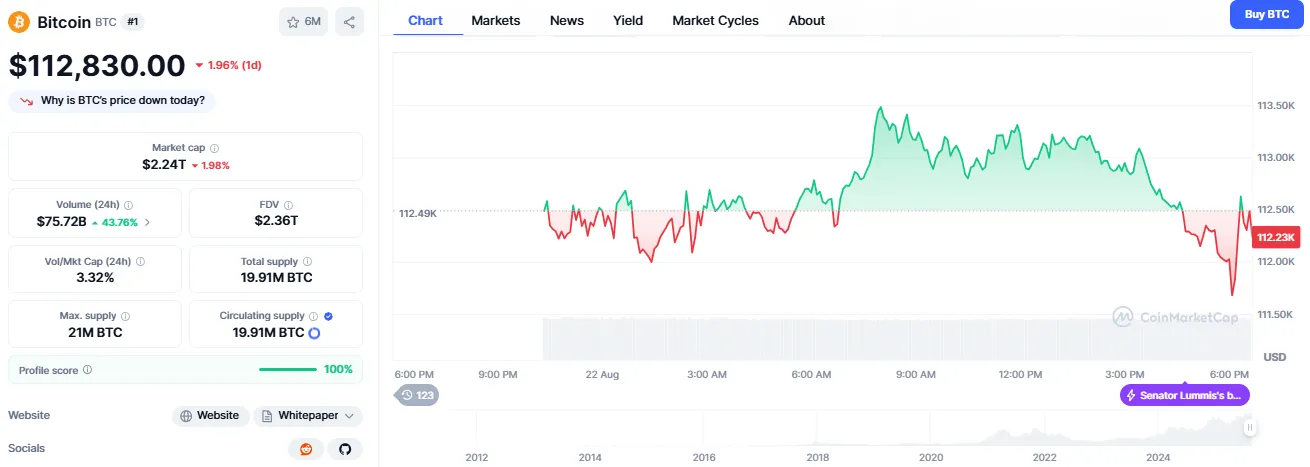

The coin has been showing a decline over the past week and is trading between $112k-$117k and is currently at $112,830 down 2.02% in the last 24 hours as per the data of CoinMarketCap.

Source: CMC

The recent odd market behavior can be attributed to several factors including ongoing geopolitical tensions, ETF outflows of $22.15 million and miners selling off their holdings.

Despite this, big firms and investors are viewing the timing of Bitcoin’s next surge remains uncertain so the current slump as a chance to accumulate which is reflecting the strong appetite of large investors.

Experts believe that once BTC ETF inflows increase or major players like Strategy, MARA Holdings or BlackRock make significant purchases then it could trigger a noticeable price surge and turn the current downturn into a potential growth opportunity for the crypto market.

Every fresh institutional move into BTC strengthens the coin’s credibility in mainstream finance. Metaplanet Bitcoin buying bold step could encourage other corporations in Japan and beyond to follow suit.

It shows that the coin is no longer just a retail investor’s play but a serious coin for crypto corporate treasuries worldwide.

Metaplanet Bitcoin buying shows how companies are preparing for a future where digital assets play a key role. By steadily building its asset reserves the firm is not just protecting capital but it is signaling confidence in the long-term shift toward a digital economy.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.