What happens when a gold mining company decides to bet on BTC? That’s exactly what’s unfolding now, as Nativo Resources bitcoin treasury strategy stuns both the crypto and traditional finance world. Known for extracting natural resource from the ground, it is now stacking worl's largest cryptocurrency on its balance sheet.

With inflation worries rising and public companies racing into crypto, the real question becomes: Is this the start of something much bigger?

In a move that blends tradition with innovation, Nativo Resources, a UK-listed enterprise, has officially stepped into the crypto world.

Source: X

The corporation has announced a bold decision to begin allocating a portion of its capital reserves to BTC. The news broke on X, where the company posted: “We’re first & foremost a mining company. But in today’s evolving financial landscape, exposure to both yellow metal and this currency allows us to future-proof our treasury.”

This new Nativo Resources bitcoin treasury plan comes as the corporation prepares to restart its yellow metal operations at the Tesoro Gold Concession in Peru.

It places the firm in the growing club of public firms moving toward bitcoin treasury news strategies, including GameStop, Sequans, and Trump Media.

Executive Chair Christian Yates explained the motivation clearly: “With concerns mounting around fiat currency depreciation, rising global debt, and inflation, we believe both of these assets will continue to strengthen as inflation hedges.”

Source: NTVO Bitcoin Treasury

This reserve diversification gives Nativo exposure to digital gold vs real gold, aligning with today’s fast-changing financial environment.

As a crypto analyst, I see Nativo Resource bitcoin treasury move as a clear sign—big companies aren’t just watching anymore, they’re getting ready for a future where this token might feel safer than fiat.

Despite the excitement, the company was honest about the risks. The agency stated that exposure to world’s largest cryptocurrency could bring price volatility, regulatory uncertainty, and investor perception challenges.

To handle these concerns, the firm is partnering with Copper.co custody for secure storage and Nemean Services for digital asset recovery.

Still, the company warned that holding this cryptocurrency might impact its ability to raise capital due to market unpredictability—especially in traditional finance sectors.

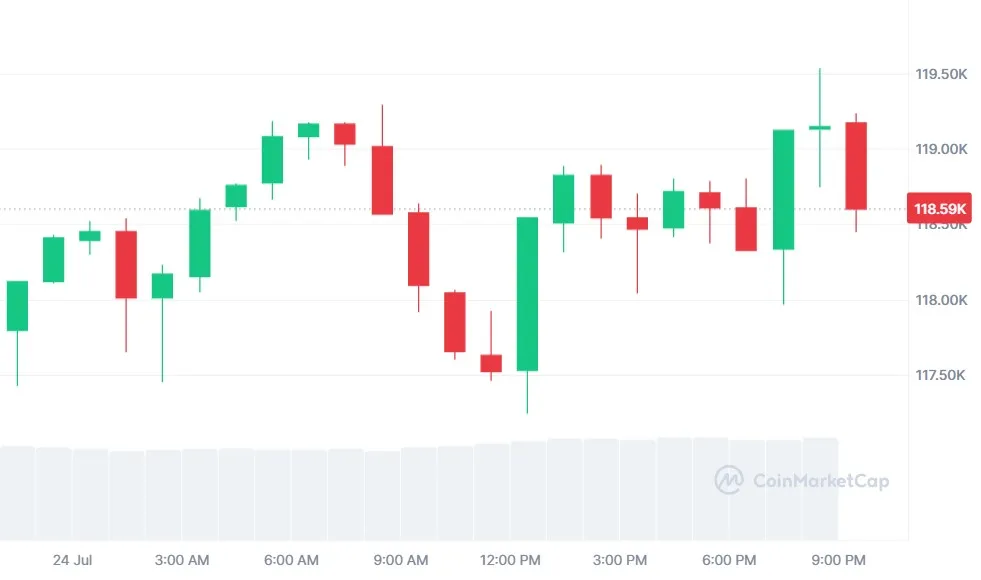

It is currently priced around $118,500, with a 24-hour uptick of 0.66%. Daily trading volume is up over 11%, suggesting growing market activity.

While this investment alone won’t move the market, it adds fuel to the narrative of rising btc adoption news. As more public companies buying bitcoin like Gamestop, the cumulative effect could provide a solid btc price boost and support a broader bull run.

The Nativo Resources Bitcoin Treasury story shows how legacy industries are rethinking their capital strategies. What once was seen as risky is now becoming standard.

This company is evolving into a dual-asset powerhouse by maintaining both physical and digital reserves – ready for both inflationary scenarios and innovative financial spaces.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.