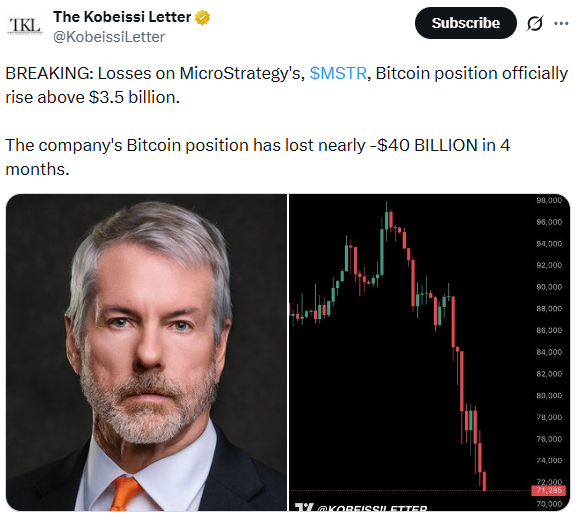

The digital asset world is facing a major storm today. The MicroStrategy Bitcoin Loss has officially climbed above $3.8 billion. This news comes as the price of Bitcoin drops below $71,000. It is a tough moment for the world’s largest corporate holder of the coin. Many investors are now watching the company’s every move. Despite the red numbers, Executive Chairman Michael Saylor is not backing down. He recently posted on X to tell his followers to stay strong. He believes that BTC will rise again, even as others are selling their holdings.

Source: X(formerly Twitter)

The current MicroStrategy Bitcoin Loss is a massive change from just a few months ago. At its peak in late 2025, the company’s stash was worth billions in profit. Now, the situation has flipped. The firm holds 713,502 Bitcoins. They bought these coins for an average price of about $76,052 each. Since the price is now under $71,000, the "paper loss" is very real. In fact, the total value of their position has dropped by nearly $40 billion in just four months.

This decline happened fast. On Michael Saylor’s birthday, the market saw a sharp sell-off. Over $777 million in bets were wiped out in a single day. Most of these were "long" bets from people who thought the price would go up. Instead, Bitcoin has dropped 19% so far this year. It is now trading at levels we have not seen since the 2024 election.

The MicroStrategy BTC Loss is also hurting the company’s stock price. MSTR shares fell over 5% on Wednesday. The stock has now dropped 72% since its high point last July. This is a huge blow to people who bought the stock as a way to bet on BTC. Wall Street experts are now changing their views. For example, Canaccord Genuity cut its price target for the stock by 60%. They moved it from $474 all the way down to $185.

Even with this cut, some experts still say "Buy." They think the company’s business model can survive a "crypto winter". They argue that the company owns enough BTC to cover its debts. However, other investors are not so sure. Big firms are starting to sell their BTC to avoid more losses. This puts even more pressure on the market.

Michael Saylor is known for his "Diamond Hands." He often says that BTC is a store of value like gold. In his view, these short-term price drops do not matter. He believes that the "scarcity" of Bitcoin makes it the best asset for the future. He has spent years building a plan to buy more coins using debt and stock sales.Still Saylor contine to buy more bitcoins.

But this plan has a limit. The company uses a metric called "mNAV". This measures the stock price against the value of the BTC they own. That number is now very low. If it drops too much, the company might have to stop buying more coins. This could slow down the "Bitcoin treasury" trend that Saylor started.

The market is at a turning point. If Bitcoin falls below $60,000, the Bitcoin Loss will grow even larger. Experts are looking at three things: ETF flows, government policy, and new crypto rules. If people keep taking money out of Bitcoin ETFs, the price could stay low.

For MicroStrategy, the goal is simple: survive. They need the price to bounce back so they can keep their lead as the king of crypto treasury firms.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.