Bitcoin has once again taken center stage in Microstrategy bitcoin news today. On June 29, the company confirmed Michael Saylore Buys 4,980 BTC for ~$531.9 million, at an average price of $106,801 per coin.

This brings Microstrategy Bitcoin purchase total holdings to 597,325, worth over $64 billion, acquired at an average of $70,982 per coin.

Source: Michael Saylor X Account

But what caught analysts off guard was the timing.

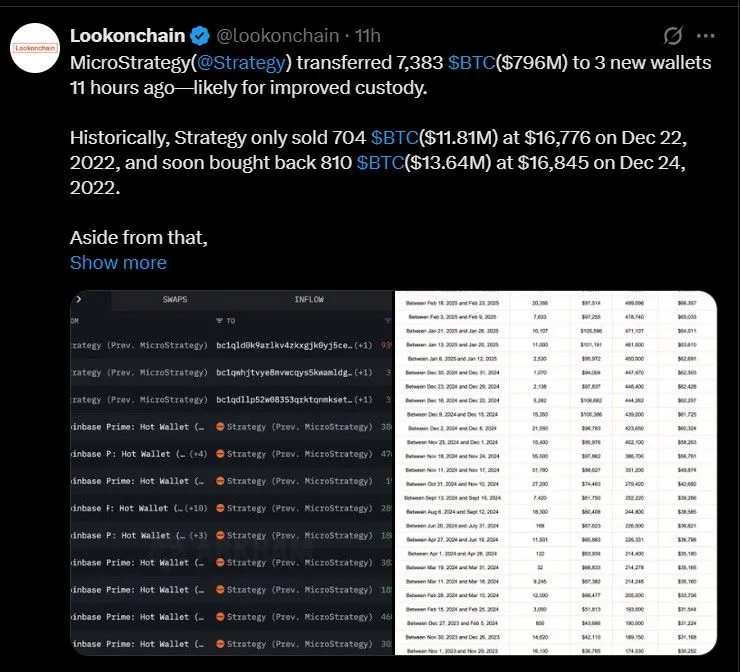

Just around 11 hours before this buy, the same company quietly transferred 7,383 BTC (worth $796 million) to three new wallets, according to lookonchain data. Why the shift? Why the sudden buy right after? It’s not just a purchase. It’s a message.

Source: Lookonchain

Historically, the firm doesn’t move its tokens unless it means something. Back in December 2022, the company sold 704 BTC at $16,776—only to buy back 810 BTC two days later at $16,845. This shows a clear pattern of strategic exits and re-entries—not simple custody changes.

This week’s wallet shuffle could signal one of two things:

OTC deal (a method of buying or selling large amounts of cryptocurrency directly between two parties, instead of through public exchanges) preparation to accumulate without moving markets

Pre-breakout setup anticipating institutional buying pressure

Whichever the case, this Michael Saylor news today doesn’t feel like a random move. The synchronization of the transfer and purchase suggests a carefully calculated play.

Right after this activity, BTC price saw a minor 1% drop, hovering around $107,668, according to CoinMarketCap.

To retail traders, this may seem like noise. But in the crypto market, a 1% drop near resistance can be either a final shakeout—or a fakeout.

So, is this dip a warning? Or the last trap before depending on a bullish breakout? MicroStrategy BTC acquisition June 2025 at $106,000, despite already holding 597,000 tokens shows conviction and not hesitation. And that means they’re expecting upside, not downside.

According to crypto analyst Rekt Capital chart, it is now brushing against the top resistance line of a descending wedge—a classic bullish breakout pattern.

Here’s what could happen next:

If it closes daily above ~$108,000, the breakout is confirmed

A retest of $108K as support could ignite a rally toward $112,000+

But if rejected, it could pull back to $102.5K or even $98,000

This aligns with the firm’s bold move.

Let’s connect the dots:

MicroStrategy transfers tokens to clean wallets

They buy more assets at a near-resistance price

Token drops 1%, shaking weak hands

Technicals show a bullish wedge breakout brewing

This isn’t a coincidence. It’s a pattern. And it looks eerily similar to how the 2020 bull market began—with institutional quiet moves, followed by explosive growth.

MicroStrategy bitcoin purchase and earlier transfer actions are loud—but the market’s response is muted. That’s what makes today's MIcrostrategy Bitcoin news moment critical.

With $42 billion invested and a 19.7% YTD yield on their token stash, Michael Saylor isn’t just investing. He’s orchestrating. Keep an eye on latest updates and always do your own research before investing in any cryptocurrency.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.