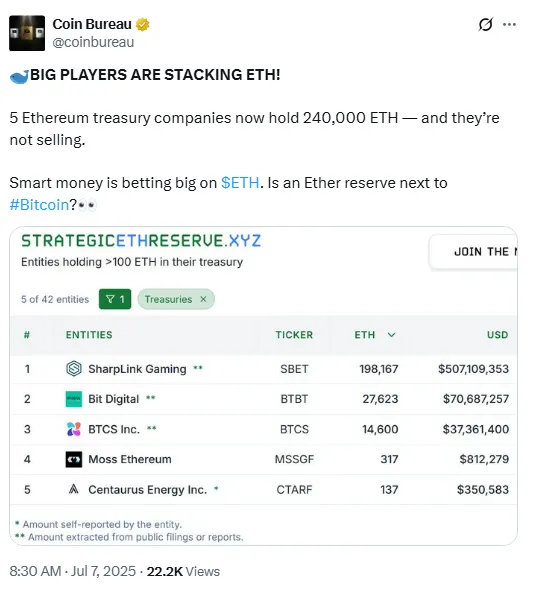

Ethereum treasury holdings are rapidly becoming a key part of institutional crypto strategies. Over the past few months, five publicly traded companies have accumulated more than 240,000 ETH, signaling a growing shift away from Bitcoin and shifting towards Ethereum Treasury Holdings.

With network fees dropping, staking yields rising, and capital inflows surging. ETH is is emerging as a preferred long-term asset among institutions.

This trend reflects more than just hype– it represents a strategic realignment in how companies are choosing to store value and earn passive income through blockchain assets.

As of more, the top firms combined Ethereum treasury holdings exceed $600 million setting a new benchmark in the corporate adoption of ETH.

Sharplink Gaming currently holds the largest Ethereum position of 198,000 ETH which is worth more than $507 million. This massive holding alone represents a bold move and underlines the growing faith in ecosystem.

Meanwhile, Bit Digital, a Nasdaq-listed firm is undergoing a full transformation. After raising $162.9 million, the company announced it would exit Bitcoin mining entirely and convert its remaining BTC– around 417 coins– into ETH, currently valued above $70 million, and has made its core treasury and revenue strategy.

The company’s CEO clearly outlined their direction, starting, “We want to be the ETH company.” This aggressive shift toward staking and away from traditional mining shows how powerful the lure of Ethereum treasury holdings has become future-focused companies.

Following this announcement, Bit Digital’s stock surged 21%, indicating strong market confidence in the move.

Source: Twitter

It isn’t just attracting attention for its staking potential. The network has recorded $9.7 billion in capital inflows over the past month alone. In the last seven days, over $3.1 billion flowed into it, outpacing all other blockchain networks and reinforcing its status as an institutional favorite.

Another major tailwind is cost efficiency. Average transaction fees have dropped 71% year-over-year, now sitting around $0.10 per transaction. This decline not only enhances scalability but also improves its usability for both enterprises and retail users.

In a further sign, the US government recently moved to Coinbase Prime following a successful test transaction– hinting at possible changes in how state entities may begin managing assets.

The rise in Ethereum treasury holdings signals more than a short-term trend- it shows deep-rooted confidence in a foundational piece of the financial future. Institutions aren’t just experimenting with ETH, they’re stockpiling it with no clear intention to sell anytime soon.

As it continues to lead in inflows, reduce transaction costs, and power a wide range of blockchain applications, its role in corporate treasuries is only expected to grow. For now, one thing is clear: Ethereum isn’t just a smart contract platform– it’s becoming a major institutional store of value.

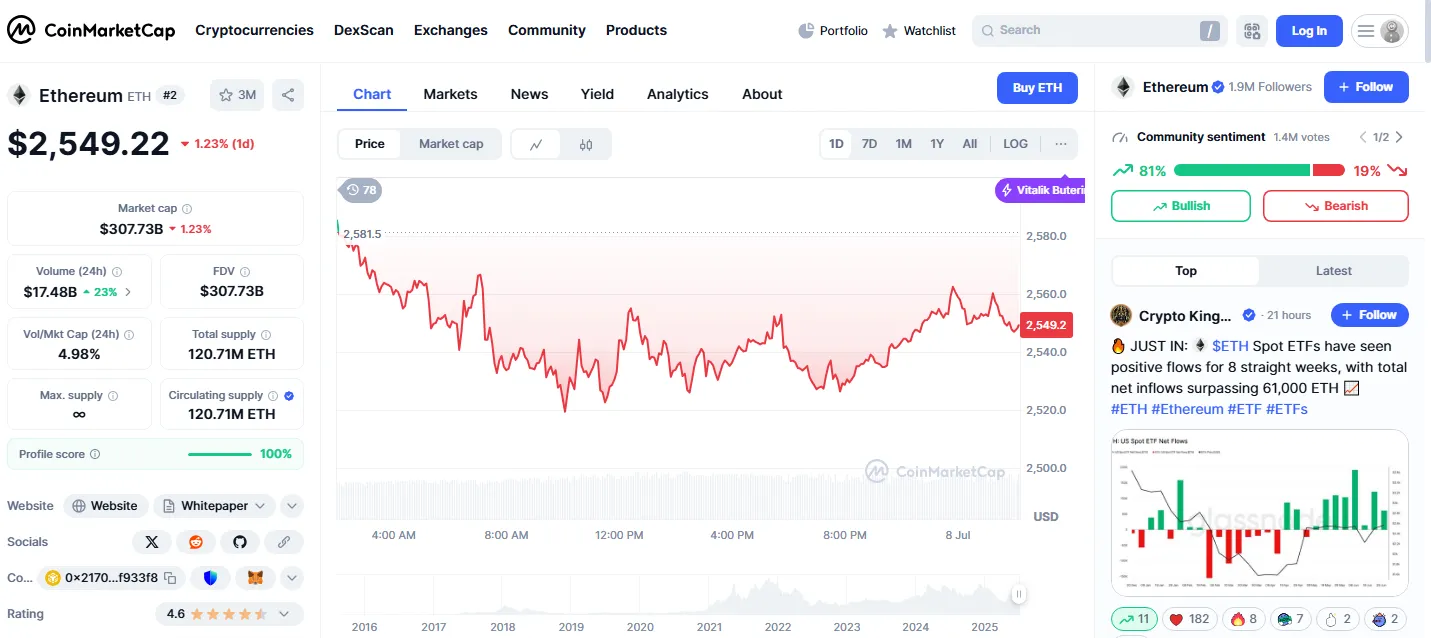

Based on the CoinMarketCap recent reports, It is now trading at $2548.49, showing 1.23% decline in the last 24 hours. Despite the dip, trading volume remains strong with $17.48 billion moved in the past day– a 23% increase, suggesting high market activity and investor interest.

The price chart shows noticeable intra-day volatility, with ETH briefly touching highs near $2,581 before pulling back due to selling pressure.

Market cap now stands at $307.73 billion with the circulating supply at 120.71 million ETH, fully matching the total supply.

Source: CoinMarketCap

Interestingly, spot ETFs have reported positive inflows for Ninth consecutive weeks, which show a strong signal of growing institutional market.

Surbhi Jain is an accomplished English News Writer and Content Writer associated with Coin Gabbar, where she covers cryptocurrency, blockchain, and financial market updates. With a focus on clarity, accuracy, and SEO-driven writing, she aims to make complex crypto concepts understandable for a broad audience. Surbhi’s content combines research and readability to deliver timely and reliable information to readers interested in digital finance.

Beyond her professional work, she enjoys reading books, which enhances her creativity and helps her stay informed about emerging trends in technology and finance.