On June 1st, 2025, MicroStrategy bitcoin holding took another aggressive leap forward. Michael Saylor announced that Strategy (formerly MicroStrategy) has acquired 705 more BTC for approximately $75.1 million, paying $106,495 per Bitcoin.

Source: Michael Saylor X Account

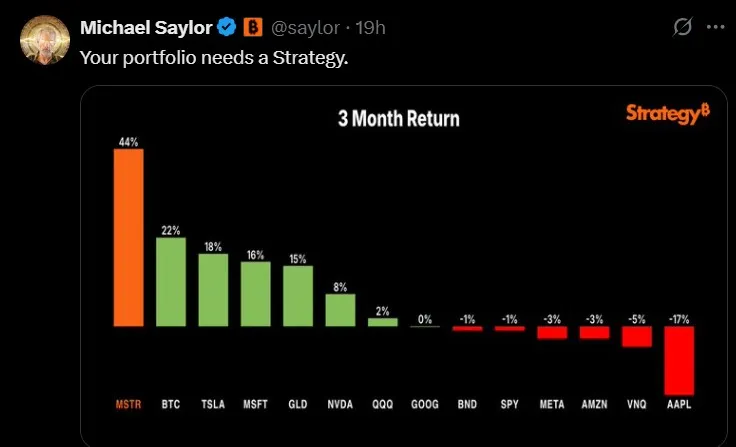

With this, the company’s total stash now stands at 580,955 BTC, worth nearly $40.68 billion, acquired at an average of $70,023. The timing of this move isn’t random — it came just hours after Saylor posted a chart on X comparing MicroStrategy +44% 3-month gain against $BTC (+22%), Tesla, Microsoft, and even gold. And then came the real flex: “Your portfolio needs a Strategy.”

Source: X

While many investors are still watching $BTC trade sideways, Michael is making strategic moves that few dare to.

At the time of writing, it is priced at $104,176, down around 0.19% in the last 24 hours and nearly 6% week-on-week, but trading volume has spiked 17.7% to $41.72 billion, signaling growing interest.

According to Wu Blockchain, CoinShares data shows $286 million in net inflows into digital asset investment products last week. Ethereum led with $321 million, its best since December 2024. Interestingly, this token saw an $8 million outflow, ending its strong six-week run of inflows that totaled $9.6 billion. Yet, while others pulled back, Michael Saylor Bitcoin purchase today leaned in harder.

Source: Wu Blockchain

He’s not just chasing profits — he’s setting an example. With a year-to-date Bitcoin yield of 16.9% in 2025, its treasury strategy is beating Wall Street. While Apple dropped 17% and Amazon fell 3%, Saylor’s Bitcoin-focused vision is producing real results. This is not a marketing stunt — it’s a calculated bet on the future of finance.

As a crypto analyst, I see clear signals on the charts too. Bitcoin price is forming a textbook bear flag on lower timeframes. This suggests a possible dip towards a solid demand zone around $100,000, before the next big leg up. Zoom in — no hype, just patterns.

Source: TradingView

So here's the big question: what happens to decentralization if one company is stacking BTC this quickly? While MicroStrategy isn't the arbiter for the network itself, its phenomenal accumulation sure has raised legitimate questions about supply distribution and liquidity on exchanges in the long term. Decentralization, after all, is as much about ownership as it is about tech.

With this company now holding over 2.76% of all this top cryptocurrency that will ever exist, Saylor has redefined corporate treasury management. His actions are being watched closely not just by traders, but by governments, fund managers, and crypto purists alike.

Michael Saylor’s latest $75 million buy is more than just another line on a chart — it’s a message to the market that it isn’t done yet. And as the microstrategy bitcoin holding keeps growing , it’s clear this play is shaping not just price movements, but this coin's financial narrative for 2025 and beyond.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.