Originally a Hotel operator, this Tokyo listed firm now plans to leverage its increasing its holdings to acquire revenue generating ventures.

Source: X

In an interview with Financial Times, Simon Gerovich, CEO has revealed the firm’s strategy to eventually Metaplanet virtual asset holdings into areas such as digital bankings.

Metaplanet has started accumulating virtual asset in 2024 to hedge against inflation. Metaplanet began as a protective financial move that has now evolved into a long term growth strategy.

Yesterday the company added more virtual currency to reserve of around 2,204 for $237 million that means each Bitcoin was brought around $107,000. Currently, the firm holds 15,555 BTC and Gerovich aims to increase his current hold to 210,000 BTC by 2027 and roughly 1% of all, that will ever be in circulation.

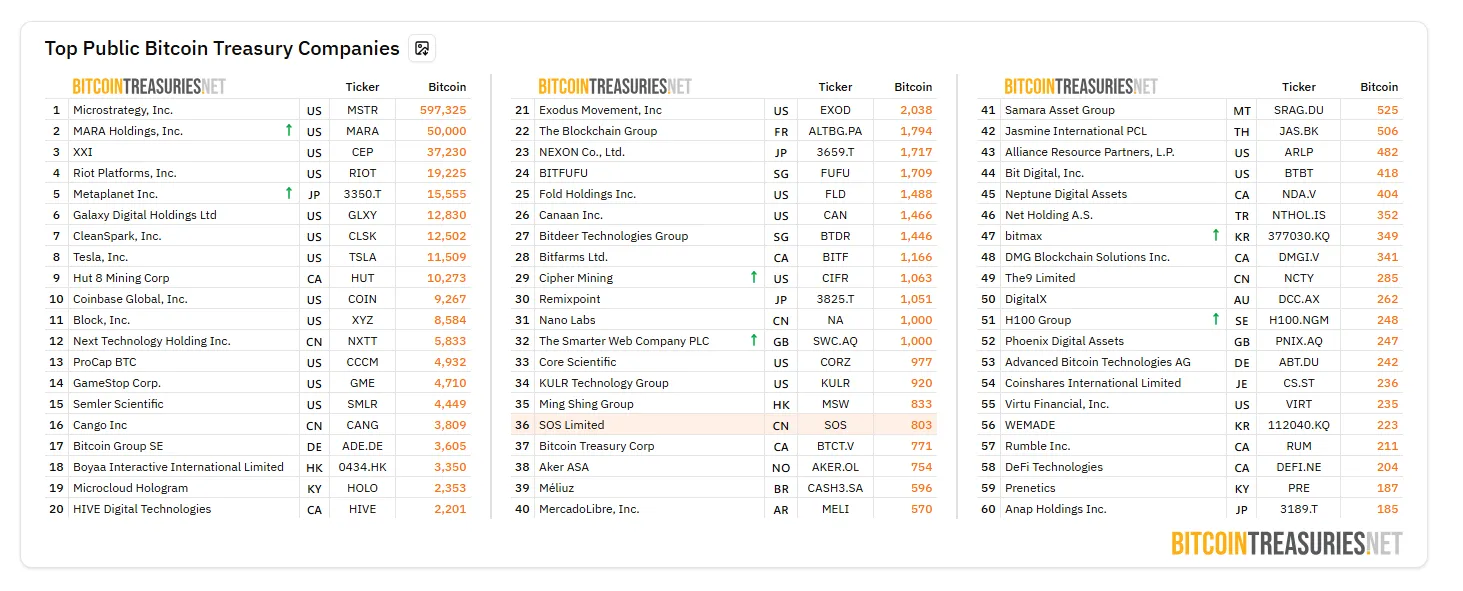

Source: Bitcoin Treasuries

Metaplanet stock has grown over 378% this year which raised the market cap above $7.08 billion. The firm goal is to use this digital gold as collateral to access funding, enabling the acquisition for gaining profits in businesses.

Metaplanet approach echoes Saylor’s model that owns 597,325 BTC with a market value topping $64.83billion.

Metaplanet Bitcoin collateral leverage targets to acquire a digital bank in Japan , Gerovich believes such an acquisition would align perfectly with the company’s vision. He said “Maybe it is acquiring a digital bank in Japan and providing digital banking services that are superior to the services that retail can retail now is getting”.

While crypto backed loans are still a rarity in traditional financing and some global institutions like Standard Chartered and OKX are experimenting with using virtual assets as collateral which is marking a move in how the financial world perceives crypto.

Metaplanet is not planning to issue convertible debt to fund ambitions. Instead, Gerovich prefers issuing preferred shares as they offer flexibility without the burden of repayments tied to fluctuating share prices.

This move indicates the company’s cautious yet ambitious approach to growth that is using BTC not only as an asset but also as a financial tool to secure long term value.

Metaplanet Bitcoin collateral leverage latest acquisition of 2,204 BTC for $237 milli0n underscores its commitment to become a powerhouse of Bitcoin. Now, its BTC holding is around 15,555 and the company is drawing comparisons to MicroStrategy’s Bitcoin strategy .

As the market cap soars past $7 billion, the company’s antique path blends traditional business growth with a crypto foundation.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.