Michael Saylor, the executive chairman of Strategy (previously microstrategy) and the biggest supporter of BTC, is once again making headlines with his bold prediction: Bitcoin is reaching $1 million. Recently, in an interview with Bloomberg, Saylor said people should not worry about another crypto winter happening. He believes that the worst days for BTC are over. He mentioned different strong reasons, why he considers the price will only go up in the coming future.

Source: Bloomberg

Saylor was clear in his view: the days of deep crashes are likely over for the biggest cryptocurrency. “Winter is not coming back,” he said confidently. “We are over that phase. If its not going to zero, it’s going to $1 million.”

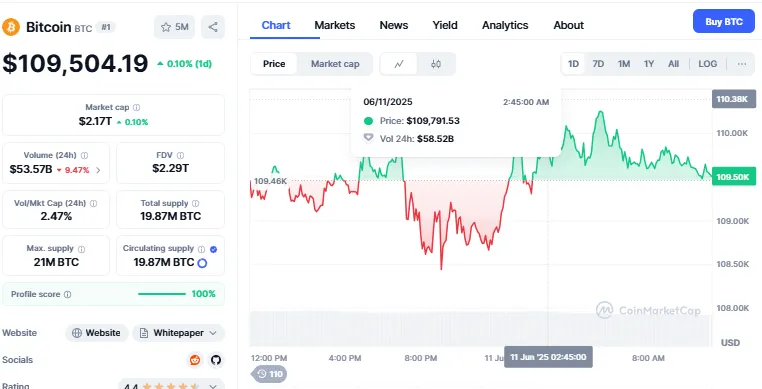

His view is based on growing adoption and a limited supply of this cryptocurrency available each day. At current prices, only about 450 BTC are mined and put up for sale daily, equal to around $50 million. According to Michael, if buyers scoop up that daily supply, the price has no choice but to rise. Currently the currency is trading at $109,504.19 with an increase of 0.13% in a day and a 3.82% in the last seven days as per the CoinMarketCap.

Source: CoinMarketCap

Source: CoinMarketCap

Since 2020, Saylor’s company, Strategy, has purchased 1045 BTC, worth about $63.85 billion on 9th June, which makes his holding to 582,000. He first raised capital through preferred shares to execute this BTC purchase. He believes public companies are playing a major role in reducing the available supply, as they continue to buy and hold large amounts of this digital asset for the long term.

He stated, that “at the current price level, it will only require $50 million to transform the entire situation of the crypto market in one turn”.

The bullish prediction by Michael is not merely based on the numbers. He also points to increasing support from major institutions and governments.

He emphasised the pro-Bitcoin stance of President Donald Trump. Along with that support from prominent personalities from the United States like Treasury Secretary Scott Bessent and newly appointed SEC Chair Paul Atkins. Saylor states this change in leadership is developing a more crypto-friendly framework in the United States.

In Congress, a bill is now being forwarded to turn executive order by Trump on a Strategic Bitcoin Reserve to convert it into law. If passed, this could signal even more official support for BTC.

Another big reason for Saylor’s confidence is the increase of Bitcoin exchange-traded funds (ETFs). It allows regular investors and organisations to purchase Bitcoin more conveniently. BlackRock’s ETF, IBIT, has already crossed $70 billion in assets and the total count of BTC they hold is nearly 700,000 BTC. It assists accelerating the demand.

Some countries are also joining the movement. Saylor noted that certain nation-states like Texas, Arizona, Ukraine, North Carolina, and New Hampshire are now purchasing this digital currency for their reserves, creating a new kind of demand that didn’t exist before.

While Michael admits that if BTC hits $1 million, it could fall back by $200,000, he believes the chances of it crashing to zero are now very small.

In his view, the combination of limited supply, rising institutional buying, and increasing global support all point to one direction, up.

“Bitcoin has gotten through its riskiest period,” Saylor said. “The accounting has been corrected. The adoption is happening.”

For now, Saylor is staying firm in his belief: Bitcoin is not just here to stay, it’s going to $1 million.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.