Now, what happens in the public markets when belief, leverage, and immensely powerful stories come together? A series of occurrences is taking place in the case of MicroStrategy Options Frenzy. What was once just a software company that supplied business tools is fast becoming something different and a lot bigger.

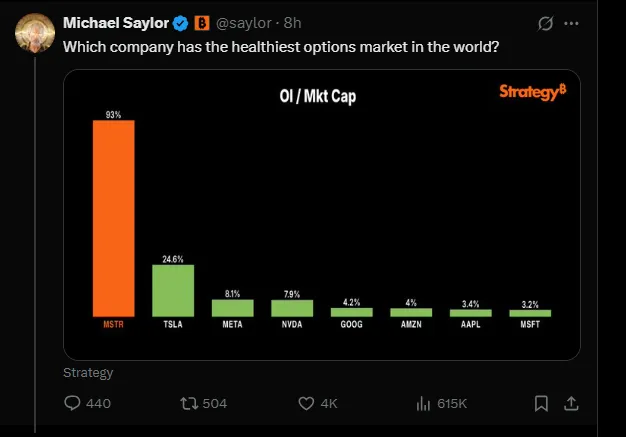

The open interest in options at MSTR is 93% of its market cap right now. That really is something rare and eye-catching. It reflects the extent to which investors have placed bets on the direction of this stock, and how deeply invested they are in its future being tied to Bitcoin.

The big question: Is the stock still just a tech stock, or has it instead become an embodiment of the belief and energy behind Bitcoin?

Let's talk about a raw number. The open interest for MicroStrategy-the gross number of contracts still to be settled-is now equal to 93 percent of the market cap. That in itself is abnormal, with all financial reflexes being tripped.

Source: X

This is not a risk management case or an outright hedge play. This is more primal, a highly leveraged bet on directional belief. Traders are not speculating about MSTR earnings on a quarter-by-quarter basis. They are expressing a longer conviction on Bitcoin through MSTR, a high-volatility proxy.

MicroStrategy Options Frenzy reflects this new kind of financial energy—where belief, narrative, and directional conviction feed on each other to create amplified market reactions rarely seen in traditional equities.

Through the leadership of Michael Saylor, MSTR has turned from a public company to a Bitcoin treasury locked in equity skin. The options market in this regard seems to have a better grasp of this concept than the stock market itself.

MSTR is known to be priced essentially as a call on Bitcoin with some leverage of debt, of compliance and of Saylor's relentless evangelism. This is a recursive form of reflexivity: a meta-leveraged belief baked into every contract.

This is where the story really gets deep. More than stacking stats, Saylor has engendered one of the world's first meme machines designed for regulatory compliance: a thing that trades on conviction rather than cash flow. MSTR is now functioning as what no Wall Street firm could have fathomed: The world's first institutional memecoin.

Memetic? Yes—the value is tied to belief held collectively.

Institutional? For sure—it's an SEC-registered pubco, filing 10-Qs, and raising debt to buy BTC.

Reflexive? Indeed-the more the masses believe in MSTR's Bitcoin thesis, the more valuable the stock becomes, the classical fundamentals notwithstanding.

And now, the options market has become an amplifier of that narrative-an echo chamber of exuberance, leverage, and speculation beyond boundaries. This is the very core of the MicroStrategy Options Frenzy: a convergence of institutional access and memetic momentum.

Then from a traditional finance perspective, it would be no. A market is said to be healthy when it is stable, mathematically predictable, and rational in hedging. But then, another account has entered the narrative economy-the very essence of a healthy market is being redefined.

MicroStrategy Options Frenzy are just something else: a monetization of belief. A loaded coil of potential energy: If Bitcoin jumps, MSTR jumps officially-as a monster amplifier of volatility; If Bitcoin falters, MSTR takes the fall-glorified proxy martyr.

So there is the duality to becoming the public avatar of Bitcoin.

MSTR isn't healthy in the traditional sense. It's possessed—by conviction, by leverage, and by the story it tells. But in an age where capital flow follows narrative liquidity, this possession could be the most valuable financial attribute.

Drugstore belief systems become investable and memetic energy begins to move faster than earnings reports, and MicroStrategy stands exactly as the model for what will arise: a public market gateway to decentralized conviction. And that’s the essence of the MicroStrategy Options Frenzy, not just a statistic, but a signal of transformation.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.