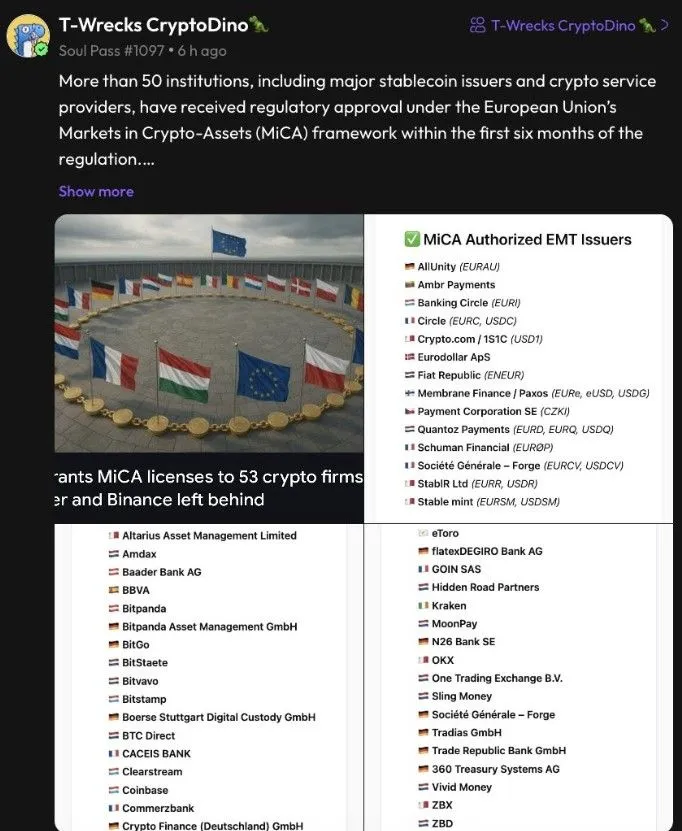

The MiCA crypto regulation EU framework is making headlines again, this time for approving 53 cryptocurrency companies across Europe while leaving out major players like Tether and Binance.

Just six months into its rollout, the European Union’s Market law is shaking up the global digital asset space. But why are some of the biggest names missing from the approved list?

Source: ICN X Account

Let’s break it down — who got in, who didn’t, and what it really means for the future of digital assets in Europe.

Under the new MiCA regulation EU, licensed asset service providers can now operate across all 30 European Economic Area (EEA) countries with just one license — a powerful tool known as passporting.

As per popular analyst account on X named Pulse SocialFi, so far, 53 firms have made it onto the Markets in crypto-assets compliant list, including big names like Coinbase, OKX, Kraken, Bitstamp, Robinhood, and even BBVA from traditional banking.

According to MiCA crypto news today, these approvals make Europe the most structured and advanced regulatory environment in the world. But the real buzz? Not who got in — but who didn’t. Let’s know why Tether and Binance not included in its companies list.

Despite being the world’s most-used stablecoin, Tether’s USDT is not on the list. The reason? Transparency issues.

It has never conducted a full, independent audit of its reserves — something EU strongly requires for all stablecoin issuers. Instead, the company has relied on attestations, which EU regulators no longer consider sufficient under the new rules.

This compliance gap may explain why Tether has not been included in the MiCA crypto regulation companies list, even as its token continues to trade around $1 during market volatility.

Similarly, Binance one of the largest exchanges globally, has failed to secure a spot on this list. Over the past year, Binance has faced regulatory pressure across the EU — from license withdrawals in Malta and Cyprus to money laundering investigations in France.

Despite restructuring its services and trying to meet its Europe rules, the platform remains sidelined.

Will MiCA’s Strict Rules Strengthen the Industry or Slow It Down?

So, what does all of this tell us about the state of cryptocurrency in Europe? The MiCA regulation explained one key message: compliance is no longer optional. Firms that can’t meet strict governance, risk control, and transparency standards are being left out — no matter how big they are.

The MiCA crypto regulation EU model is setting a global precedent, but it also means that some industry giants will have to reinvent their internal operations to survive in the post-digital asset world.

The MiCA crypto regulation EU is forecast to release a nine-month licensing update in September 2025. Many are hopeful that Tether and Binance can resolve their issues and come back to the conversation by that time.

In the meantime, markets in crypto assets news will continue to drive global trends, and the firms that adapt to policy might be the next preeminent players in the European market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.