Tokyo-based company Metaplanet has posted its highest-ever earnings for Q1 2025. The company revealed it made around $6 million (877 million Japanese yen) in revenue. A major part of this profit came from the company’s strategy. It has now become the largest Bitcoin-holding company in Asia.

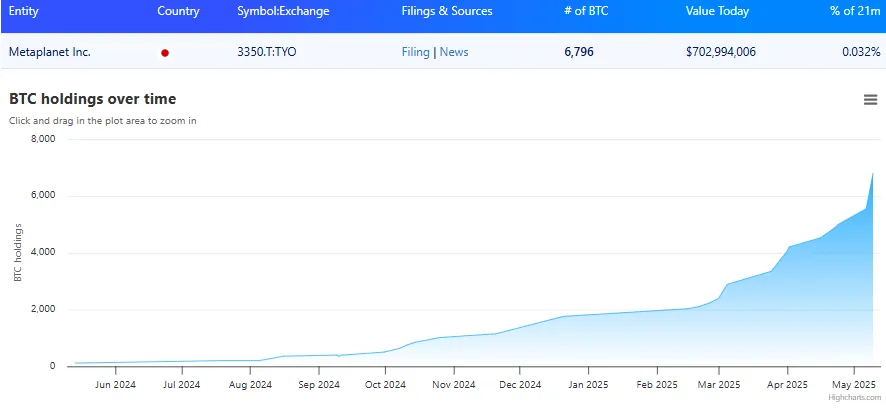

In just the first few months of 2025, the firm increased its Bitcoin holdings nearly four times. Starting the year with 1,762 BTC, it added another 5,034 BTC by May 10. That brought the total to 6,796 BTC, making it the largest treasury holder in Asia and the 11th biggest worldwide.

Source: BitBo Report

To fund these purchases, the company used a financial tool called “moving-strike warrants.” It raised 76.6 billion yen ($524.8 million) through this method—87% of total plan. With this capital, it has already met 68% of its goal to own 10,000 BTC.

The average price it paid per coin was about ¥13.27 million or $90,929. Despite some price swings, the returns have been strong. The BTC yield in Q1 was nearly 95.6%, with goals set for 232% growth this year. They expect 35% gains in both Q3 and Q4.

Another sign of the company's growing influence is its rising number of shareholders. In one year, the count grew by 500%, reaching 64,000 by the end of March 2025. The company's stock (3350.T) has also gained 70.91% since January, showing that investor trust is rising alongside its crypto-focused strategy.

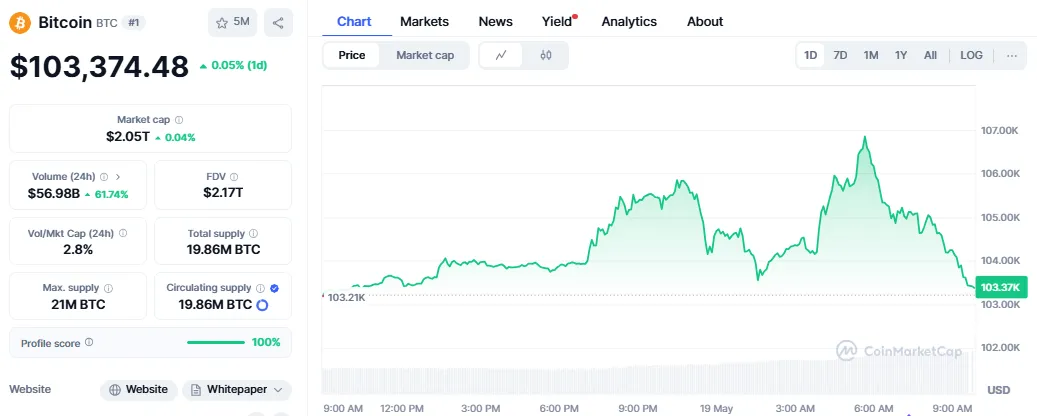

While Metaplanet was busy growing its holdings, Bitcoin price itself also hit a new record. For the first time ever, the total market cap crossed $2.18 trillion, with a single coin trading around $104,000. According to Crypto Rover, this marked a major bullish milestone for the crypto.

According to CoinMarketCap, It is currently trading at $103,352.56 with $2.05T in market cap and $56.94B in 24-hour market cap.

Source: CoinMarketCap

Daily trading volumes were massive—over $55 billion on platforms like Binance and Coinbase. Analysts from Glassnode also reported that wallet addresses holding more than 1 BTC went up by 15% between May 10 and May 18. This shows retail and institutional investors are actively buying.

The ProShares Bitcoin Strategy ETF (BITO) climbed 5% to $28.50. Stocks linked to the crypto market also performed well. On May 17, MicroStrategy rose 3.2%, Coinbase gained 2.8%, and the S&P 500 index moved up by 0.5%.

However, traders have been warned about industry conditions. The RSI is currently 72—considered overbought. The MACD is also showing bullish signs, but experts say a minor pullback could happen.

As the crypto king continues to break new highs, companies like Metaplanet are setting the stage for a new kind of investment strategy. Their move into BTC is not just boosting profits but also changing how traditional sectors look at crypto.

With $583 million in digital assets already under its name, Metaplanet is proving that crypto can power serious business growth. But like all investments, the market remains risky. Interest rates, regulations, and stock market trends could affect what happens next.

Still, for now, both Metaplanet and Bitcoin seem to be riding a strong wave of momentum in 2025.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.