Is there finally a positive update for investors after weeks of falling crypto prices? While markets struggle and sentiment remains weak, the Spur Protocol airdrop has arrived as a rare bright spot for participants searching for fresh opportunities.

The broader environment remains challenging. Since January 14, the crypto sector has erased nearly $1 trillion in value. Over the past 24 hours alone, total market capitalization slipped 8.99% to $2.21 trillion, according to CoinMarketCap. Against this backdrop, today’s distribution event is drawing strong attention across trading circles.

Momentum started building with SON Listing on CoinStore on February 2, 2026, at 9:00 AM UTC. Despite modest presale traction, launch activity surprised watchers with steady demand.

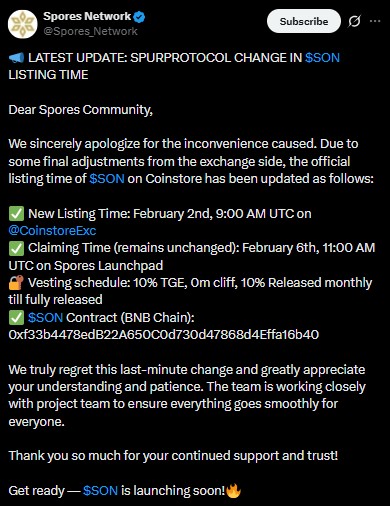

According to Spores Network X post, the claiming time remains unchanged: February 6 at 11:00 AM UTC (4:30 PM IST) via the official launchpad.

Source: Spores Network X

Key details investors should note:

Vesting: 10% at TGE, zero-month cliff, followed by 10% monthly unlocks until completion

Spur Protocol contract address: 0xf33b4478edB22A650C0d730d47868d4Effa16b40 (BNB Chain)

To receive tokens, users must connect a supported wallet to the official portal and complete the guided process. Eligibility checks are essential before proceeding to the SON token airdrop claim link to avoid delays.

This development has quickly become one of the most discussed pieces of Spur Protocol news, mainly because it arrives during a risk-off phase.

Market data shows a structured but cautious setup. With a total supply of 1 billion, the asset listed at $0.0350, surged near $0.050, and now trades around $0.03979 after a mild intraday rise of 0.30%, as per CoinStore data.

Source: CoinStore Exchange

Technical indicators reflect consolidation:

MA5, MA10, MA30: clustered near $0.03979–$0.03975

Support: $0.03650–$0.03730

Liquidity spike: around $0.04800

Average volume: 11.75K

MACD: flat near 0.00002, signaling weak momentum

Bullish path: Holding above $0.04000 could open a move toward $0.04500, then $0.05000–$0.05200 — roughly 25–30% upside within three months.

Bearish risk: Losing $0.03600 may drag SON token price to $0.03300 or even $0.03000, implying 20–25% downside.

Unless volume consistently crosses 50K, ConGabbar analysts expect movement between $0.03300 and $0.05200 heading into Q2.

At present, trading is limited to a single exchange. However, the roadmap hints at several possible catalysts:

Additional exchange integrations, including MEXC, Binance Alpha, KuCoin and more

Ecosystem expansion

Open Network mainnet rollout

New dApps and developer participation

If these milestones arrive on schedule, they could reshape medium-term sentiment around the SON token price and adoption trajectory.

The Spur Protocol airdrop launches at a time when confidence across digital assets remains fragile, making this event especially notable. With a confirmed listing, defined vesting plan, and measurable price levels, the project now enters its next evaluation phase. Whether momentum builds will largely depend on execution, exchange expansion, and renewed market strength in the months ahead.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk due to volatility. Readers should conduct independent research and consult a financial advisor before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.