Ripple Labs, the company behind XRP, is having a strong year ahead. With important partnerships, legal clarity on the horizon, and growing ETF interest, XRP is showing signs of a bright future. The XRP Ledger (XRPL) is at the center of it all, helping bring real-world assets like U.S. Treasuries into the world of blockchain.

The organisation recently collaborated with Guggenheim, a prominent U.S. investment firm that manages more than $345 billion in assets. Together, they plan to launch a digital commercial paper (DCP) backed by U.S. Treasuries on the XRP Ledger. Guggenheim’s own unit, Treasury Services, will list the asset, and Ripple is putting $10 million into the project.

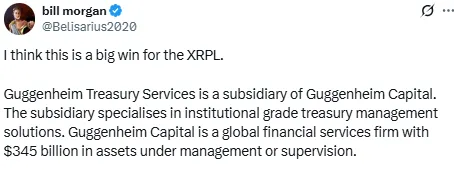

Ripple lawyer Bill Morgan appreciated the deal, calling it a “big win” for the XRP Ledger. This move helps bring traditional finance into crypto and shows that tokenized finance is no longer just a theory, it’s happening.

Source: Bill Morgan Twitter Handle

RippleX executive Markus Infanger said this shows the shift from testing blockchain to actually using it. He also hinted that buyers may one day use Ripple’s own stablecoin, RLUSD, to buy the asset. The price of the currency has increased by 0.52% in the last 24 hours, currently trading at $2.29 as per the CoinMarketCap.

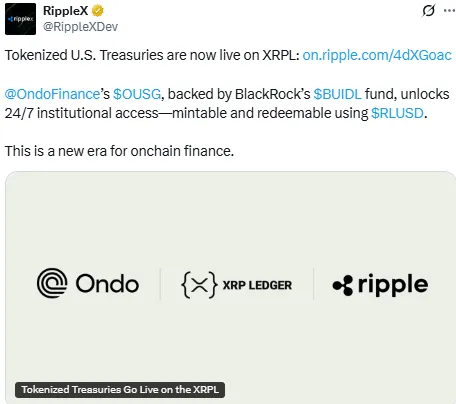

The organisation didn’t stop there. It also teamed up with Ondo Finance to launch tokenized short-term U.S. Treasuries (OUSG) on the XRPL. This means institutions can access these assets anytime, day or night, using RLUSD.

Source: RippleX Twitter Handle

Ripple celebrated the launch on social media, saying, “Tokenized U.S. Treasuries are now live on XRPL.” Ondo’s OUSG fund is supported by BlackRock’s $BUIDL fund, adding trust and stability.

Ripple has been battling a long legal battle with the U.S. SEC. The case may finally wind up soon. On June 16, 2025, the commission is likely to file an update on the expected $50 million settlement.

This could be a turning point. If the settlement gets final, it would confirm that programmatic sales of this cryptocurrency, which were made on exchanges, are not considered securities. It will clear up years long legal uncertainty.

As the organisation edges closer to legal clarity, interest in this altcoin ETF is rising. Bloomberg analyst James Seyffart said there’s now an 85% chance that an ETF could get approved in 2025. That’s just behind Solana (90%) and ahead of Dogecoin (80%).

ETF approval would make it possible for other investors to purchase this crypto conveniently, as they would with stocks. This might popularize it and increase its price.

Ripple is undertaking ambitious steps both in business and law spheres. The Guggenheim and Ondo transactions display a positive outlook toward the use of this altcoin in tokenizing real-world assets. In the meantime, the potential SEC settlement and increasing chances of ETF are making investors optimistic about having a brighter future. Ripple seems ready to lead the next big wave in digital finance.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.