MicroStrategy ($MSTR) has become the best-performing large-cap U.S. stock since going all-in on BTC in August last year under the leadership of Michael Saylor.

In his latest update, Michael states that the company has registered impressive annualized returns of 83%, beating such tech giants as NVIDIA and Tesla. This is an indication of the increasing interest in corporate adoption of Bitcoin as a strategic financial decision.

Since 10 August 2020, MicroStrategy has beaten over 1,400 publicly traded companies in the U.S. Saylor explains this triumph by a courageous choice based on the book of Saifedean Ammous, which made $MSTR invest $425 million in Bitcoin and transform its balance sheet policy. The company has made its investment in BTC its most notable feature in its long-term development strategy. This indicates its belief in the value of the digital currency in increasing corporate value.

Source: Michael Saylor X

Although $MSTR is traditionally in the shadow of technology giants, its BTC-related strategy has helped it to overcome other popular stocks. NVIDIA, a semiconductor and AI giant, and Tesla, an electric vehicle company, had annualized returns of 74% and 71%, respectively.

The performance advantage of MicroStrategy is a testament to the extraordinary effect of corporate cryptocurrency adoption on stock performance, unlike traditional tech-oriented growth strategies.

Although the returns of MicroStrategy are high in the long term, short-term volatility indicates the risks of having exposure. As an illustration, Yahoo Finance had a one-day drop of 4.17% of $MSTR on August 22, 2025. The volatility is consistent with the historical price fluctuations of BTC that have been shown to average 150% annualized volatility since 2020, as reported in the Journal of Risk and Financial Management (2023). Investors must remember that although the Bitcoin Standard has been the driving force behind major long-term returns, it also poses a great deal of short-term risk.

Surprisingly, Dillard, a retail chain, is the second best in annualized returns of 82% in the same duration. This is contrary to the story that only tech-intensive companies are leading the post-pandemic recovery. The success of Dillard can be explained by strong retailing activities, online retailing, and overcoming the impact of COVID-19.

Although there is no direct correlation between the performance of Dillard and the adoption of cryptocurrency. Its impressive performance indicates that other factors in the market, beyond the tech and cryptocurrency spheres are affecting the performance of stocks.

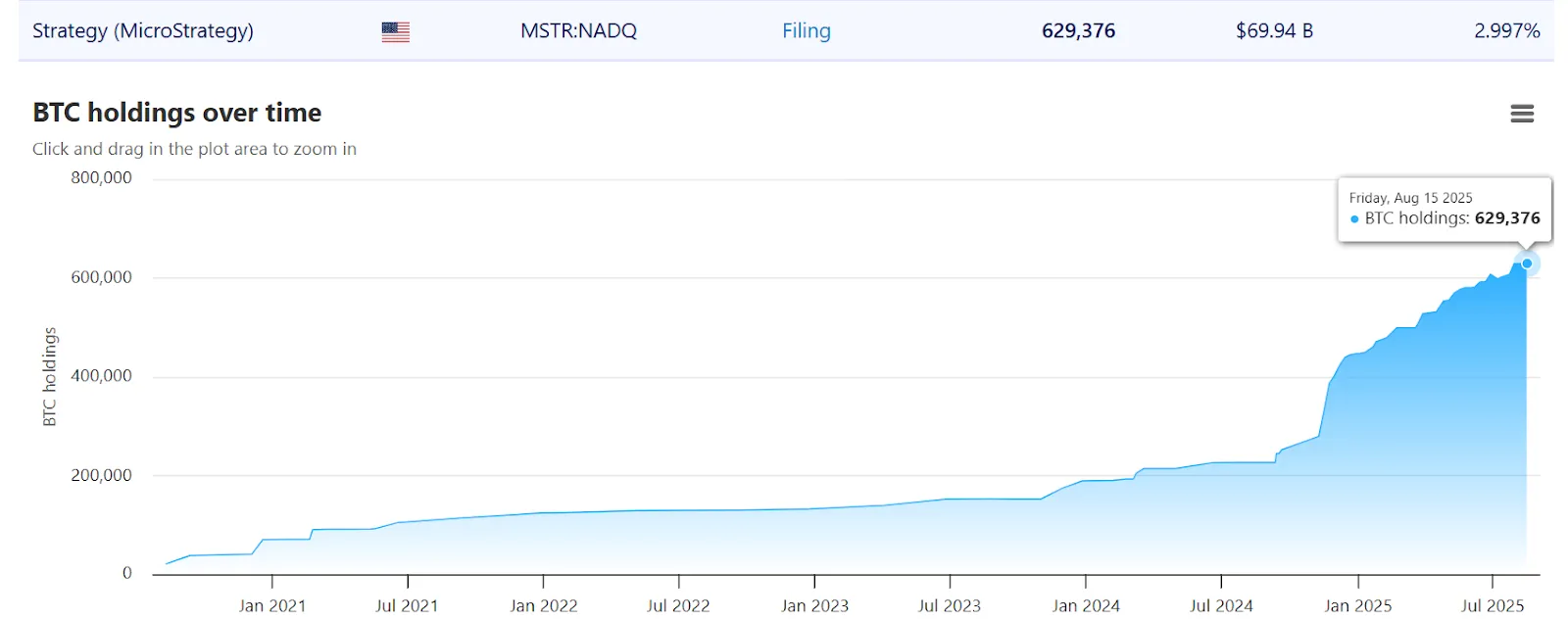

The attitude of Michael Saylor is reflected in his recent Bitcoin purchases in July and August 2025. In July and August, MicroStrategy bought more than 34,000 BTC, spending about $4.1 billion, taking its total inventory to 632,457 BTC worth 46.5 billion.

Source: BitBo

These strategic purchases reaffirm MicroStrategy's commitment to the BTC Standard, a move that has seen $MSTR become the best-performing large-cap U.S. stock since August 2020. Saylor is a clear example of how a concentrated cryptocurrency strategy can achieve long-term returns, surpass the largest tech companies, and transform corporate balance sheet management in the digital era.

The success of MicroStrategy is the best-performing large-cap U.S. stock. Michael Saylor Bitcoin prediction underscores a new world of business investment in which cryptocurrency positioning can deliver exceptional returns.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.