Mutuum Finance crypto presale officially surpassed the $20.5 million funding milestone this week. Operating on the Ethereum blockchain, the project is positioning itself as a professional-grade lending and borrowing hub designed to remove intermediaries from the credit lifecycle. With over 19,000 individual holders already participating, the project has transitioned from a conceptual roadmap into a live technical validation phase, following the successful activation of its V1 protocol on the Sepolia testnet.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

Currently, the crypto presale is in Phase 7, with the native $MUTM token priced at $0.04. This stage follows a disciplined pricing ladder that began at just $0.01 in early 2025, representing a 300% appreciation for the earliest supporters. As Phase 7 is already more than 15% allocated, investors are moving quickly to secure positions before the next scheduled price jump to $0.045. The team has confirmed an official exchange listing price of $0.06, providing a clear valuation target for those entering the market before the public debut.

The momentum behind the Mutuum Finance crypto presale is driven by its "Utility-First" philosophy. Unlike many speculative assets, the $MUTM token is the primary engine for a dual-market lending model. The first pillar is a Peer-to-Contract (P2C) system, which utilizes shared liquidity pools. When users supply assets like ETH or USDT, they receive mtTokens interest-bearing receipts that grow in value as borrowers repay their loans. This automated system ensures that liquidity remains high while providing a "set and forget" yield for lenders.

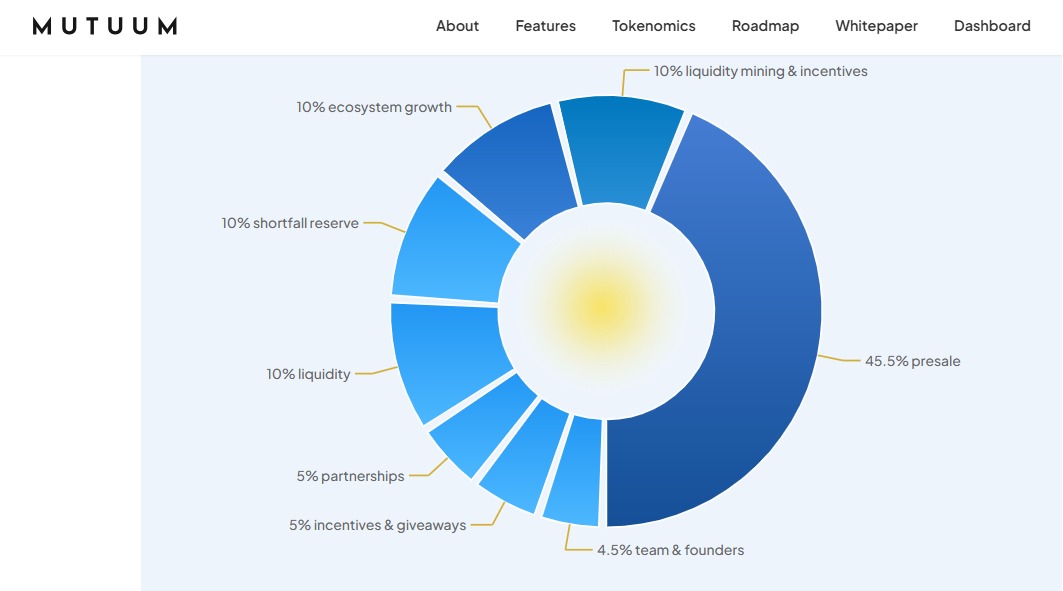

The crypto presale follows a structured supply model to support long-term growth.

Token Name: Mutuum Finance ($MUTM)

Blockchain: Ethereum (ERC-20)

Total Supply: 4,000,000,000 MUTM

Presale Allocation: 45.5% (1.82 Billion Tokens)

Current price: $0.04

Tokens Sold to Date: 845,000,000+ MUTM

Security Score: 90/100 on CertiK Token Scan

The success of the crypto presale highlights a broader 2026 trend where capital is flowing toward "transparent credit" hubs. By providing a live, testable protocol ahead of the mainnet launch, the team has reduced the execution risk that often plagues early-stage projects. The integration of Chainlink oracles for real-time price feeds and a $50,000 bug bounty program further demonstrates a commitment to institutional-grade standards.

Looking ahead, the planned introduction of a native overcollateralized stablecoin and Layer-2 scaling solutions suggests that Mutuum Finance is building for global scale. While all early-stage digital asset ventures carry inherent market risks, the project’s focus on proven lending mechanics rather than pure hype positions it as a serious contender in the Ethereum DeFi ecosystem. As Phase 7 nears completion, the window for sub-launch pricing is narrowing, and the market is paying close attention to the upcoming transition into Phase 8.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.