Key Highlights

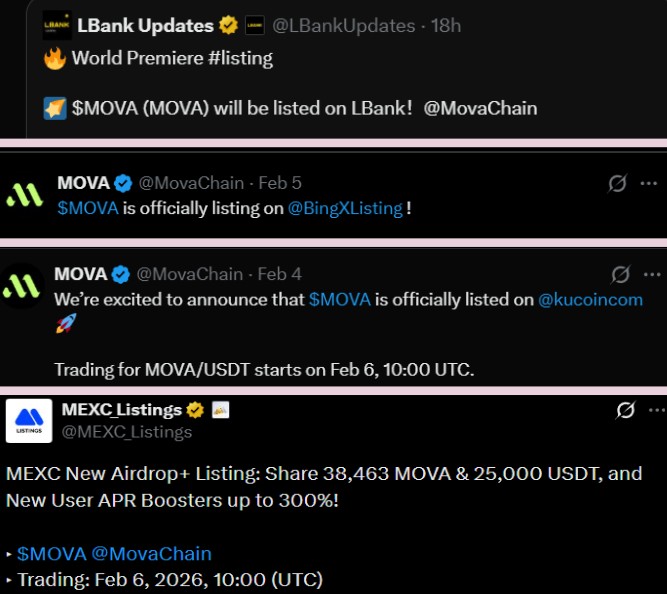

MOVA is going to live on KuCoin, BingX, MEXC, and LBank.

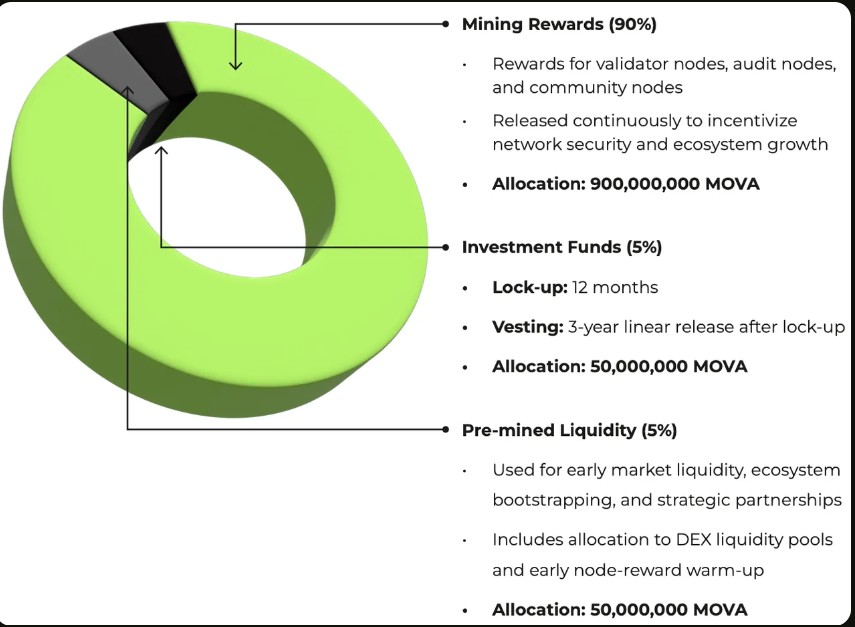

The MovaChain tokenomics show that there is a total supply of 1 billion, 90% of which is sent through mining rewards.

The platform focuses on establishing compliant PayFi and Web3 infrastructure.

MOVA Chain listing today is a significant milestone for the project since the token will start trading on several centralized exchanges at the same time. Today, 6 Feb 2026, becomes live at 10:00 UTC on:

KuCoin

BingX

MEXC

LBank

The confirmed trading pair offers immediate access to the global market and liquidity.

The current launch date marks the initial mass exposure of the project to centralized exchange markets, where traders and initial adherents can trade the token in an open price-discovery market.

Source: Official X

MovaChain is establishing itself as the infrastructure of compliant and scalable Web3 and PayFi systems, with its emphasis on real-world blockchain adoption. Although documentation is still in progress, the project points out:

Participation of the validator and audit node.

Blockchain infrastructure, which is compliance-oriented.

Distribution of tokens caused by mining.

Incentives for long-term growth in the ecosystem.

It is assumed that the project ecosystem will grow along with such tools as a Movechain Explorer, validator participation systems, and integrations of developers.

There is also some reference to a Mova chain airdrop in some community discussions, but there is little official information on pricing or allocation. Any Mova chain airdrop price should be taken as a speculative price until it is confirmed by the project.

The maximum supply is 1,000,000,000 tokens, with a deflationary release plan.

Token Allocati

Mining Rewards: 90% (900M)

Investment Funds: 5% (50M)

Pre-mined Liquidity: 5% (50M)

Mining incentives are shared by the use of validator nodes, audit nodes, and community participation.

Source: Official Tokenomics

Mining Mechanics

Block reward: 10.7143 tokens

Block time: ~1.5 seconds

Halving cycle: Every ~2 years

Incentives are reduced over time until the network becomes self-sufficient through transaction fees. This structure is designed to strike a balance between decentralization, liquidity growth, and long-term sustainability.

Concurrent listing on four exchanges is rare with early-stage projects, and can be of great benefit in initial liquidity and exposure.

The possible effects of MOVA listing on BingX, Kucoin, MEXC, and LBank are:

Increased speed of accessibility worldwide.

Early price discovery

Greater involvement in trading.

Incentives of exchange campaigns (airdrops and APR boosters)

As an example, MEXC exchange introduced Airdrop+ programs that offer incentives and USDT bonuses to early adopters.

Nevertheless, similar to the majority of new listings, the volatility risk is great, particularly in the initial trading sessions.

Since the Mova chain listing price has not been set officially before the commencement of trading, any prediction is speculative.

Based on:

exposure of multi-exchange launch,

mining-based tokenomics,

positioning of the early ecosystem,

A supposed short-term MOVA token price range may lie between $0.03-$0.08 in the first trading hours, based on the liquidity, demand, and the general mood in the crypto market.

As the ecosystem adoption and infrastructure development proceed, the price might stabilize in the middle of the next three years between $0.10 and $0.18, but this is highly dependent on the implementation and market factors.

This listing will be the first introduction of the project to the worldwide crypto trading market. Although the availability of exchanges increases accessibility, the project is still in its infancy, with transparency, adoption, and ecosystem growth being the determinants of long-term success.

For traders monitoring, it is important to keep an eye on risk management, liquidity situation, and official project news rather than on the short-term price fluctuations only.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.