Monero on-chain activity is back in the spotlight after new research from TRM Labs showed that network usage has stayed steady through 2024 and 2025.

This is happening even after many big exchanges removed or restricted XMR. At the same time, the XMR price jumped more than 5% in just 24 hours, showing that traders are paying attention again.

According to the latest TRM Labs findings, Monero on-chain activity is still higher than it was before 2022. This is important because platforms like Binance and Coinbase have limited support for privacy coins.

Source: X (formerly Twitter)

Even with these restrictions, people are still using it regularly. That tells us there is real demand for private transactions.

TRM Labs explained that on-chain activity did not fall apart after exchange delistings. Even though liquidity moved away from major platforms, XMR activity on Monero continues at a stable level.

The report also shared that 48% of new darknet markets launched in 2025 support only XMR. That is a big shift compared to earlier years.

Ransomware groups often say they prefer it because of privacy. However, most actual ransom payments are still made in Bitcoin.

The reason is simple: Bitcoin is easier to buy, sell, and move in large amounts. So even if criminals prefer privacy, liquidity still matters more in practice.

Researchers also noticed that about 14–15% of Monero network peers behave in non-standard ways. This includes unusual timing patterns and handshake behavior. Still, there is no proof that blockchain’s core cryptography is broken. Experts say the privacy system remains strong, but real-world network behavior can sometimes affect how privacy works in practice.

Overall, the on-chain activity looks stable and purposeful. It does not appear to be driven by hype or short-term speculation.

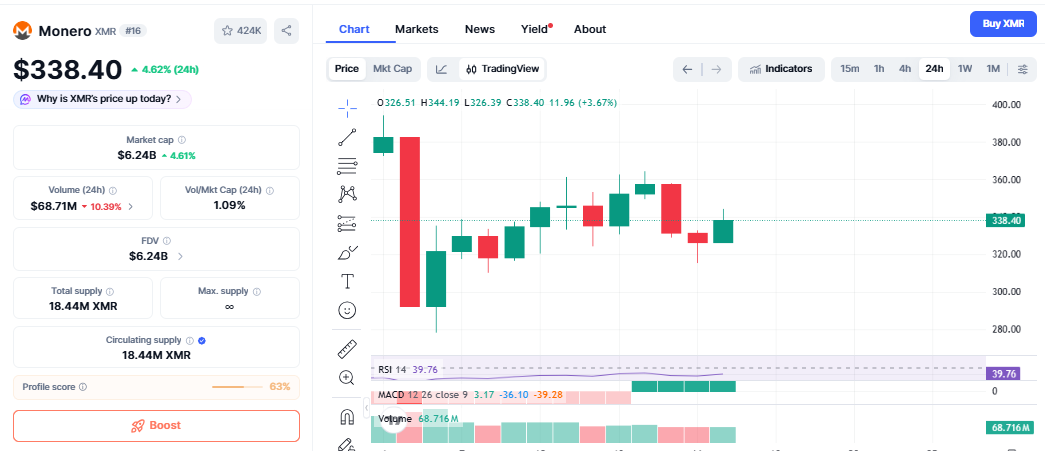

At the same time, the altcoin saw a noticeable price recovery. The XMR price climbed 5.45% to $340.97 in one day, while Bitcoin barely moved as per the CoinMarketCap. This clear outperformance grabbed attention.

Source: CoinMarketCap

The recent rally came after XMR dropped nearly 40% over the past 30 days. Many traders saw the coin as oversold.

The RSI indicator jumped to 80.75, showing strong buying pressure.

The MACD also turned positive, signaling that momentum shifted to the upside.

Monero trading volume reached about $69 million, which helped support the move.

There was no big announcement or partnership behind the surge. This looks like a technical bounce, helped by improved market sentiment.

For the short term, traders are watching the $331 to $334 resistance zone. If XMR price stays above this area, it could move toward $347–$350 next.

On the downside, support levels sit near $328 and $325. If the price falls below $325, it may revisit the $315 area. The overall outlook is cautiously positive, but the rally needs strong and steady buying volume to continue.

The on-chain activity remains solid despite regulatory pressure and exchange delistings. TRM Labs data shows that usage is still higher than pre-2022 levels, proving that demand for privacy-focused crypto has not disappeared.

Meanwhile, the recent price jump appears to be a technical recovery rather than a news-driven rally. If momentum continues and key resistance levels break, it could test $350. Still, traders should stay careful and watch volume and overall market trends before expecting a bigger breakout.

YMYL Disclaimer: Cryptocurrency investments are volatile and carry high risk. This content is for informational purposes only and not financial advice. Always conduct your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.