Michael Saylor’s company, Strategy, has again bought and added a huge amount of BTC to its holdings. Between April 21 and April 27, 2025, the company bought 15,355 Bitcoins for $1.42 billion. The organisation invested an average price of $92k per BTC. Following this latest purchase, the organisation now holds 553,555 coins. The organisation bought this number of coins for about $37.90 billion, which makes it $68,459 per bitcoin.

Now the worth of the organisation's holdings is above $50 billion, all because of the coin’s price surge of $90,000 last week.

Michael Saylor and his team at Strategy have made it clear: they believe this crypto is the best investment for the future. Even though the prices are already very high, he believes there is still a lot of room to grow. By buying more coins now, Strategy is betting that the value of the cryptocurrency will continue to climb higher over time.

Saylor has also pointed out that “you can still buy Bitcoin for under $0.1 million” in a X post, hinting that someday it could be worth much more. He encourages people to "stay humble and stack sats," meaning buy small amounts of BTC while it’s still affordable compared to where he thinks it's heading.

Every time Strategy buys a large amount of the currency, it shows strong confidence in the future of the cryptocurrency. Big purchases such as these can help drive prices even higher. When investors notice a big company like this organisation purchasing billions worth of BTC, it can get people excited and bring in more buyers to the market.

This can get into a cycle: increased buying equals increased prices, and increased prices bring even more buying. That’s why some experts believe the company's aggressive BTC vision could help drive the currency closer to new all-time highs.

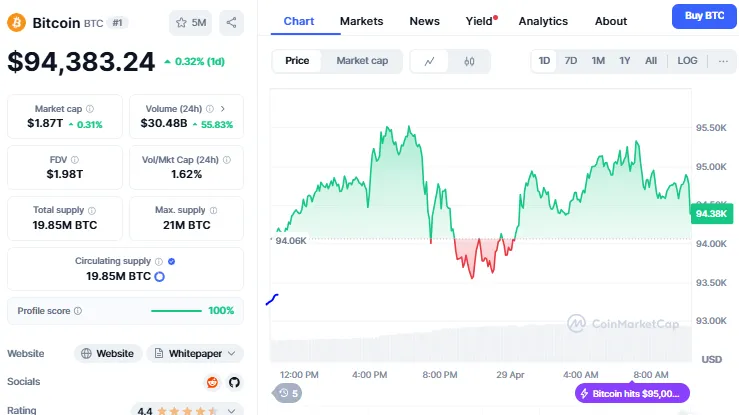

In fact, the coin already moved up about 8% during the week when Strategy made its latest purchase. It is now trading above $94,000, but still a little below its record high of $109,000 set back in January 2025. The coin is currently trading at $94,422 with a 0.40% increase in 24 hours.

Source: CoinMarketCap

Investors are showing a lot of excitement. Strategy’s stock, MSTR, is up about 23% so far in 2025. It is now trading at $369.25 per share, and the company is moving closer to a $100 billion market cap.

The company also achieved a Bitcoin yield of 13.7% year-to-date. This "yield" shows how much their BTC position has grown compared to the number of company shares. Last year, their BTC yield jumped an amazing 74%. They now aim to hit a 15% yield by the end of 2025.

Michael Saylor is being true to his vision of Bitcoin-first. By consistently buying more coins, even at high prices, Strategy is sending a loud message: they believe the currency is still in the early stages of growth. If it keeps climbing, Saylor’s bold moves could turn into one of the most successful investment strategies ever.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.