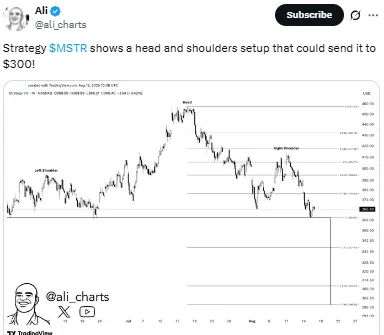

The market is flashing warning signs again. MSTR stock (MicroStrategy) has formed a head-and-shoulders chart pattern, and if this plays out, its price could fall toward $300.

Since the company holds one of the largest BTC reserves, any sharp drop in its share price could spell trouble for the digital currency as well.

Looking at the charts, the MSTR stock has built a clear head-and-shoulders pattern. This is a common technical pattern that traders use to spot reversals.

The neckline sits near $370, and if it breaks below this line, it could send the stock close to $300.

Source: Ali Charts X Handle

Why is this a matter of Concern? Because Strategy’s MSTR stock is often considered as a mirror of Bitcoin’s performance.

A fall in the share price usually signals weaker sentiment around the crypto asset too.

At the same time, the digital asset itself is testing a very important level. Currently, it is trading near $114,900, slipping almost 1% in the past 24 hours.

Source: Trading View

For months, the Bitcoin price followed a rising trendline since March, but recently it closed under both the trendline and the 50-day EMA at $115,000.

This is a red flag for traders. If it cannot get back above $115,000, it could head down to the $100,000 zone.

On the upside, a bounce over $117,000 would cancel the breakdown and open the door back toward $120,000.

Technical signals are also cooling off.

The RSI sits at 44, showing momentum is fading. It is not oversold yet, but it goes bearish, which means sellers may take control if bulls fail to defend support.

If MicroStrategy’s shares slide further, confidence in its Bitcoin strategy could shake, adding more selling pressure on the crypto market.

MicroStrategy owns more than 629,376 coins after the latest purchase of 430 BTC at the average price of $119,666. This makes it the largest corporate holder of BTC.

Source: Michael Saylor Portfolio Tracker

Because of this, MSTR stock often acts like a mirror version of BTC itself. When the share price rises, it boosts optimism for Bitcoin. But when it drops, the opposite happens.

That’s why this head-and-shoulders pattern is so important. It could serve as an early warning for this digital currency's next move.

If the digital currency goes towards 100,000 it is probable that Michael Saylor could buy more BTC. As he tweeted recently, "insufficient oranges”, it signals potential buying is coming soon. This could also impact the price of the currency.

Both MSTR stock and Bitcoin are at turning points. If the bearish setup in MicroStrategy plays out, its price may drop to around $300.

That kind of fall would likely drag BTC down with it, possibly toward $100,000.

At this point, the focus is on the $115,000 mark of the digital asset as well as the $370 neckline of the microstrategy's share price. If these levels stay strong, the market can stay steady. But if they break, prices may fall in the short term.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.