Asia laid critical groundwork for non-USD stablecoins in 2025, as regulators, banks, and crypto firms pushed local-currency digital assets despite the continued dominance of dollar-backed stablecoins.

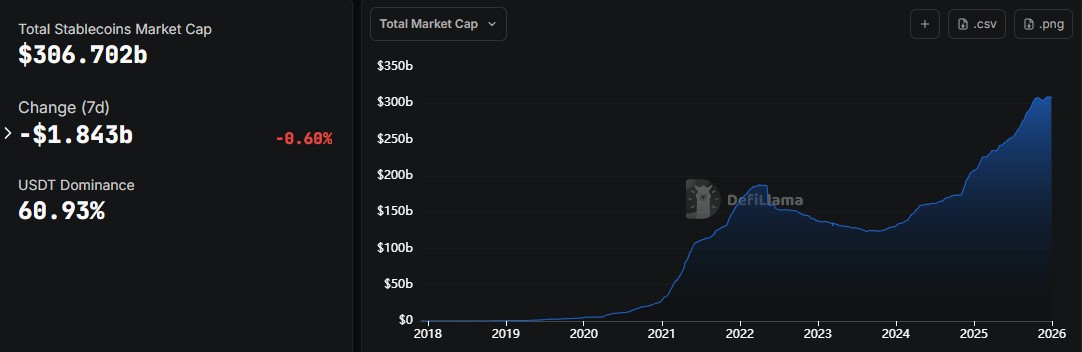

While U.S. dollar tokens still control most on-chain liquidity, around 61% of the total $306.702 billion market, the region spent the year quietly building alternatives.

Source: DeFiLlama Data

The question now is, can non-USD stable coins move beyond strategy and achieve real adoption in 2026?

Japan and South Korea emerged as early leaders in Asia’s non-USD stablecoin push. While other majors named as India, also stated the introduction of its own Rupee-backed set to launch in Q1, 2026, but it is yet to come out.

On the other hand, in October 2025, Japanese fintech firm JPYC launched what it described as the country’s first legally recognised yen-backed stablecoin.

Simultaneously, Japan’s three megabanks, MUFG, SMBC, and Mizuho, began pilot programs focused on Digital stable assets and tokenised deposits for payments, interbank settlement, and institutional finance.

In December, Japan’s Financial Services Agency publicly backed these initiatives.

Financial groups also moved quickly. SBI Holdings announced plans to work with blockchain firm Startale on fixed value coin issuance and infrastructure, signaling growing private-sector confidence.

South Korea followed a similar path. Crypto custody firm BDACS launched KRW1, a won-pegged stablecoin on Avalanche, aimed at global payments and remittances.

Another native currency– Won, backed token, KRWQ, debuted on Coinbase’s Base network, while KakaoBank advanced its stablecoin project into the development stage.

Although South Korea lacks a regulated or formal stablecoin framework, law makers have signaled one is in progress.

Although there is a lot of momentum, non-USD stablecoins still comprise a minute size. Where dollar-dominated stable digital coins still make up more than 60.9% of the total stable digital coins market capitalization worth, and yen-stablecoins comprise only $6.54 million. It is stated that projects revolve around diversifying and not replacing the dollar.

While it seems likely that 2025 will see a payments-first approach to use cases such as cross-border settlement payments, it is likely that Asia will be seen as a route between multiple stable currencies in the future, rather than a threat to dollar power, in 2026.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.